Analysis of trades and tips on USD/JPY

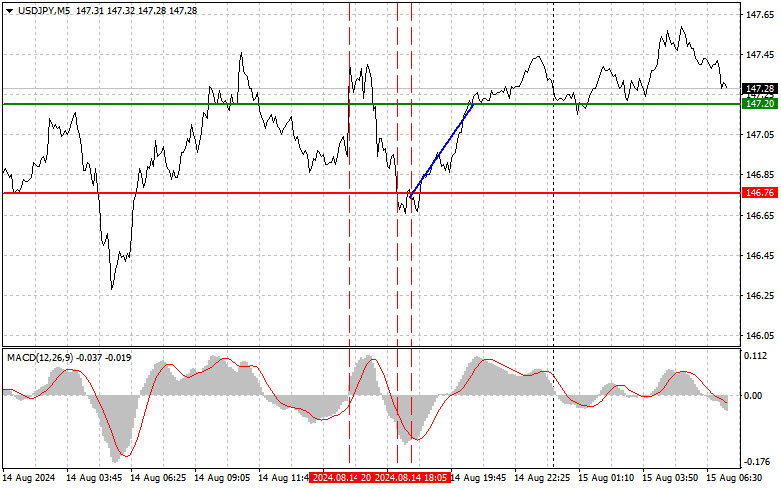

The price test of 146.76 occurred when the MACD indicator had moved down significantly from the zero mark, limiting the pair's downward potential. For this reason, I did not sell the dollar. A little later, another test of 146.76 happened when the MACD was in the oversold area, providing a chance to implement scenario No. 2 for buying the dollar. As a result, the pair rose by 50 pips. I refrained from buying at 147.20, as the chances of the U.S. dollar rising after the news of a slowdown in inflation were extremely slim. Today, strong data on Japan's GDP growth was released, but the yen did not react to it, although this increases the chances of further interest rate hikes. However, the GDP deflator index for the second quarter of this year was worse than economists' forecasts. Against this backdrop, the pair will continue to trade within the horizontal channel with a slight advantage for yen buyers. As for the intraday strategy, I will rely more on implementing scenarios No. 1 and 2.

Buy signals

Scenario No. 1. Today, I plan to buy USD/JPY when the price reaches the entry point around 147.62, plotted by the green line on the chart, with the goal of rising to 148.32 plotted by the thicker green line on the chart. At around 148.32, I will exit long positions and open short ones in the opposite direction, expecting a movement of 30-35 pips in the opposite direction from that level. You can expect the pair to rise today as part of the upward correction. But the higher the pair, the more attractive it is to sell the dollar. Important: Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario No. 2. I also plan to buy USD/JPY today in case of two consecutive tests of 147.12 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reverse market upturn. We can expect growth to the opposite levels of 147.62 and 148.32.

Sell signals

Scenario No. 1. I plan to sell USD/JPY today only after testing 147.12 plotted by the red line on the chart, which will lead to a rapid decline in the pair. The key target for sellers will be 146.32, where I will exit short positions and immediately open long positions in the opposite direction, expecting a movement of 20-25 pips in the opposite direction from that level. Pressure on USD/JPY may return at any moment, especially in case of unsuccessful correction in the first half of the day and failure to test the daily high. Important: Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario No. 2. I also plan to sell USD/JPY today in case of two consecutive price tests at 147.62 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse market downturn. We can expect a decline to the opposite level of 147.12 and 146.32.

What's on the chart:

Thin green line: the entry price at which you can buy the trading instrument.

Thick green line: the estimated price at which you can set Take Profit or manually close positions, as further growth above this level is unlikely.

Thin red line: the entry price at which you can sell the trading instrument.

Thick red line: an estimated price at which you can place Take Profit or manually close positions, as further decline below this level is unlikely.

MACD indicator: when entering the market, it is essential to be guided by overbought and oversold zones.

Important: Novice traders in the forex market must be cautious when deciding to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You must set stop orders to avoid losing your entire deposit, especially if you don't use money management and trade in large volumes.

Remember, a clear trading plan, like the one I've outlined, is essential for successful trading. Making impulsive decisions based on the current market situation is a losing strategy for novice intraday traders.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The price test of 146.76 occurred when the MACD indicator had moved down significantly from the zero mark, limiting the pair's downward potential. For this reason, I did not sell the dollar. A little later, another test of 146.76 happened when the MACD was in the oversold area, providing a chance to implement scenario No. 2 for buying the dollar. As a result, the pair rose by 50 pips. I refrained from buying at 147.20, as the chances of the U.S. dollar rising after the news of a slowdown in inflation were extremely slim. Today, strong data on Japan's GDP growth was released, but the yen did not react to it, although this increases the chances of further interest rate hikes. However, the GDP deflator index for the second quarter of this year was worse than economists' forecasts. Against this backdrop, the pair will continue to trade within the horizontal channel with a slight advantage for yen buyers. As for the intraday strategy, I will rely more on implementing scenarios No. 1 and 2.

Buy signals

Scenario No. 1. Today, I plan to buy USD/JPY when the price reaches the entry point around 147.62, plotted by the green line on the chart, with the goal of rising to 148.32 plotted by the thicker green line on the chart. At around 148.32, I will exit long positions and open short ones in the opposite direction, expecting a movement of 30-35 pips in the opposite direction from that level. You can expect the pair to rise today as part of the upward correction. But the higher the pair, the more attractive it is to sell the dollar. Important: Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario No. 2. I also plan to buy USD/JPY today in case of two consecutive tests of 147.12 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reverse market upturn. We can expect growth to the opposite levels of 147.62 and 148.32.

Sell signals

Scenario No. 1. I plan to sell USD/JPY today only after testing 147.12 plotted by the red line on the chart, which will lead to a rapid decline in the pair. The key target for sellers will be 146.32, where I will exit short positions and immediately open long positions in the opposite direction, expecting a movement of 20-25 pips in the opposite direction from that level. Pressure on USD/JPY may return at any moment, especially in case of unsuccessful correction in the first half of the day and failure to test the daily high. Important: Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario No. 2. I also plan to sell USD/JPY today in case of two consecutive price tests at 147.62 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse market downturn. We can expect a decline to the opposite level of 147.12 and 146.32.

What's on the chart:

Thin green line: the entry price at which you can buy the trading instrument.

Thick green line: the estimated price at which you can set Take Profit or manually close positions, as further growth above this level is unlikely.

Thin red line: the entry price at which you can sell the trading instrument.

Thick red line: an estimated price at which you can place Take Profit or manually close positions, as further decline below this level is unlikely.

MACD indicator: when entering the market, it is essential to be guided by overbought and oversold zones.

Important: Novice traders in the forex market must be cautious when deciding to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You must set stop orders to avoid losing your entire deposit, especially if you don't use money management and trade in large volumes.

Remember, a clear trading plan, like the one I've outlined, is essential for successful trading. Making impulsive decisions based on the current market situation is a losing strategy for novice intraday traders.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment