Analysis of Trades and Tips for Trading the British Pound

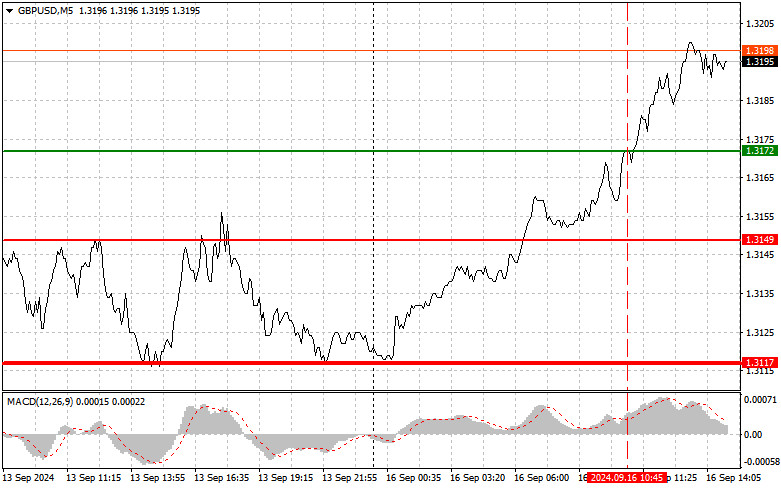

The test of the 1.3127 price level occurred when the MACD indicator was already significantly above the zero line, limiting the pair's upward potential. As a result, I chose not to buy the pound and remained out of the market, which caused me to miss the upward movement seen in the first half of the day. We have only the U.S. Empire Manufacturing Index report ahead, which could help pound buyers if the data is weak. Therefore, I expect the continuation of the upward trend, as demand for the pound is currently strong. As for my intraday strategy, I plan to follow scenario No. 1 and scenario No. 2.

Buy Signal

Scenario No. 1: Today, I plan to buy the pound when the price reaches the entry point around 1.3206 (green line on the chart) with a target of rising to 1.3231 (thicker green line on the chart). At 1.3231, I will exit my long positions and open short positions, aiming for a 30-35 point movement in the opposite direction from the level. A potential increase in the pound can be expected within the prevailing uptrend, especially if U.S. data is weak. It's important to ensure that the MACD indicator is above the zero line and just starting to rise before buying.

Scenario No. 2: I also plan to buy the pound today if the 1.3177 price level is tested twice consecutively and the MACD indicator is in the oversold area. This will limit the pair's downward potential and prompt an upward reversal. Growth toward the resistance levels at 1.3206 and 1.3231 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price reaches and updates the 1.3177 level (red line on the chart), which is likely to lead to a quick decline. The key target for sellers will be the 1.3151 level, where I will exit my short positions and immediately open long positions, aiming for a 20-25 point movement in the opposite direction. Sellers are likely to emerge in response to strong U.S. data. It's important to ensure the MACD indicator is below the zero line and just starting to fall before selling.

Scenario №2: I also plan to sell the pound today if the 1.3206 price level is tested twice consecutively and the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline toward the support levels of 1.3177 and 1.3151 can be expected.

What's on the chart:

* Thin green line – the entry price where the currency pair can be bought.

* Thick green line – the suggested price where Take Profit can be set, or profits can be manually fixed, as further growth above this level is unlikely.

* Thin red line – the entry price where the currency pair can be sold.

* Thick red line – the suggested price where Take Profit can be set, or profits can be manually fixed, as further decline below this level is unlikely.

* MACD Indicator: When entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner traders in the forex market should be very cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, to trade successfully, you need a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for intraday traders.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The test of the 1.3127 price level occurred when the MACD indicator was already significantly above the zero line, limiting the pair's upward potential. As a result, I chose not to buy the pound and remained out of the market, which caused me to miss the upward movement seen in the first half of the day. We have only the U.S. Empire Manufacturing Index report ahead, which could help pound buyers if the data is weak. Therefore, I expect the continuation of the upward trend, as demand for the pound is currently strong. As for my intraday strategy, I plan to follow scenario No. 1 and scenario No. 2.

Buy Signal

Scenario No. 1: Today, I plan to buy the pound when the price reaches the entry point around 1.3206 (green line on the chart) with a target of rising to 1.3231 (thicker green line on the chart). At 1.3231, I will exit my long positions and open short positions, aiming for a 30-35 point movement in the opposite direction from the level. A potential increase in the pound can be expected within the prevailing uptrend, especially if U.S. data is weak. It's important to ensure that the MACD indicator is above the zero line and just starting to rise before buying.

Scenario No. 2: I also plan to buy the pound today if the 1.3177 price level is tested twice consecutively and the MACD indicator is in the oversold area. This will limit the pair's downward potential and prompt an upward reversal. Growth toward the resistance levels at 1.3206 and 1.3231 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price reaches and updates the 1.3177 level (red line on the chart), which is likely to lead to a quick decline. The key target for sellers will be the 1.3151 level, where I will exit my short positions and immediately open long positions, aiming for a 20-25 point movement in the opposite direction. Sellers are likely to emerge in response to strong U.S. data. It's important to ensure the MACD indicator is below the zero line and just starting to fall before selling.

Scenario №2: I also plan to sell the pound today if the 1.3206 price level is tested twice consecutively and the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline toward the support levels of 1.3177 and 1.3151 can be expected.

What's on the chart:

* Thin green line – the entry price where the currency pair can be bought.

* Thick green line – the suggested price where Take Profit can be set, or profits can be manually fixed, as further growth above this level is unlikely.

* Thin red line – the entry price where the currency pair can be sold.

* Thick red line – the suggested price where Take Profit can be set, or profits can be manually fixed, as further decline below this level is unlikely.

* MACD Indicator: When entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner traders in the forex market should be very cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, to trade successfully, you need a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for intraday traders.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment