GOLD

Higher Timeframes

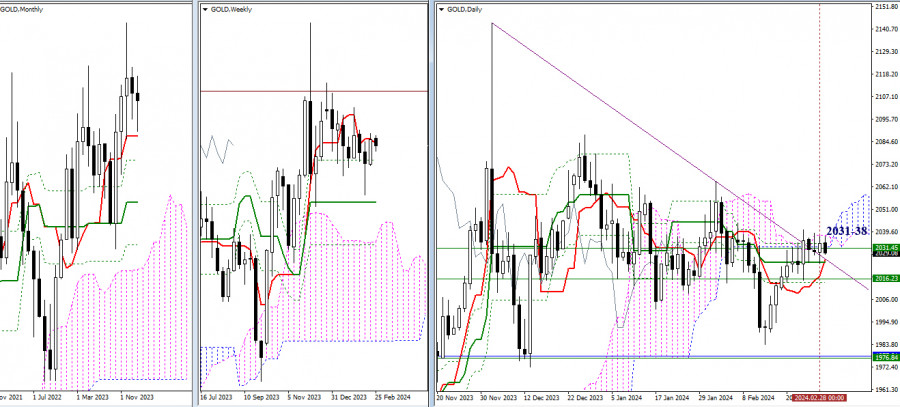

Gold has encountered a strong resistance boundary, combining the daily cloud (2,032 – 2,038) and the weekly short-term trend (2,031). As a result, a daily consolidation is unfolding. If the bulls are the first to abandon this attraction zone, breaking out and consolidating in the bullish zone relative to the daily cloud will form a new upward target – the target for breaking the daily Ichimoku cloud. This will serve as the initial reference point for continuing the ascent.

After achieving the daily target, the main focus will shift to breaking out of the weekly and monthly correction zones. Updating the December 2023 high (2,144) will enable the formation of new historical highs for gold.

However, if the bulls fail to cope and relinquish control to the opponents, the bears will first need to go beyond the daily Ichimoku cross (2,024 – 2,015), currently reinforced by weekly support (2,016). After that, prospects for a decline to the crucial level of 1,977 will open up, uniting strong support levels such as the monthly short-term trend and the weekly medium-term trend.

H4 – H1

As of this writing, key levels on the lower timeframes are being tested, ranging from 2,030–32 (central pivot point + weekly long-term trend). A breakthrough of these levels and movement below these supports will lead to an intensification of bearish influence. In case of a decline, intraday bearish benchmarks today are at 2,026 – 2,019 – 2,013 (supports of classic pivot points). Trading above the key levels and maintaining a bullish advantage will allow advancing through the resistances of classic pivot points, which, in the current situation, are located at the boundaries of 2,026 – 2,018 – 2,013.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Higher Timeframes

Gold has encountered a strong resistance boundary, combining the daily cloud (2,032 – 2,038) and the weekly short-term trend (2,031). As a result, a daily consolidation is unfolding. If the bulls are the first to abandon this attraction zone, breaking out and consolidating in the bullish zone relative to the daily cloud will form a new upward target – the target for breaking the daily Ichimoku cloud. This will serve as the initial reference point for continuing the ascent.

After achieving the daily target, the main focus will shift to breaking out of the weekly and monthly correction zones. Updating the December 2023 high (2,144) will enable the formation of new historical highs for gold.

However, if the bulls fail to cope and relinquish control to the opponents, the bears will first need to go beyond the daily Ichimoku cross (2,024 – 2,015), currently reinforced by weekly support (2,016). After that, prospects for a decline to the crucial level of 1,977 will open up, uniting strong support levels such as the monthly short-term trend and the weekly medium-term trend.

H4 – H1

As of this writing, key levels on the lower timeframes are being tested, ranging from 2,030–32 (central pivot point + weekly long-term trend). A breakthrough of these levels and movement below these supports will lead to an intensification of bearish influence. In case of a decline, intraday bearish benchmarks today are at 2,026 – 2,019 – 2,013 (supports of classic pivot points). Trading above the key levels and maintaining a bullish advantage will allow advancing through the resistances of classic pivot points, which, in the current situation, are located at the boundaries of 2,026 – 2,018 – 2,013.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment