The news background in the United States will attract the most attention. The dollar's course is crucial in the currency market and the global economy. Therefore, market participants focus on US reports and other events. Therefore, after analyzing the events in the EU and the UK, it will be useful to understand the events of the following week in America.

Events will unfold on Tuesday when the Producer Price Index (PPI) is released, and Federal Reserve Chair Jerome Powell will speak. The PPI is interesting because it directly affects overall inflation. If producers raise prices, then prices rise in retail networks, driving up overall inflation, and vice versa. As for Powell's speech it doesn't require any special explanations. Powell may say that the Fed will not begin to ease monetary policy until there is confidence that inflation will fall to 2% in the medium term. Since this isn't the case right now, and some members of the FOMC have already hinted at the potential need to raise interest rates again, there is no doubt that Powell will remain dovish.

The main report of the week will be released on Wednesday – the inflation report for April. The value is expected to remain unchanged compared to March or slow down by a maximum of 0.1% to 3.4% on an annual basis. Core inflation is also expected to remain relatively unchanged at around 3.8%. Such data could support the US dollar, as the market may once again be reassured that the decision to lower interest rates is clearly not imminent.

Data on the housing market and industrial production will be released on Thursday. With these reports, the week will essentially end in the United States. In my opinion, the key focus will be on the CPI report. If it turns out that the indicator has begun to slow down again, it could have very negative consequences for the US dollar, which the market is not eager to buy despite the news background. For me, a slight decrease will not change the general picture, but the market may react by reducing demand for the dollar, unfortunately. However, I remain faithful to the current wave analysis for both instruments and continue to expect a decline.

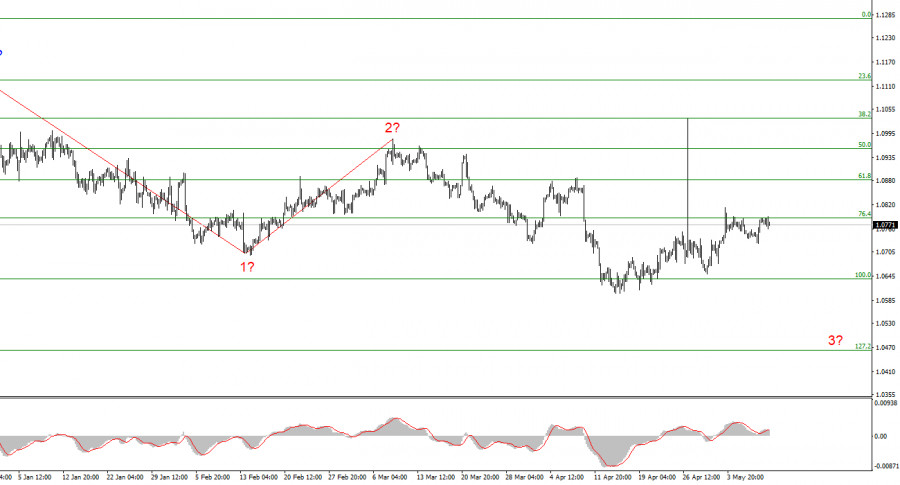

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark. Failure to break 1.0787, which is equal to 76.4% Fibonacci, will indicate that the market is ready for new short positions.

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c is being formed. A successful attempt to break 1.2625, which corresponds to 38.2% Fibonacci, indicates the completion of an internal, corrective wave 3 or c, but 1.2470 is still holding back the sellers from attacking, preventing the British from building a downward wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment