The first signs of weakness in the US labor market became a compelling argument in favor of the EUR/USD correction transitioning into breaking the downtrend. This requires further cooling of the US economy, however, the eurozone may also help the euro bulls. Although the GDP has not yet recovered, positive signs from business activity and other indicators indicate a bright future for the currency bloc.

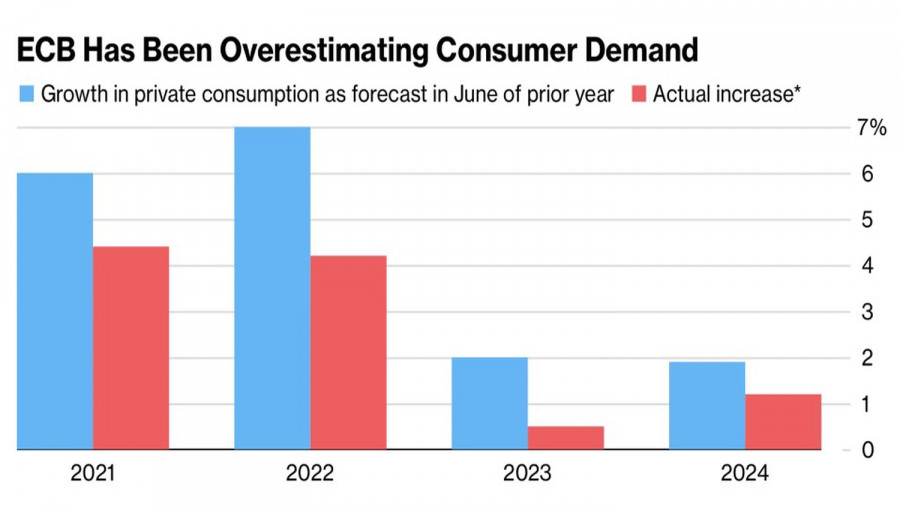

A strong labor market, bright wage growth, and inflation slowing down towards 2%, seemingly create ideal conditions for consumers to loosen their purse strings. This is what the European Central Bank predicted, yet it was wrong every time. As it faced shocks such as the armed conflict in Ukraine and the energy crisis, cautious eurozone citizens led to an economy teetering on the brink of recession.

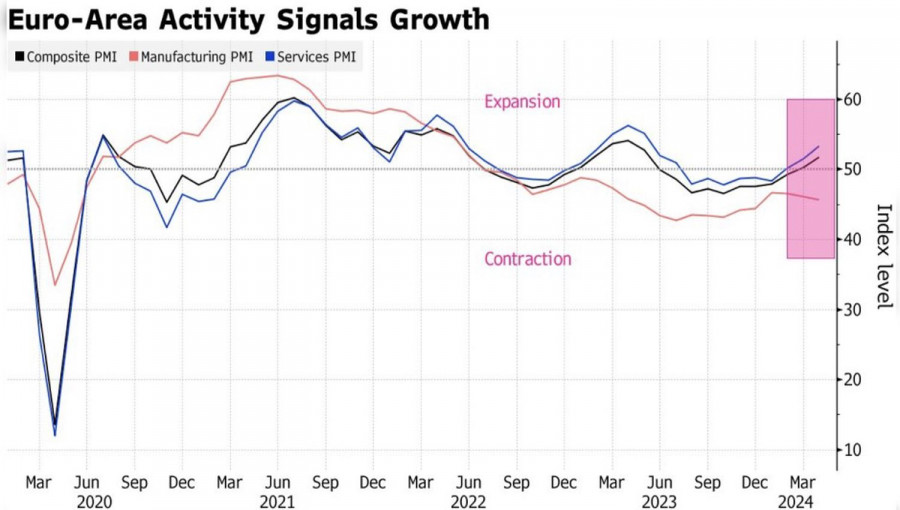

The dynamics of European business activity

However, adapting to new conditions, falling gas prices, and swift monetary expansion are pushing Europeans from savings towards consumption. This is already reflected in the GDP data for the first quarter. The indicator increased by 0.3% quarter-on-quarter compared to the +0.4% growth in Gross Domestic Product in the United States. The divergence in economic growth is becoming smaller, which is a compelling argument in favor of buying EUR/USD.

The market currently expects the ECB to start monetary expansion in June and the Federal Reserve in September. The scale of the ECB's monetary policy easing in 2024 is estimated at 75 basis points, while that of the United States is at 50 basis points. However, if new data indicates further cooling of the US economy, the market will return to the scenario of three Fed rate cuts, as envisaged in the March FOMC forecasts. The bears will not have the strongest advantage, so EUR/USD will be able to continue its rally.

Forecasts and actual consumption data in the eurozone

Everything could change with the US inflation report for April. Investors will turn to the dollar if inflation accelerates once again. However, judging by the drop in energy prices due to de-escalation of geopolitical conflict in the Middle East, the cooling labor market, including the slowdown in average wages, and the overall US economy, the downward trend in CPI and PCE will likely recover soon. Excellent news for EUR/USD bulls.

Interestingly, one of the main hawks, Michelle Bowman, is confident about this. Despite the existing risks of accelerated inflation, the downward trend remains intact. If the disinflation process resumes, the Fed may not wait until September and could lower rates in July.

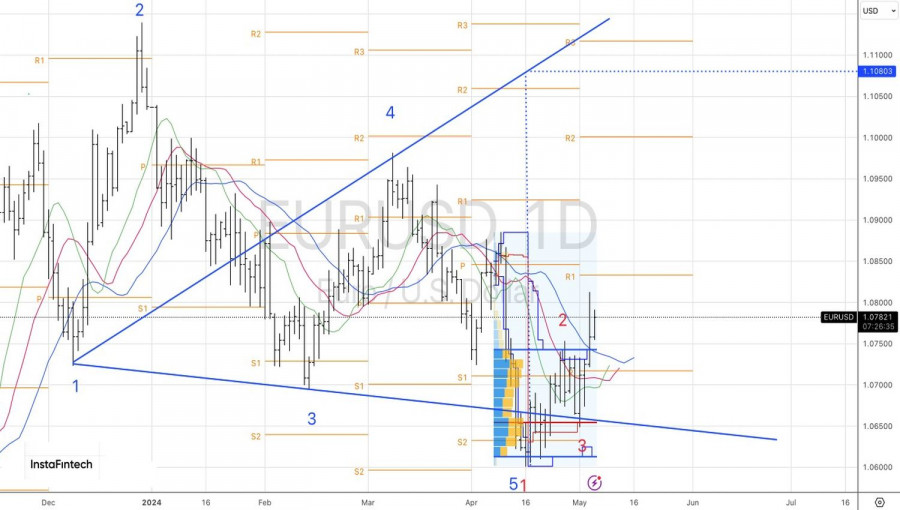

Technically, on the EUR/USD daily chart, the fact that bears could not return the quotes to the fair value range of 1.061-1.074 indicates their weakness. Bulls continue their attack towards the target at 1.108 according to the Wolfe Wave pattern. Traders may consider long positions.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment