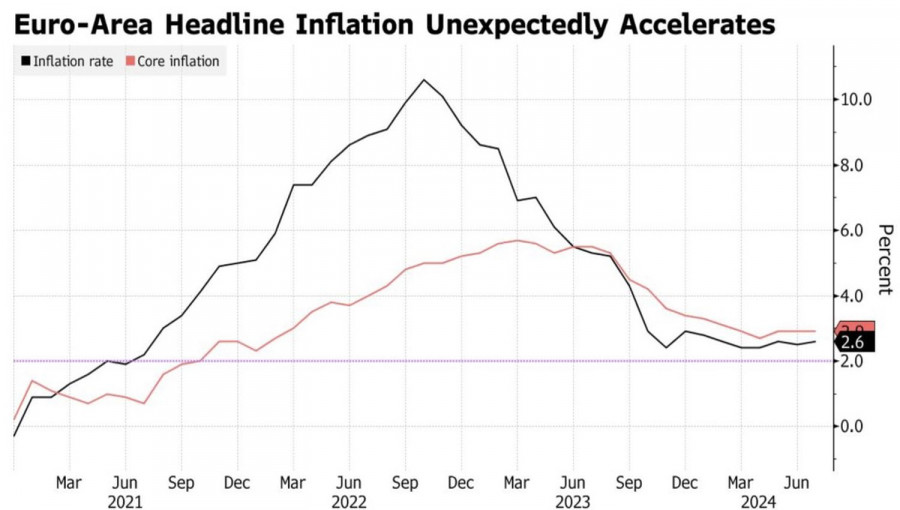

Central banks' decisions are heavily reliant on data, but sometimes, that data can be mind-boggling. Consumer prices in Germany and the Netherlands unexpectedly accelerated, while in Spain and France, they were below forecasts. Eurozone inflation at 2.6% also exceeded Bloomberg experts' estimates. Core inflation was anchored at 2.9%, and service prices slightly decreased from 4.1% to 4% in July. The situation remains complex, with one more report to be released before the European Central Bank's September meeting.

According to Governing Council member Isabel Schnabel, deviations in the trend can be either isolated or systematic. In the first case, rates will continue to go down. In the second case, it's worth monitoring the data closely to avoid premature monetary policy easing. At first glance, July's CPI report increases the risks of maintaining the deposit rate at 3.75%, which is good for EUR/USD.

Dynamics of European Inflation

However, the futures market believes in a rate cut of 59 basis points by the end of 2024. This refers to two acts of 25 basis points, each with a slight probability of a third. If not in September, then when? It's no surprise that after two steps forward, the euro took a step back. Investors still need clear answers from the ECB and continue waiting for Federal Reserve signals.

What could those hints be? The U.S. central bank might note progress in the fight against inflation and state that monetary policy is excessively tight. It could express concerns about the labor market's fate and emphasize the shifting balance of two-sided risks. If inflation slows and unemployment rises, it's time to lower the federal funds rate. And the closer we get to the start of monetary easing, the worse it will be for the U.S. dollar.

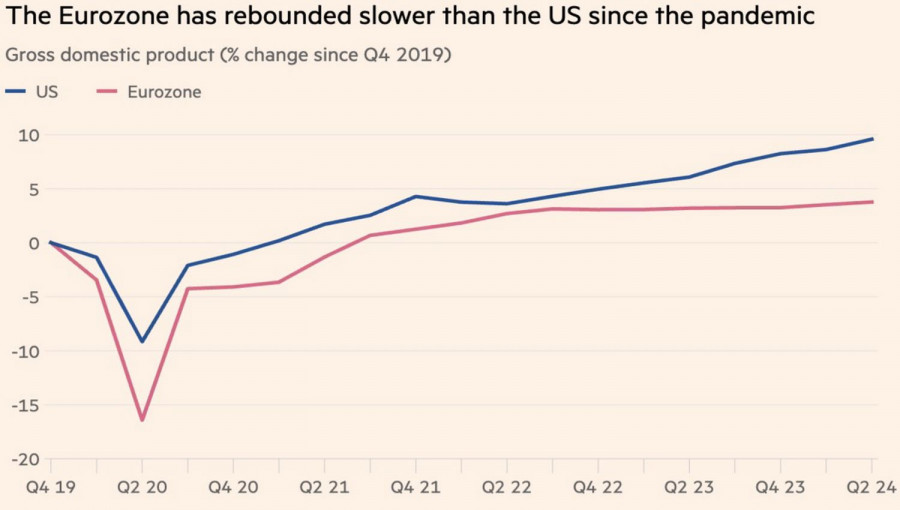

Does this mean that EUR/USD will quickly surge? Not necessarily. The euro is a pro-cyclical currency that loses ground in a slowing global GDP environment. Moreover, no one has canceled the divergence in economic growth between the United States and the eurozone.

Dynamics of US and Eurozone GDP

Signs of a slowing global economy are visible. This includes declining purchasing managers' indices, an unscheduled easing of monetary policy by the People's Bank of China, and data on the U.S. labor market and inflation. The situation could worsen further if Donald Trump returns to power in the U.S. with his tariffs and trade wars. In such a scenario, expecting consolidation of the main currency pair makes sense.

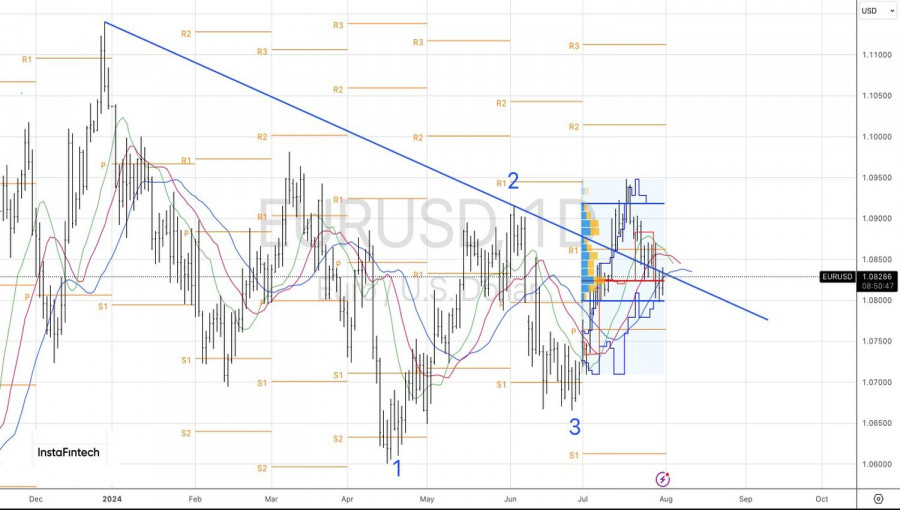

Technically, the bulls attempt to push EUR/USD quotes beyond the trendline on the daily chart. If successful, the long positions formed from 1.0790-1.0800 should be held and periodically increased. The target levels for the upward movement are 1.0865 and 1.0900.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment