EUR/USD

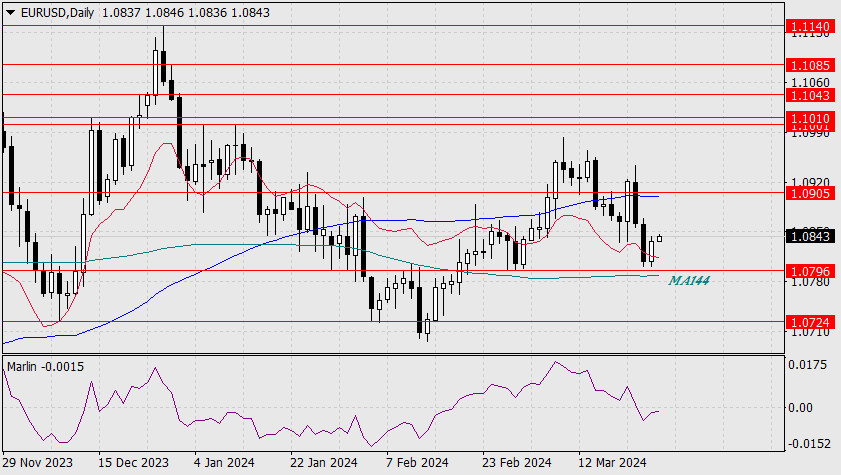

As part of the correction, the euro rose by 28 pips on Monday. The pair continues to rise this morning, as it stays above the balance indicator line (red moving line). It may seem that the euro is trying to start an upward movement, as it aims to climb above the MACD line and resistance at 1.0905, that is, trying to pass the range of 1.0796-1.0905 in the opposite direction. But the current situation is such that the price is rising under the MACD line and on the declining Marlin oscillator, so it is more likely that the price is trying to complete the corrective move and after that it will go under the support at 1.0795 and under the simple moving average MA144, as this will open the nearest target at 1.0724.

Today, the US will release a report on durable goods orders in the US for February, with a forecast of 1.2%, and the Consumer Confidence Index for March, which is expected to rise to 106.9 from the previous 106.7. In addition, the S&P Home Price Index for January is expected to increase from 6.1% y/y to 6.6% y/y. In combination with the anticipated high reading of the core Personal Consumption Expenditures (PCE) index at 2.9% year-on-year, compared to 2.8% y/y previously, this could lead to a fundamental shift in expectations towards two rate cuts from the Federal Reserve instead of three. According to media reports, Fed Chief Jerome Powell's Friday speech in San Francisco will be related to these latest data. Macroeconomic expectations do not contribute to the euro's growth.

On the 4-hour chart, the double convergence of price with the Marlin oscillator is still effective, and the oscillator's signal line has already moved into positive territory. Due to the aforementioned reasons, the limit of the corrective rise is represented by the MACD line at the level of 1.0875. Breaking through the 1.0796 level will finally remove the euro's desire to rise.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

As part of the correction, the euro rose by 28 pips on Monday. The pair continues to rise this morning, as it stays above the balance indicator line (red moving line). It may seem that the euro is trying to start an upward movement, as it aims to climb above the MACD line and resistance at 1.0905, that is, trying to pass the range of 1.0796-1.0905 in the opposite direction. But the current situation is such that the price is rising under the MACD line and on the declining Marlin oscillator, so it is more likely that the price is trying to complete the corrective move and after that it will go under the support at 1.0795 and under the simple moving average MA144, as this will open the nearest target at 1.0724.

Today, the US will release a report on durable goods orders in the US for February, with a forecast of 1.2%, and the Consumer Confidence Index for March, which is expected to rise to 106.9 from the previous 106.7. In addition, the S&P Home Price Index for January is expected to increase from 6.1% y/y to 6.6% y/y. In combination with the anticipated high reading of the core Personal Consumption Expenditures (PCE) index at 2.9% year-on-year, compared to 2.8% y/y previously, this could lead to a fundamental shift in expectations towards two rate cuts from the Federal Reserve instead of three. According to media reports, Fed Chief Jerome Powell's Friday speech in San Francisco will be related to these latest data. Macroeconomic expectations do not contribute to the euro's growth.

On the 4-hour chart, the double convergence of price with the Marlin oscillator is still effective, and the oscillator's signal line has already moved into positive territory. Due to the aforementioned reasons, the limit of the corrective rise is represented by the MACD line at the level of 1.0875. Breaking through the 1.0796 level will finally remove the euro's desire to rise.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment