Nothing lasts forever. After a decade and a half of dominance in Japan's political arena, the Liberal Democratic Party has lost its majority in the House of Representatives. It and its ally, Komeito, must bring new members into their coalition. Political uncertainty and increasing fiscal stimulus risks are pushing USD/JPY higher to the point where the government has had to resort to verbal interventions.

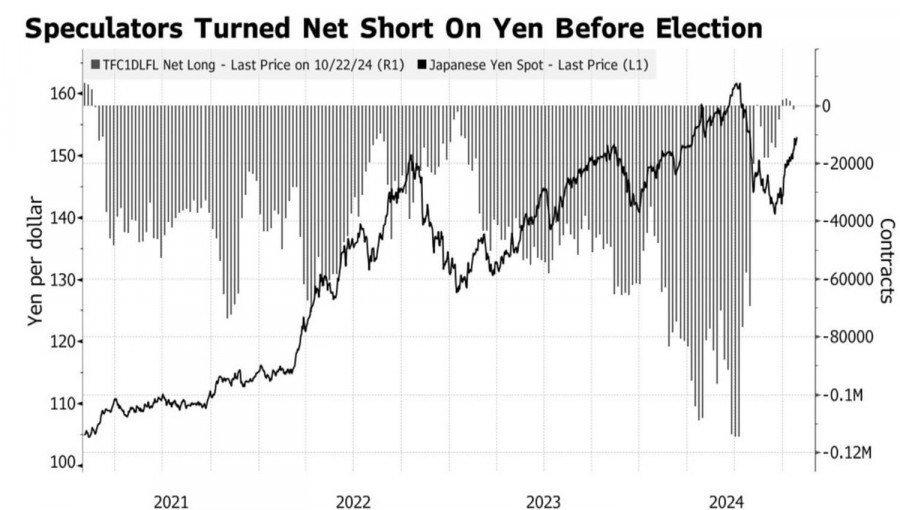

According to Finance Minister Katsunobu Kato, authorities monitor Forex developments with heightened vigilance. Previously, such statements have foreshadowed currency interventions, which have cost Tokyo over $100 billion in 2024 alone. However, speculators are more concerned about the Bank of Japan's limited options. Ahead of parliamentary elections, hedge funds have turned bearish on the yen for the first time since early October.

Speculative Position Dynamics on the Yen

Bloomberg experts had anticipated signals from Kazuo Ueda about continuing the monetary policy normalization cycle in December or January. However, political uncertainty will likely render the October Governing Council meeting a formality. It's doubtful that the BOJ will discuss a near-term rate hike. If investors do not receive hints, USD/JPY's rally may continue.

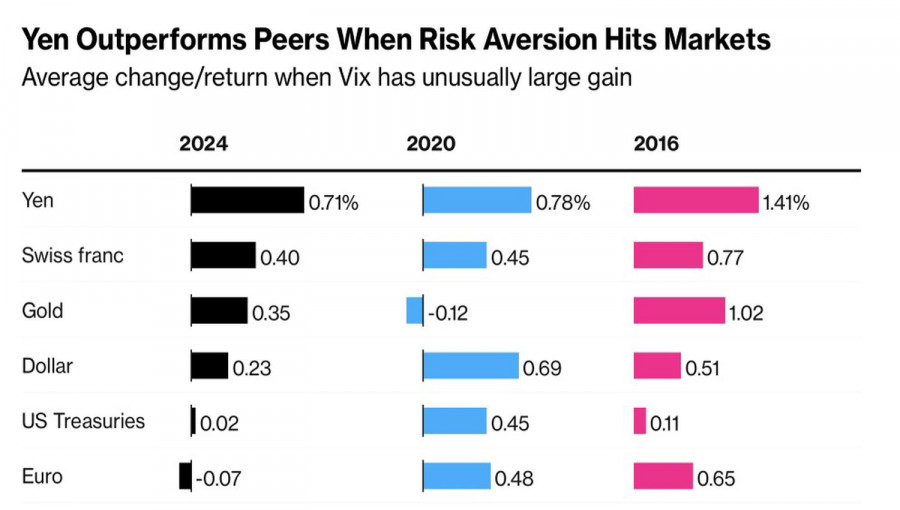

Yet, the yen's weakness against the U.S. dollar doesn't mean it's lost ground against other major currencies. According to Vanguard research, the yen performs well as a safe-haven asset during U.S. presidential elections. Japan's $20 billion current account surplus, high liquidity, and relatively low inflation reflect the currency's reliability.

Global Currencies' Response to U.S. Elections

Thus, it's too early to discount USD/JPY bears. They still have some advantages, and if the U.S. dollar weakens, the pair's rally could quickly reverse into a sharp decline.

There's also a reason for this: Reuters experts predict a slowdown in U.S. nonfarm payrolls growth for October from 254,000 to 125,000. Hurricanes and strikes could push the actual figure below 100,000. Should this happen, markets may revisit the possibility of a 50 basis point federal funds rate cut in December. This would be bad news for the U.S. dollar and great news for its competitors, including the yen.

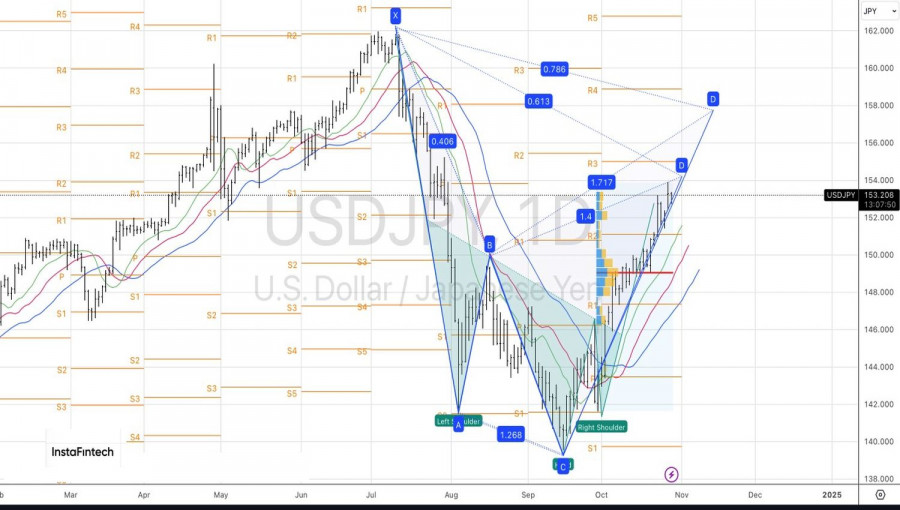

Technically, on the USD/JPY daily chart, the pair has approached the 161.8% target according to the AB=CD harmonic trading pattern. This forms a convergence zone between 153.85 and 154.20 with pivot levels. A reversal would justify profit-taking on long positions and a shift to short positions.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment