While investors are engrossed in Trump trading, the oil market offers a safe haven. According to Citi, neither Republicans nor Democrats propose radical changes in their programs that would impact oil and gas operations. Instead of reacting sensitively to the approaching US presidential elections, as other assets do, black gold is focused on fundamental factors, which, unfortunately, are not in Brent's favor.

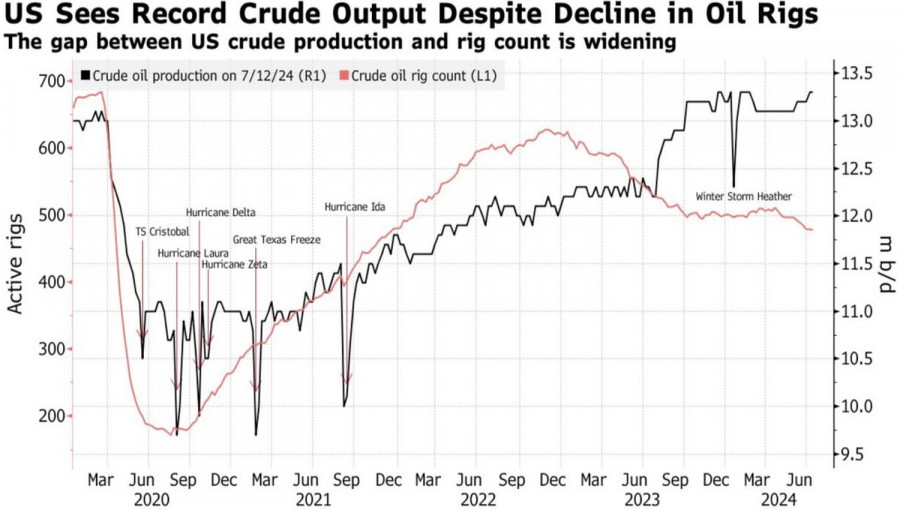

OPEC+'s gradual withdrawal from production cut commitments is formally due to the stabilization of the oil market. However, in reality, the void does not remain empty. US oil production has reached a record high of 13.3 million barrels per day. This seems at least strange against the backdrop of drilling rigs falling to their lowest levels since December 2021. However, everything makes sense when considering higher productivity per well and the use of some reserves from drilled but uncompleted wells.

Trends in Oil Production and Number of Drilling Rigs in the US.

Members of OPEC+ need to consider changing the plan to gradually withdraw from the production cut commitments. The alliance will have to do this if Brent continues to decline. According to Morgan Stanley, the black gold market will balance in the fourth quarter, and in 2025, there will be a supply surplus, leading to a drop in the North Sea grade to $70 per barrel.

Fears of increased production and concerns about global demand influence the decline in Brent prices. According to StoneX, global oil inventories increased in the week leading up to July 19. This process is active in North America and Asia, while Europe has not seen a clear trend. There is certainly logic in such inventory dynamics. Statistics indicate a slowdown in the US economy, and China has recently released disappointing data regularly.

Even the easing of monetary policy by the People's Bank of China has not significantly impressed Brent enthusiasts. To drastically change the situation, more aggressive rate cuts are required. And there are still risks of Donald Trump returning to the White House with his protectionist policies, which, according to UBS, could slow China's GDP growth by almost half.

Neither Ukrainian drone attacks on Russian oil infrastructure, fires in Canada, nor skirmishes between Israel and Hezbollah are helping black gold. The North Sea grade ignores politics and geopolitics and focuses instead on the economy.

Technically, on the daily chart, Brent activated and completed the 1-2-3 reversal pattern. As a result, the first of two previously set short targets at $82.4 and $81 per barrel was achieved. It makes sense to hold and periodically increase positions formed from $84.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

OPEC+'s gradual withdrawal from production cut commitments is formally due to the stabilization of the oil market. However, in reality, the void does not remain empty. US oil production has reached a record high of 13.3 million barrels per day. This seems at least strange against the backdrop of drilling rigs falling to their lowest levels since December 2021. However, everything makes sense when considering higher productivity per well and the use of some reserves from drilled but uncompleted wells.

Trends in Oil Production and Number of Drilling Rigs in the US.

Members of OPEC+ need to consider changing the plan to gradually withdraw from the production cut commitments. The alliance will have to do this if Brent continues to decline. According to Morgan Stanley, the black gold market will balance in the fourth quarter, and in 2025, there will be a supply surplus, leading to a drop in the North Sea grade to $70 per barrel.

Fears of increased production and concerns about global demand influence the decline in Brent prices. According to StoneX, global oil inventories increased in the week leading up to July 19. This process is active in North America and Asia, while Europe has not seen a clear trend. There is certainly logic in such inventory dynamics. Statistics indicate a slowdown in the US economy, and China has recently released disappointing data regularly.

Even the easing of monetary policy by the People's Bank of China has not significantly impressed Brent enthusiasts. To drastically change the situation, more aggressive rate cuts are required. And there are still risks of Donald Trump returning to the White House with his protectionist policies, which, according to UBS, could slow China's GDP growth by almost half.

Neither Ukrainian drone attacks on Russian oil infrastructure, fires in Canada, nor skirmishes between Israel and Hezbollah are helping black gold. The North Sea grade ignores politics and geopolitics and focuses instead on the economy.

Technically, on the daily chart, Brent activated and completed the 1-2-3 reversal pattern. As a result, the first of two previously set short targets at $82.4 and $81 per barrel was achieved. It makes sense to hold and periodically increase positions formed from $84.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment