Demand for the British pound has not increased over the past month, just like demand for the euro. We could even say that it has decreased in the last two weeks. However, the pound still shows no signs of falling against the dollar and cannot form a convincing wave 3 or C. An unsuccessful attempt to break through the 1.2470 level delays the pound's decline. The market is pleased with the recent UK reports, and this has supported the pound. Recent reports from the US have put pressure on the dollar.

The UK is set to release interesting reports. First and foremost, I will highlight the unemployment report, which may continue to rise and reach 4.3% in March. I will also mention the report on the change in the number of unemployed, which may increase by 14,000. Average earnings will also be significant, as they affect the inflation rate. The faster wages grow, the slower inflation will decelerate or may not decelerate at all. If inflation stops decreasing, the Bank of England will begin to lower interest rates later than the market currently expects. Based on this factor, demand for the pound may rise again. Therefore, we need high unemployment and low wage growth rates.

There are other significant events to highlight as well. Traders may pay attention to the speech of the Chief Economist of the Bank of England, Huw Pill, who stated on Friday that the rate will start to decrease when there is sufficient evidence to maintain the trajectory towards 2%. He also urged the market not to make medium-term forecasts about the timing of rate cuts, as everything will depend on the dynamics of inflation. I don't think Pill will add anything significant to this speech next week. There won't be any other major events in Britain.

However, the pound's exchange rate is also influenced by the American economy, and much more significantly than the UK one. In the next overview, we will consider US events and reports, as they are of paramount importance for the dollar, and therefore for the euro and the pound.

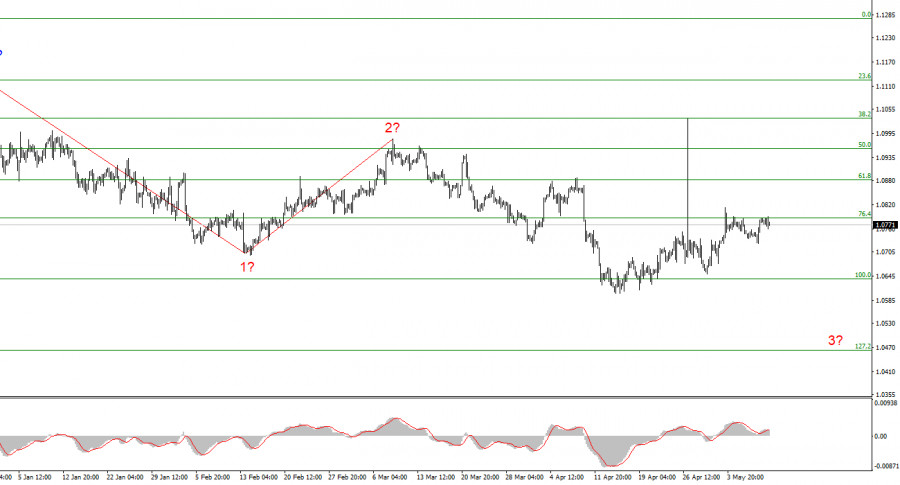

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark. Failure to break 1.0787, which is equal to 76.4% Fibonacci, will indicate that the market is ready for new short positions.

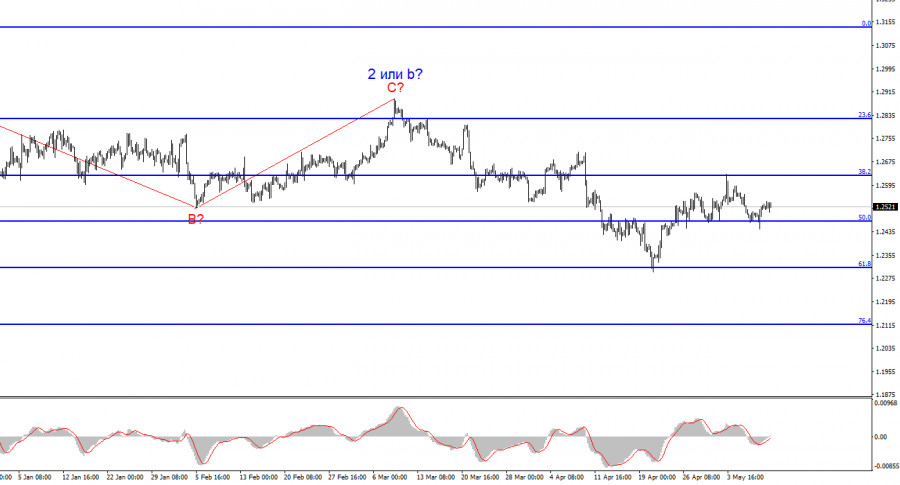

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c is being formed. A successful attempt to break 1.2625, which corresponds to 38.2% Fibonacci, indicates the completion of an internal, corrective wave 3 or c, but 1.2470 is still holding back the sellers from attacking, preventing the British from building a downward wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment