On Tuesday morning, the Bank of Japan modestly raised its policy rate from -0.1% to a range of 0.0-0.1%, ending eight years of negative interest rates, and also announced to discontinue its yield-curve-control framework. At the same time, the BOJ will continue its JGB purchases with broadly the same amount as before and promised to react promptly in case of a rapid rise in rates. The yen fell, as the decision was expected, and we will discuss the long-term consequences of the BOJ's decision in the next review.

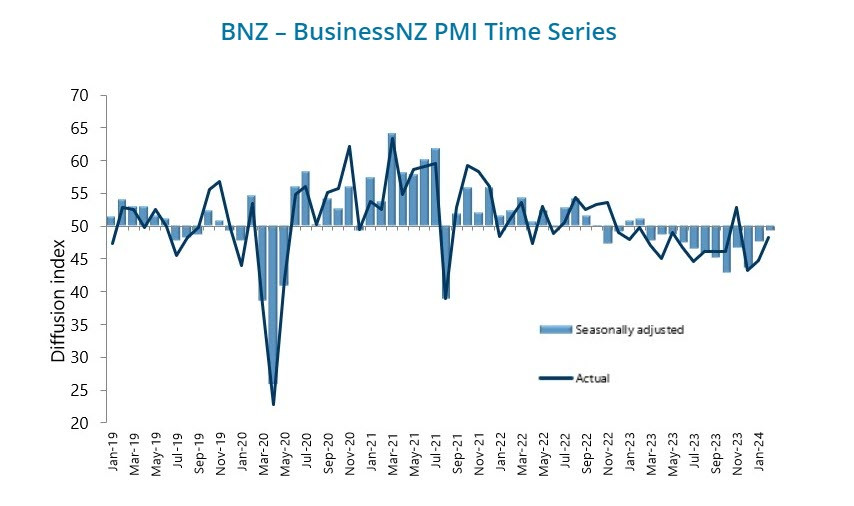

New Zealand's GDP report for the fourth quarter is set for release on Wednesday. While the GDP forecast is conditionally positive, it is expected to rise by 0.1% due to the services sector. High interest rates have damaged sectors such as retail, manufacturing, and construction, but the services sector continues to grow despite tightening conditions, maintaining positive momentum, and along with it, the threat of sustained high inflation. The seasonally adjusted manufacturing PMI has been in contraction territory for 12 consecutive months.

Accordingly, as soon as signs of a slowdown in the services sector appear, this will be a clear signal for the Reserve Bank of New Zealand, and the first signs of this slowdown may be evident in the Q4 GDP report.

With almost zero growth, the economy is clearly under pressure, especially in the context of rapid migration growth, and it is expected that GDP per capita will decline for the fifth consecutive month, with a 3.7% drop in the fourth quarter compared to the third quarter. The problem for the RBNZ is that the impact of weaker demand on inflation does not occur in real-time; this process stretches over months. Accordingly, weak economic growth will contribute to weakening inflation, but with a considerable delay, and this is not what the RBNZ expected when it called for an end to rate hikes.

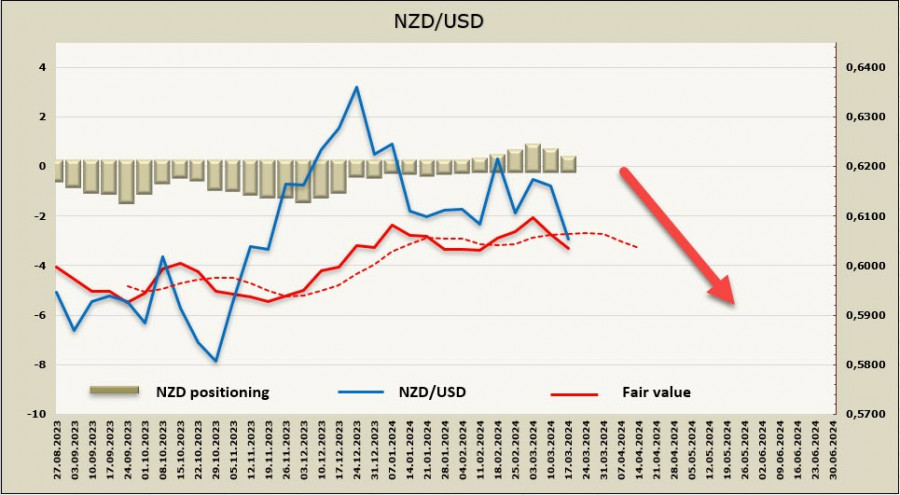

Since January, the yield spread between New Zealand and U.S. 10-year bonds has been working in favor of the UST, putting pressure on the kiwi's exchange rate in favor of the dollar. We expect this trend to continue in the coming week. If the Federal Reserve acknowledges the threat of renewed inflation at its meeting on Wednesday, the NZD will react by falling.

The net long NZD position decreased by 288 million over the reporting week, such a change is significant for the kiwi, with an overall excess of 152 million. The positioning is neutral, but the trend is bearish, with the price heading downwards.

A week earlier, we assumed that the pair would trade within the range of 0.6060/0.6210 in anticipation of new data. As of Tuesday, it became clear that a break below would take place, with the nearest support at 0.6030, followed by the lower boundary of the bearish channel at 0.5890/0.5910.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment