The pound sterling can only rely on the US news background. The GBP/USD pair has been trading sideways for a long time, so it will require a very strong news background for the market to break out of this "mess." America will provide all the necessary data to increase market activity, but the strength of this data will determine whether we will see the long-awaited wave 3 or just sideways movement.

Data on business activity indexes in the services, manufacturing, and construction sectors will be released in the UK. We don't expect such reports to wake the market from its slumber. Especially since these will not be the initial estimates of the March indexes, but the final ones, which rarely surprise market participants. I believe that the British news background will have no impact on the movement of the GBP/USD pair. We will discuss the American news feed in the corresponding review.

In my opinion, what's extremely important for the pound right now is not just the news background, but rather the market sentiment. Over the past four months, there have been at least two Bank of England meetings, two Federal Reserve meetings, four sets of Nonfarm Payrolls reports, GDP, unemployment, and inflation data. As we can see, all these data points haven't ended the pair's sideways movement. The fifth set of reports also have a small chance of breaking the pound out of its horizontal movement.

I also want to remind you that over the past four months, the likelihood of a Federal Reserve rate cut has significantly decreased. It's already clear that there won't be any monetary easing in March because the meeting has already taken place. Now the market is betting on June, but even the current level of US inflation puts this date in serious doubt. Consequently, the timing of the first Fed rate cut keeps getting pushed further out, and the number of expected rounds of cuts decreases. This whole process is referred to as the Fed maintaining its hawkish stance instead of being dovish and this should increase the demand for the dollar. This pattern works in the EUR/USD instrument, but not in the GBP/USD instrument. Therefore, regardless of the news background, it's crucial for the pound that the market stops ignoring the obvious factors.

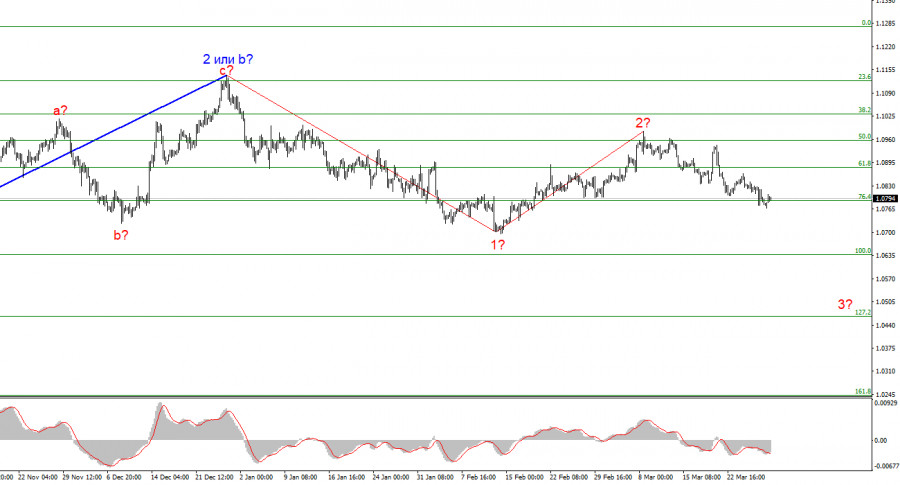

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci.

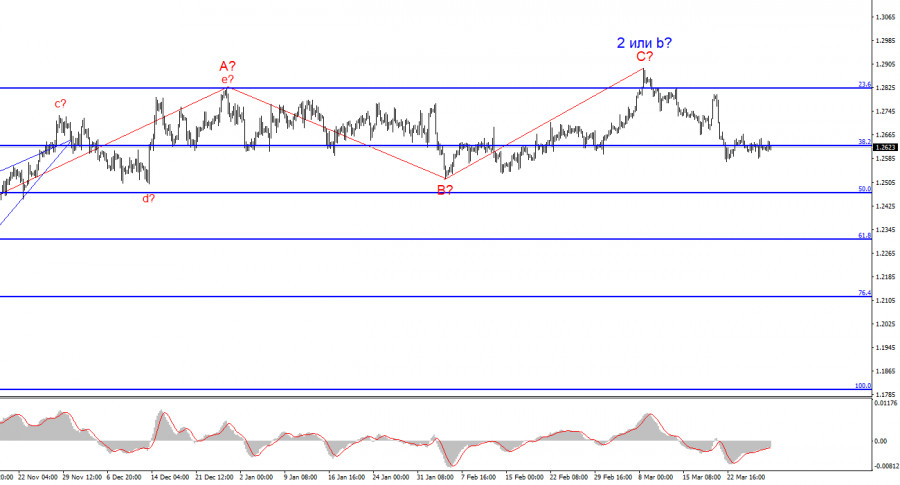

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can confirm that wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The quotes haven't moved far away from the peaks, so we cannot confirm the start of the wave 3 or c.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment