Over the past two weeks, the market has been actively correcting the euro within the framework of the downward wave 3 or C. In my opinion, it is finally time to end this wave. Therefore, it is important for you to understand what the upcoming news background will bring. Will it be positive for the single currency or the opposite?

There will be quite a few interesting reports in the European Union. On Monday, one of the most important reports at the moment will be released in Germany – on inflation. The Consumer Price Index is expected to rise to 2.3% in April from 2.2% in March. An accelerated pace of inflation may support the euro, but in this case, we are about a minor pickup. At the same time, the indicator will remain in close proximity to the target level if the forecast is realized. In addition, German inflation is just inflation in one country of the European Union, albeit the most influential one. If the CPI slows down in most other countries, then overall inflation in the EU will decrease. And this is bad for the euro, because in this case the European Central Bank will have more reasons to conduct the first round of easing in June.

The euro area inflation report will be released on Tuesday. The CPI is expected to remain unchanged at 2.4% in April. Also, the preliminary estimate of GDP for the first quarter will be released. The bloc economy may grow by 0.1%. Such a value is unlikely to have a positive impact on buyers, as this growth is practically equivalent to no growth at all. And this has been the case in the EU for several quarters now. Regarding European inflation, the lack of changes means no changes in the sentiment of the ECB policymakers. The baseline scenario for interest rates will remain the same.

In addition, reports on the Manufacturing PMI and the unemployment rate will be released. These data no longer have the same degree of influence on market sentiment as before. Based on all the above, if inflation in Germany and the EU does not suddenly accelerate, demand for the euro may start to fall again. This is the scenario I am counting on.

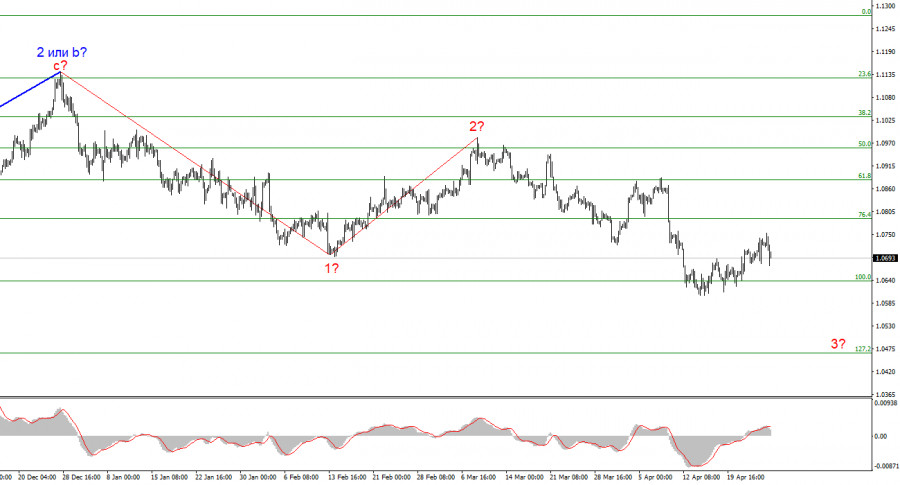

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, as the news background works in the dollar's favor. A successful attempt to break 1.0637, which is equal to 100.0% Fibonacci, will indicate that the market is ready for new short positions.

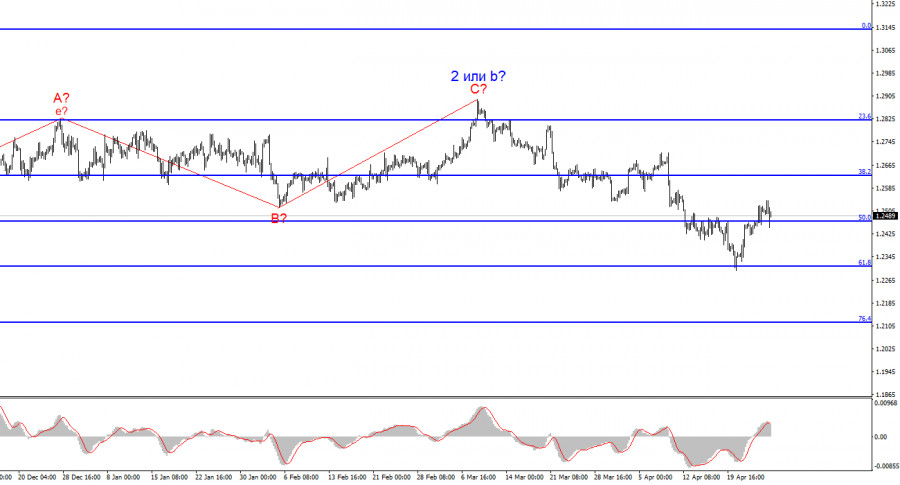

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment