The third European Central Bank meeting of 202 has ended. The market expected that interest rates would remain unchanged, and it proved to be right. However, some analysts and economists also anticipated that ECB President Christine Lagarde would announce that it is ready to shift towards a more accommodative monetary policy at the next meeting. This did not happen, although a rate cut in June was suggested.

Lagarde said that price pressures in the European Union are gradually diminishing, but the EU economy remains weak as well. According to her, some indicators suggest recovery, however, the "restrictive" policy of the central bank is slowing economic growth. "The tightness in the labour market continues to gradually decline. Inflation is expected to fluctuate around current levels in the coming months and to then decline to our target next year," Lagarde said. Confirming the picture of gradually diminishing inflation risks.

Since Lagarde's speech lacked concerns about a new surge in consumer prices (for instance, due to geopolitical risks), we can arrive at the conclusion that the central bank will be ready to consider easing policy in June. Lagarde said that there will be a lot more data available at the next policy meeting, and that they can't assume that Eurozone inflation will mirror US inflation. "We are data-dependent, we are not Fed-dependent," Lagarde said.

Therefore, the ECB does not intend to keep the rate at its peak value simply because the Federal Reserve is unable to lower its rate at this time. If Lagarde says that inflation will remain around the current level in the coming months and does not believe that a stronger slowdown is needed, then the current CPI value is enough to start easing policy. In my opinion, the probability of rate cuts in June is currently around 90%, unless inflation accelerates above 2.6% year-on-year in April and May.

Overall, I believe that after the ECB meeting, the news background for the EUR/USD instrument has not changed. It still supports the US currency. Therefore, I expect the instrument to fall in line with the current wave pattern. It will not be a rapid decline. Wednesday was quite rare.

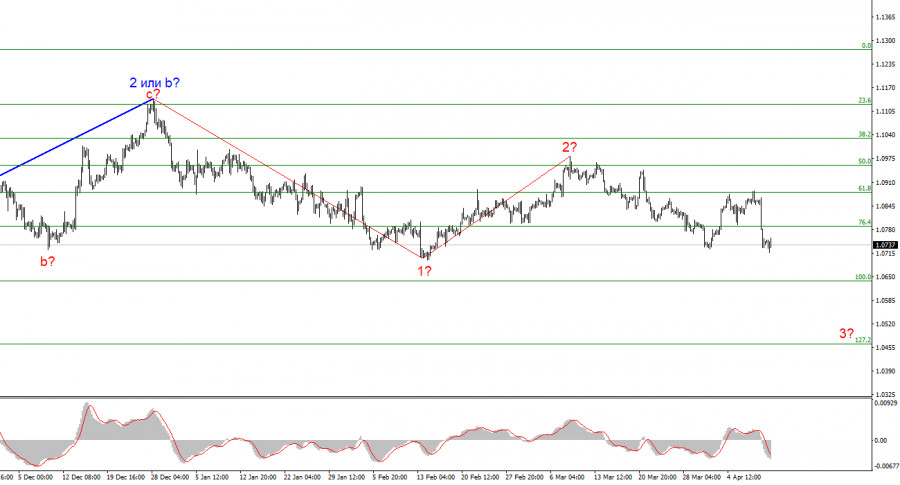

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci, as the news background remains in favor of the dollar. The sell signal we need near 1.0880 was formed this week.

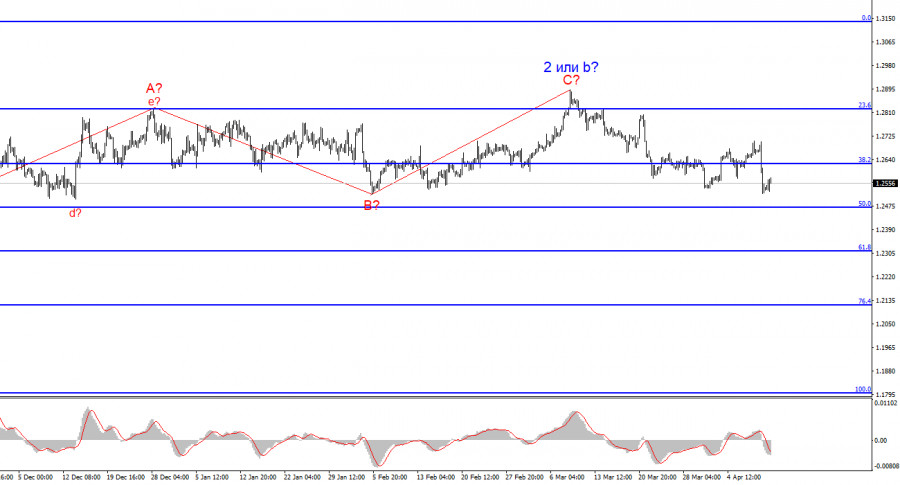

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can guarantee that wave 2 or b has ended, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The quotes haven't moved far away from the peaks, so we cannot confirm the start of the wave 3 or c.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment