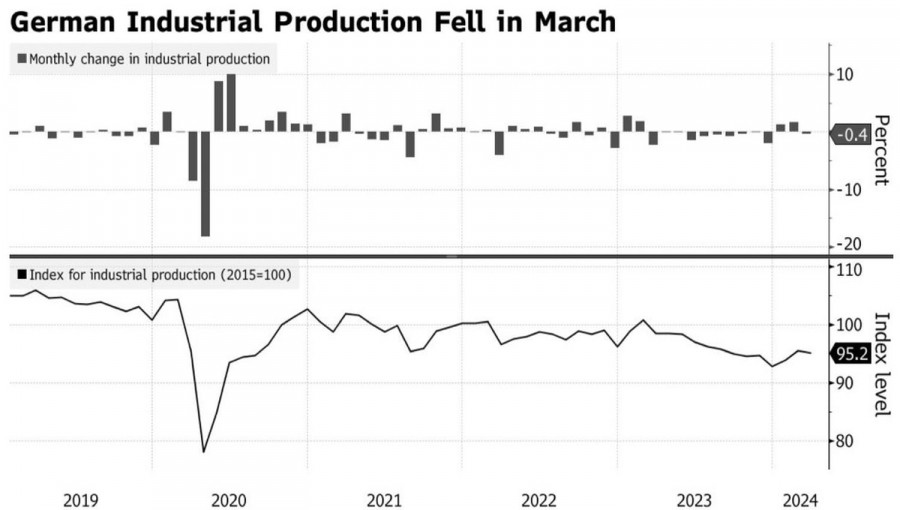

Disappointing data from Germany and the realization that Europe will lower rates before the United States brought the EUR/USD bulls down to earth. Following the decline in industrial orders, Germany's industrial output also showed negative growth. Although the positive results from German external trade managed to make the situation seem less unpleasant, the market began to question whether the euro was too weak to break the downward trend.

Germany's Industrial Production Dynamics

Despite European Central Bank Governing Council member Joachim Nagel's comments that certain forces could keep inflation in the eurozone elevated, markets see things differently. Following the Swiss National Bank, the Swedish Riksbank lowered its main interest rate. Investors anxiously await the Bank of England meeting, where it may signal a rate cut in the summer.

Usually, central banks move in a pack, led by the Federal Reserve. However, this time Europe decided to lead the way. Derivatives anticipate a cut in the ECB deposit rate in June and three acts of monetary easing by the end of 2024. This is more than the two rate cuts by the Fed and the US central bank is expected to start in September. While the different pace of monetary policy easing is already largely reflected in EUR/USD quotes, the Riksbank and BoE remind the bulls of their potential weakness.

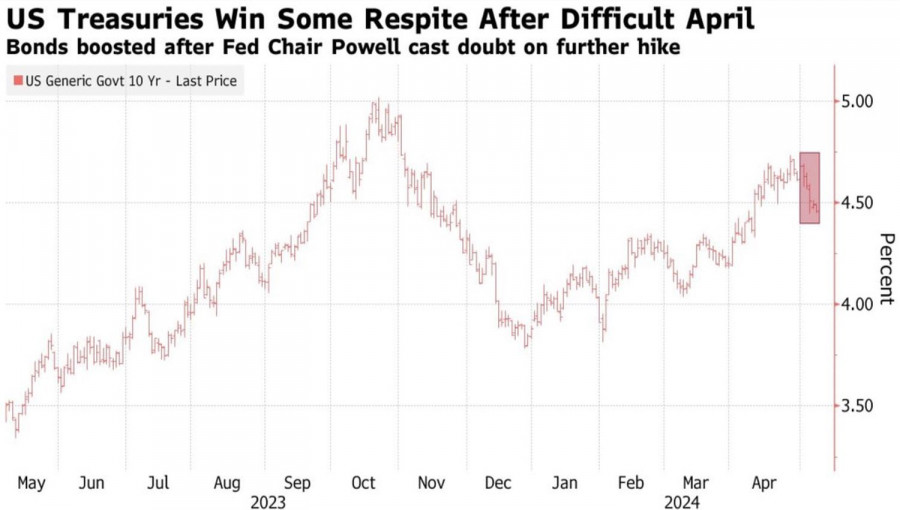

Some pressure on the US dollar was expected from the US Treasury auctions. It plans to auction $125 billion of 3-, 10-, and 30-year bonds. High demand will lead to a reduction in yields in both the primary and secondary markets. However, who knows if investors will buy securities amid recent rate cuts? If not, this will lead to a rise in yields and support the EUR/USD bears.

US Treasury bond yield

Thus, weak data from Germany, uncertainty surrounding the US Treasury bond auctions, and reminders that Europe will be the first to ease monetary policy exert pressure on the main currency pair.

However, in a situation where US employment data showed the first signs of economic cooling and since US inflation data will be released by May 17, many investors are not in a rush to force events. If inflation continues to accelerate, the markets may actively sell the EUR/USD pair. At the same time, traders await speeches from Philip Jefferson, Lisa Cook, and Susan Collins. Fed representatives may provide clues about the central bank's future course of actions.

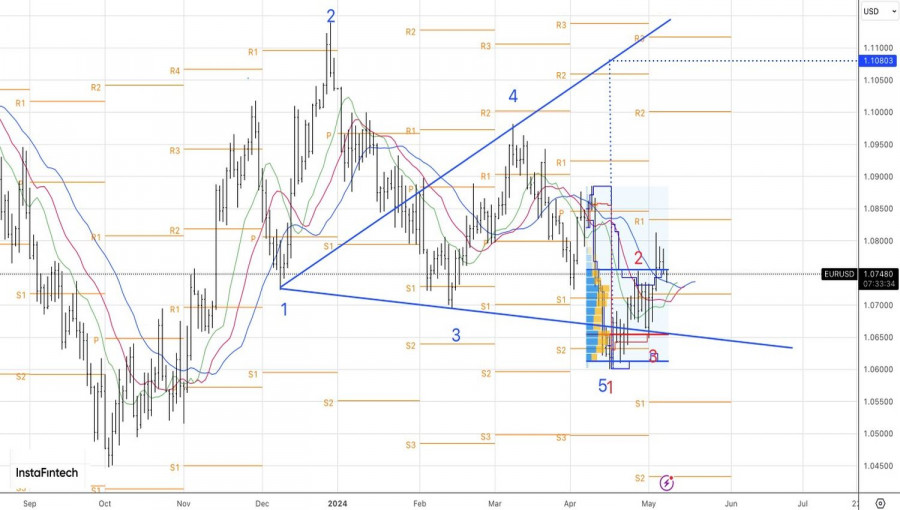

Technically, on the EUR/USD daily chart, the bears managed to play out the internal bar on the second attempt. As a result, the main currency pair tested dynamic support in the form of a moving average and bounced off it. You may consider buying the euro once it climbs above the upper boundary of the fair value range of $1.0615-1.0755.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment