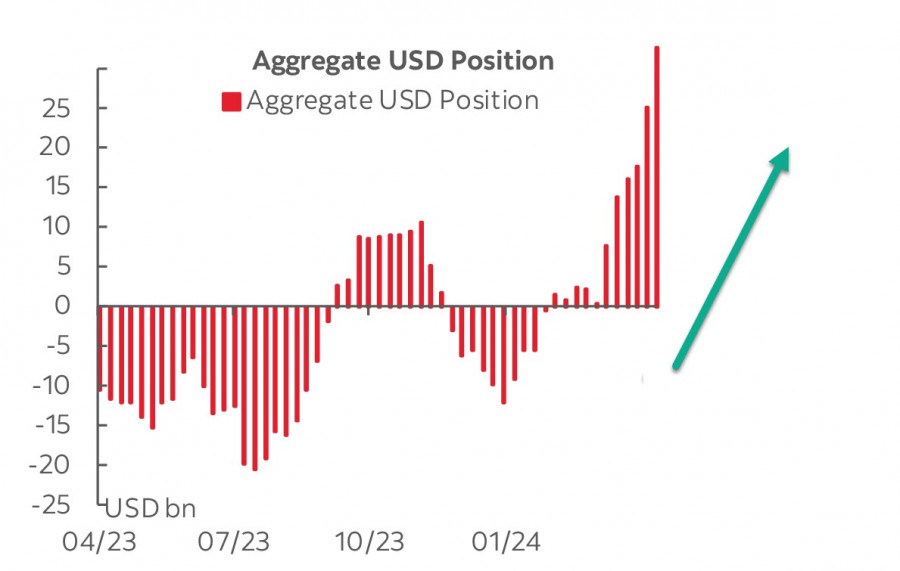

The net long USD position increased by 7.2 billion to 32.6 billion over the reporting week. Speculative investors are actively buying the dollar, as they increasingly believe that the US currency will strengthen in the coming weeks.

The European currencies registered the biggest losses – the euro, pound, and franc, as well as the Japanese yen, while commodity currencies posted minor changes.

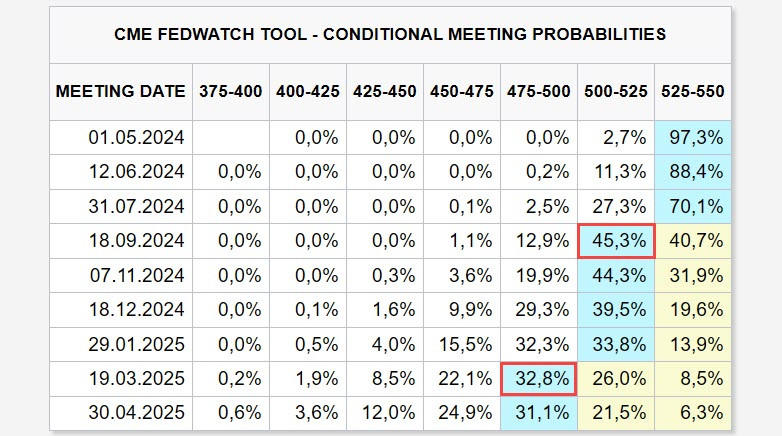

The Federal Reserve meeting on Wednesday, May 1st, will be this week's main event. This should be a standard meeting with no forecasts, as the main focus will be on Fed Chief Jerome Powell's press conference. Powell is expected to adopt a more hawkish tone, confirming the consensus regarding a slower trajectory of interest rate cuts.

As of Monday morning, the markets anticipate only one rate cut this year. According to CME data, the futures market implies a quarter-point rate cut in September, with the next cut not until March 2025. This trajectory is smoother than was assumed very recently and generally favors higher yields, and consequently, the dollar.

An unpleasant surprise emerged last week as US GDP growth slowed to 1.6% in the first quarter, below the long-term trend and significantly lower than expectations. The ISM Manufacturing PMI will be released on Tuesday, and if it falls below the forecast of 50.1, which seems plausible, it will suggest that the economy is cooling and will reinforce the Fed's expectations regarding further progress in slowing inflation.

Overall, the situation continues to favor a stronger dollar, reflected in yield dynamics. 10-year US Treasuries fell to 3.79% in December, reflecting market expectations of an imminent Fed rate cut, but in April, yields rose to 4.75%, persistently approaching the October peak of 5.02%.

There is no doubt that the US dollar is still the favorite instrument in the currency market. Structural problems in the US economy, such as rapidly growing government debt and budget deficits, currently do not influence investor preferences—faith in a strong dollar outweighs any concerns.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment