Demand for the euro has been declining over the past few weeks, which is fully consistent with the current wave pattern. Since the descending wave 3 or c has not yet ended at this time, I expect the quotes of the instrument to fall further. This will require a news background from the European Union, which will be weaker or dovish than the market expectations. But not everything depends on the news background, but it has always had a significant impact on the movement of any currency.

The upcoming news background of the European Union will consist of two events. On Monday, European Central Bank President Christine Lagarde will make a speech. I believe that at this time, when the ECB has almost decided on the time of the first easing of the monetary policy, Lagarde will not be able to tell the market anything new on this issue. Lagarde may only change her stance if key economic indicators change dramatically. For instance, if inflation starts to accelerate in April or May.

Earlier, some ECB members said that if inflation doesn't accelerate, then the central bank will be ready to lower rates in June. And if it does, then we can expect changes in Lagarde's rhetoric and this can influence the EUR exchange rate.

The second event is the reports on business activity in the manufacturing and services sectors, which I personally do not consider as important data. They can certainly influence the market mood on Tuesday, but they will not change the market mood globally.

In addition, there will be speeches of many ECB members during the week, but in general I think they will also give the same speeches as before. Based on everything I mentioned, I think that the upcoming week will not bring any global changes - the euro should fall further, as it appears that wave 3 or c has not yet ended.

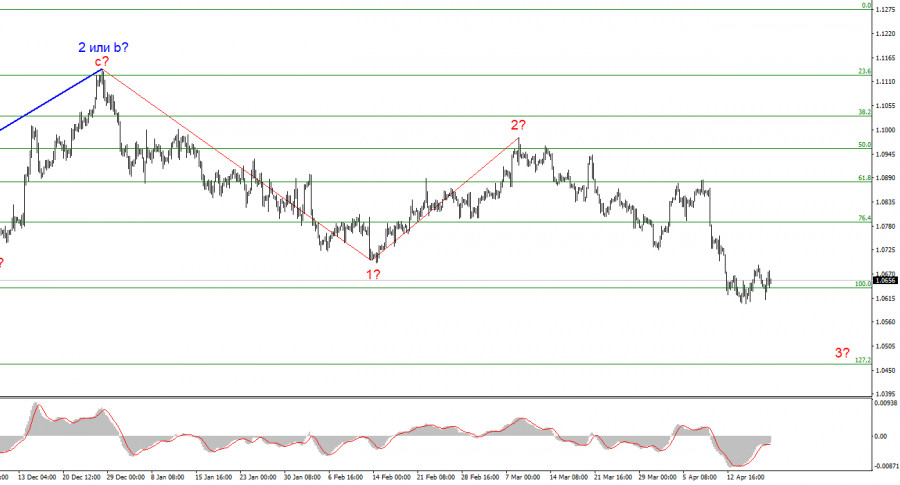

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

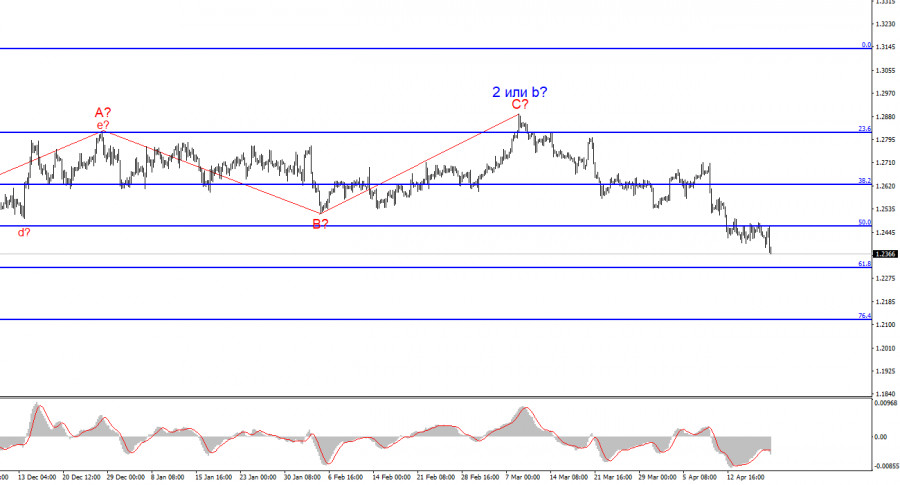

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment