The EUR/USD currency pair is preparing for a new week, and the euro could use a bit of divine intervention at this point. While this is a joke, the euro is no longer merely declining—it's plummeting at an alarming rate. Some might argue that the drop isn't particularly steep or fast, but let me point out that the euro is the second most stable currency globally. A 700-pip drop in two months is significant for this currency. Furthermore, the euro is falling with virtually no corrections, indicating (in simple terms) that there are no buyers in the market—everyone is selling the euro.

On Friday, the euro collapsed following weak reports from the US, both in direct and figurative terms. Directly, the Eurozone's business activity reports fell significantly short of forecasts. Figuratively, these reports are not particularly influential or important for the market. At the same time, business activity does reflect certain economic changes—none of them positive—the euro fell by 150 pips after these reports, a reaction rarely seen even after European Central Bank or Federal Reserve meetings.

Next week, there will be very few significant events in the Eurozone. Traders should pay attention to the November inflation reports for Germany and the Eurozone, scheduled for Thursday and Friday. German inflation is mainly of interest for predicting the overall Eurozone inflation. While Germany remains the economic engine of the Eurozone, the EU-wide inflation rate holds greater importance.

The Eurozone inflation rate is expected to accelerate to 2.4%. Theoretically, this report could provide some support for the euro, but given the currency's current near-collapse, it's reasonable to assume the support will be minimal.

The focus now is on when the current bearish momentum will end. This momentum is not tied to macroeconomic or fundamental factors. A correction would be welcome, but it's impossible to predict when it might occur, as the euro has already fallen substantially. A potential correction could be identified if the price consolidates above the moving average. However, bullish divergences and oversold levels are proving to have little effect. The euro may very well continue to decline in the coming week.

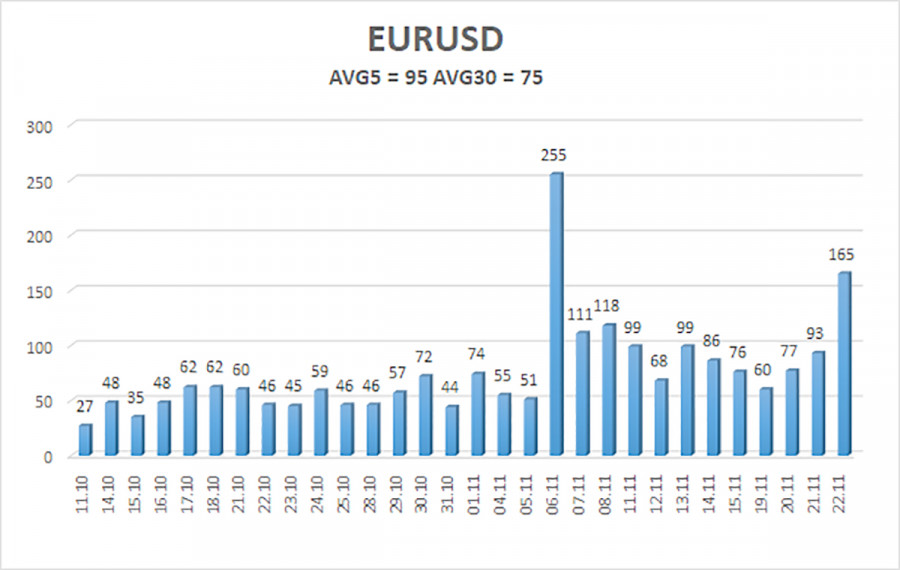

The average volatility of the EUR/USD pair over the last five trading days as of November 24 is 95 pips, classified as "moderate." We expect the pair to move between 1.0325 and 1.0515 on Friday. The higher linear regression channel is directed downward, confirming the persistence of the global downtrend. The CCI indicator frequently enters the oversold area and forms bullish divergences, leading to only minor pullbacks.

Key Support Levels:

- S1: 1.0376

- S2: 1.0254

- S3: 1.0132

Key Resistance Levels:

- R1: 1.0498

- R2: 1.0620

- R3: 1.0742

Trading Recommendations:

The EUR/USD pair continues its downward movement. In recent months, we've maintained that the euro will likely decline in the medium term, fully supporting the bearish trend. Likely, the market has already priced in all or most of the Fed's future rate cuts. If so, the dollar has little reason for a medium-term decline, though it didn't have many before. Short positions can still be considered with targets at 1.0325 and 1.0254 if the price remains below the moving average. For those trading solely on technical signals, long positions can be considered if the price is above the moving average, with targets at 1.0665 and 1.0742. However, we currently advise against taking long positions.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment