AUD/USD has been quite bullish with the recent gains after being dominated by USD, since the price bounced back from the 0.7300 area with a daily close.

The Australian Consumer and Employment data is expected to impact the interest rate situation in Australia. If the situation is not restored, certain rate cuts by the RBA can be seen. AUD struggling with the worse economic reports has managed to sustain momentum over USD, which indicates the potential for further upward momentum in the coming days. Recently, AUD Home Loans report has been published with a decrease to -2.6% from the previous value of -6.0% which failed to meet the expectation of -2.0%. NAB Business Confidence has also decreased to 2 from the previous figure of 4 and Westpac Consumer Sentiment also reduced significantly to -4.8% from the previous value of 4.3%.

Today, the AUD MI Inflation Expectations report has been published with an increase to 4.1% from the previous value of 3.7% which has not yet helped much to push the currency higher against USD. Australian stock market and housing market fall is expected to impact the overall gains of AUD, whereas USD is anticipated to regain momentum in the coming days.

On the other hand, USD CPI report has been recently published with an increase to 0.2% as expected from the previous value of 0.0%. However, Core CPI decreased to 0.1% which was expected to be unchanged at 0.0%. The Fed being on the observer mode, expressed its rather hawkish expectations about USD to gain further momentum with the economic development in the future.

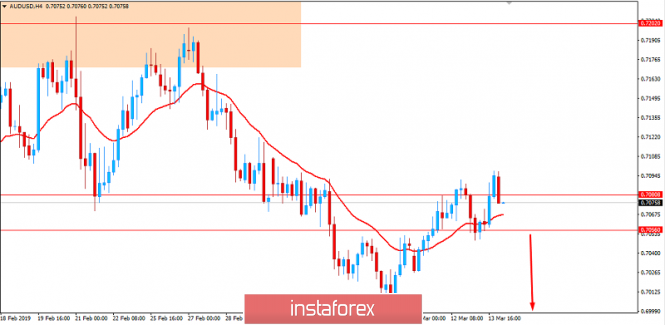

Now let us look at the technical view. The price is currently residing just above the 0.7050-80 area from where, according to the preceding trend, the price is expected to push lower, but with confirmation of a breakout below 0.7050 with a strong impulsive bearish momentum. As the price remains below the 0.7200 area with a daily close, the bearish bias is expected to continue further.

Download NOW!

Download NOW!

No comments:

Post a Comment