The euro managed to find its footing thanks to positive macro data from Germany, doubts among European Central Bank officials about monetary policy easing, and revisions by major banks to forecasts regarding the scale of the ECB's rate cut cycle. The closure of speculative short positions ahead of ECB President Christine Lagarde's speech also played a significant role in the rebound of EUR/USD.

The futures market is confident about a rate cut in June and assesses the probability of a second step in July at 50%. Lagarde may confirm or refute market expectations, which will influence the euro exchange rate. Her colleague on the Governing Council, Olli Rehn, said that key rates could be lowered in June, noting that the biggest risks to the ECB's monetary policy stem from Iran-Israel tensions and the ongoing Russia-Ukraine war. This refers to the return of the energy crisis, which pushed CPI above 10% in the fall of 2022.

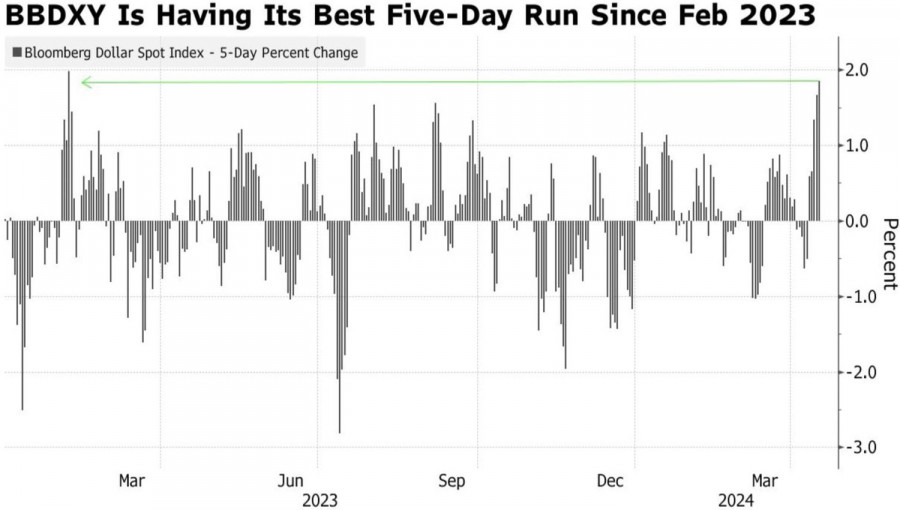

Due to expectations that the Federal Reserve will continue to hold the federal funds rate at the 5.5% plateau while the ECB will start reducing it in June, the USD index recorded its best 5-day rally since February 2023. However, as forecasts for the Fed's rate cut change, so do those for other central banks. If the leader of the pack slows down, the rest of the pack must do the same.

Dynamics of the US Dollar

As a result, Deutsche Bank lowered its expectations for the number of ECB rate cuts in 2024 from five to three, while Morgan Stanley has reduced theirs from four to three. The head of the Bank of Lithuania, Gediminas Simkus, says that there will be more than three rate cuts this year, while his colleague from Ireland, Gabriel Makhlouf, said that he would never rule out a 50 basis point cut.

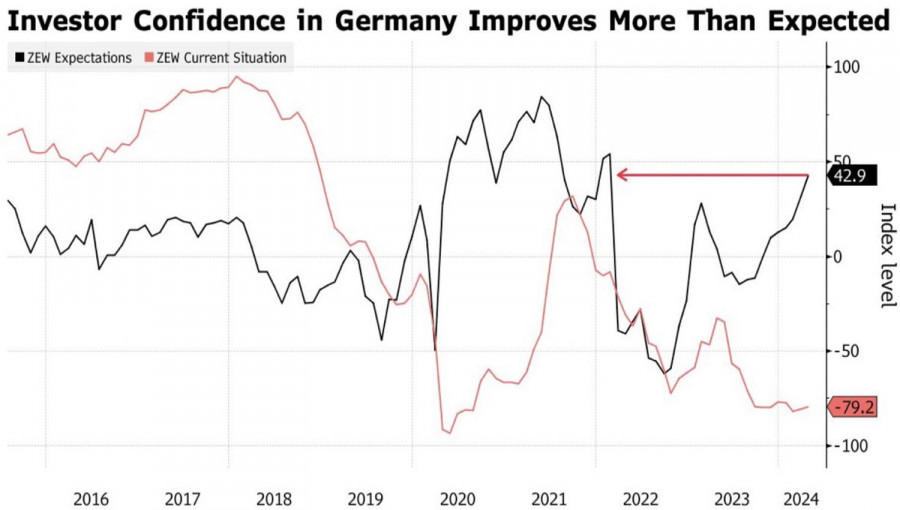

Meanwhile, growing investor confidence in the recovery of the German economy helped the EUR/USD bulls. The ZEW Economic Sentiment Index rose from 31.7 to 42.9 in March, significantly higher than Bloomberg forecasts. As the global economy gets back on its feet, the German economy follows suit.

Dynamics of Economic Conditions and ZEW Sentiment

The bulls were also optimistic on Tuesday due to faster GDP growth of China and hopes for an increase in IMF forecasts for the global economy. As this would be excellent news for a pro-cyclical currency like the euro.

However, Israel's intention to retaliate against Iran for the attack on its territory is fueling demand for safe-haven assets. Escalation of the conflict in the Middle East could undermine the hopes of the main currency pair for salvation. It would contribute to higher oil prices and accelerate inflation in the United States, pushing the Fed, if not to raise rates, then to keep them at 5.5%.

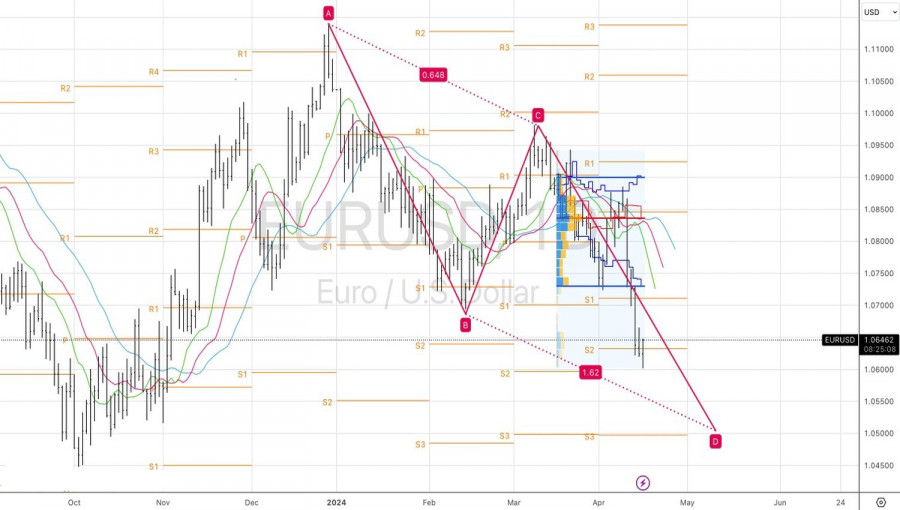

Technically, on the EUR/USD daily chart, the bulls are attempting to form a pin bar or a doji bar to create a foundation for a counterattack. If they manage to cling to the level of 1.053, the risks of a rebound will increase. In this scenario, you may consider long positions in the short-term with subsequent return to selling.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment