On Monday, the EUR/USD bulls tried to advance with the help of hawkish comments from the European Central Bank officials, Spain's inflation data, and rumors of a ceasefire between Israel and Hamas. However, the accelerating pace of growth in the US Personal Consumption Expenditures Index looms over opponents of the US dollar. Especially in the run-up to the Federal Reserve meeting and the release of labor market data.

According to Pierre Wunsch, a member of the ECB's Governing Council, the ECB should be cautious about the signal that a second consecutive interest-rate cut in July would send to investors. "Cutting again in July would be interpreted by markets to mean that we're going to cut every meeting," the Belgian central-bank chief was cited as saying. Wunsch expects good news and predicts only two rate cuts in 2024.

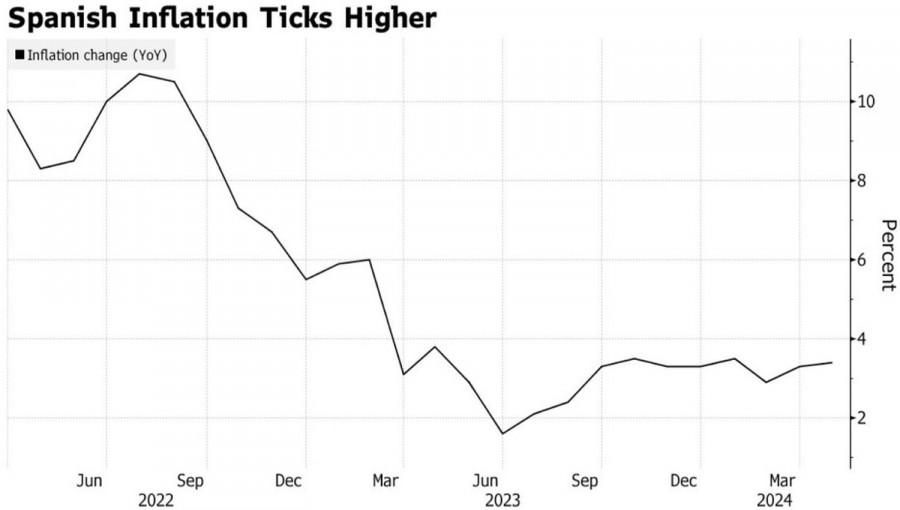

This may be the case, as Spanish inflation has been accelerating for the second consecutive month against the backdrop of the government's withdrawal of support measures to combat the energy crisis. This immediately brings to mind the ECB's forecasts that CPI will anchor in the near future. If so, expecting aggressive monetary expansion from Frankfurt is not worth it.

Inflation dynamics in Spain

The concerns of ECB officials against the backdrop of accelerating CPI growth rates may seem logical at first glance. Rapid loosening of monetary policy could lead to a decline in the euro exchange rate and an increase in imported inflation. However, Credit Agricole is ready to argue against this. The bank says the impact of a weaker currency on prices has diminished in recent years. A 10% decline in the nominal effective exchange rate slows CPI by 0.2-0.3 percentage points over four quarters, rather than the previously estimated 0.5 points. In addition, the trade-weighted exchange rate of the regional currency remains stable, unlike the decline in EUR/USD.

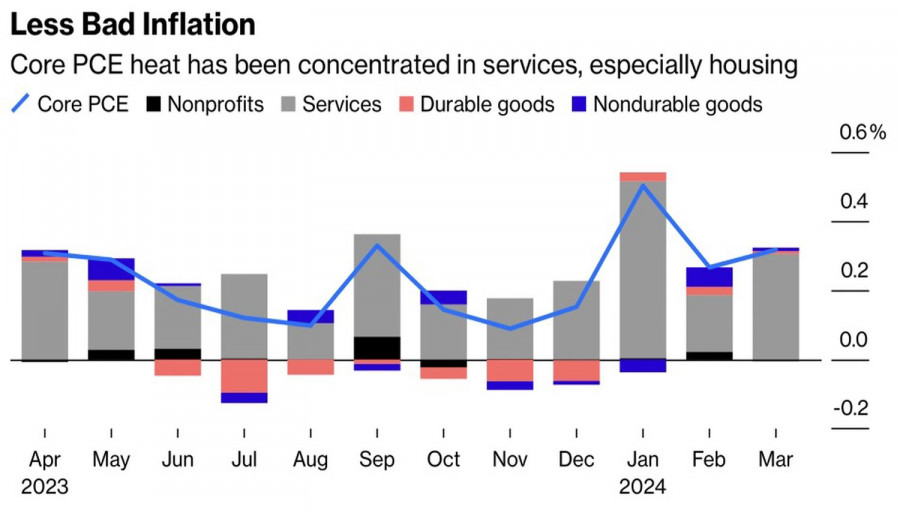

It seems that the fears of ECB representatives are unfounded, which opens the door for monetary policy easing in the euro area, but the situation is different in the US. Three consecutive months of accelerated Personal Consumption Expenditures mean that for the rest of the year, the PCE index should increase by an average of 0.2% month-on-month to reach the Fed's forecast of 2.6% by the end of 2024.

Dynamics and structure of inflation in the US

It's no wonder that the market strongly doubts the feasibility of the FOMC's March forecast of three rate cuts. At best, risk asset enthusiasts will get two cuts. This is bad news for US stocks. If borrowing costs remain unchanged and the yield on 10-year Treasury bonds continues to rally towards 5%, tight financial conditions will hinder the economy.

Technically, on the EUR/USD daily chart, the bulls' failure to keep the pair's quotes above the pivot level of 1.071 and the formation of a bar with a long upper shadow shows their weakness. It makes sense to sell towards 1.064 and 1.061.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment