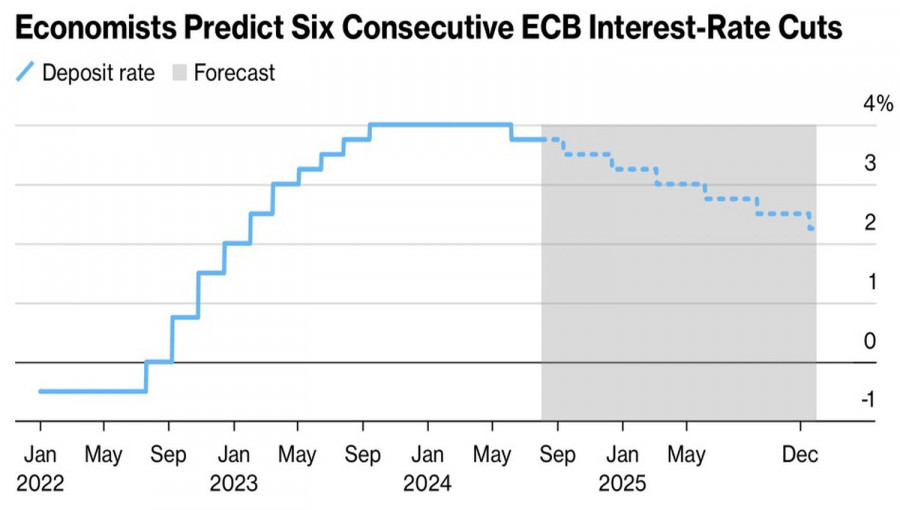

The city sleeps. The mob awakens. While the markets slumber, awaiting the July U.S. inflation data, EUR/USD bulls decided to launch an attack, buoyed by updated Bloomberg forecasts on deposit rates. Experts believe the European Central Bank will cut rates quarterly, with borrowing costs expected to reach 2.25% by December 2025. The futures market anticipates a more aggressive adjustment to the federal funds rate, and the differing pace of monetary policy creates a tailwind for the euro.

ECB Deposit Rate Forecasts

The ECB's slow pace underpins Bank of America's bullish outlook for EUR/USD. The company notes that core inflation in the Eurozone remains high at 2.9%, with service prices stuck above 4%, allowing ECB President Christine Lagarde and her colleagues to be patient with easing monetary policy. Against the backdrop of a slowing U.S. economy, this situation pushes the euro higher against the American dollar.

ING expects to see EUR/USD at 1.10 in the near future as the global risk appetite gradually recovers, supporting the euro. Meanwhile, the narrowing yield differential between U.S. and German bonds indicates that the main currency pair is still undervalued.

EUR/USD bulls are not at all deterred by the reduced probability of a 50 basis point rate cut by the Federal Reserve in September to less than 50% or Bloomberg experts' pessimism regarding the German economy. They have downwardly revised their GDP growth forecasts for Germany for 2024 and 2025 to 0.1% and 1.1%, respectively.

Dynamics of Germany's GDP and Growth Forecasts

News of the German economy's struggle has been coming for a long time. The slowdown in the Chinese economy negatively impacts it—Germany's major trading partner—and the growing risks of Donald Trump's return to the White House with his protectionist policies and the potential revival of trade wars. For Brussels and Berlin, this would be a real shock.

In my opinion, the release of the U.S. inflation data for July will be a defining moment for EUR/USD. Until then, any attempts by the pair to break out of the 1.088–1.094 consolidation range may seem like child's play. Even if support or resistance levels are breached, it is unlikely that the main currency pair will establish a trend without these crucial CPI figures. The Fed's policy is heavily dependent on this data, and investors have no choice but to be on high alert for these figures.

Technically, on the daily chart, EUR/USD consolidates within the Adam and Eve pattern. The pair is trading close to its fair value. A successful breach of resistance at 1.094 or support at 1.088 is needed to determine the direction of its further movement. In the first case, it makes sense to consider a buying strategy; in the second, it makes sense to sell the euro against the U.S. dollar.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

ECB Deposit Rate Forecasts

The ECB's slow pace underpins Bank of America's bullish outlook for EUR/USD. The company notes that core inflation in the Eurozone remains high at 2.9%, with service prices stuck above 4%, allowing ECB President Christine Lagarde and her colleagues to be patient with easing monetary policy. Against the backdrop of a slowing U.S. economy, this situation pushes the euro higher against the American dollar.

ING expects to see EUR/USD at 1.10 in the near future as the global risk appetite gradually recovers, supporting the euro. Meanwhile, the narrowing yield differential between U.S. and German bonds indicates that the main currency pair is still undervalued.

EUR/USD bulls are not at all deterred by the reduced probability of a 50 basis point rate cut by the Federal Reserve in September to less than 50% or Bloomberg experts' pessimism regarding the German economy. They have downwardly revised their GDP growth forecasts for Germany for 2024 and 2025 to 0.1% and 1.1%, respectively.

Dynamics of Germany's GDP and Growth Forecasts

News of the German economy's struggle has been coming for a long time. The slowdown in the Chinese economy negatively impacts it—Germany's major trading partner—and the growing risks of Donald Trump's return to the White House with his protectionist policies and the potential revival of trade wars. For Brussels and Berlin, this would be a real shock.

In my opinion, the release of the U.S. inflation data for July will be a defining moment for EUR/USD. Until then, any attempts by the pair to break out of the 1.088–1.094 consolidation range may seem like child's play. Even if support or resistance levels are breached, it is unlikely that the main currency pair will establish a trend without these crucial CPI figures. The Fed's policy is heavily dependent on this data, and investors have no choice but to be on high alert for these figures.

Technically, on the daily chart, EUR/USD consolidates within the Adam and Eve pattern. The pair is trading close to its fair value. A successful breach of resistance at 1.094 or support at 1.088 is needed to determine the direction of its further movement. In the first case, it makes sense to consider a buying strategy; in the second, it makes sense to sell the euro against the U.S. dollar.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment