AUD has been weighed down in light of disappointing economic reports. AUD managed to gain certain momentum over EUR recently which indicates severe EUR weakness.

EUR is facing an economic slowdown ahead of BREXIT. Besides, the ECB is currently looking forward to getting over this issue as soon as possible. The ECB is currently thinking of a rate hike by 2020 after the crisis it is facing now. The regulator offers banks a new round of cheap loans to revive the eurozone's economy. EUR is keeping the main refinancing rate unchanged as expected at 0.00%. This averted the market sentiment away from EUR, curbing recent gains. Additionally, the European Union wants to avoid a trade war with the United States as it can hurt the economy more.

Today Germany's Factory Orders report is going to be published which is expected to increase to 0.5% from the previous value of -1.6%, French Industrial Production is expected to decrease to 0.1% from the previous value of 0.8%, French Trade Balance is expected to decrease to -4.9B from the previous figure of -4.7B, and Italian Industrial Production is expected to increase to 0.2% from the previous negative value of -0.8%.

On the other hand, the Australian economy has been facing headwinds. Dismal economic performance has been proved by downbeat data. The Australian Housing market took a downturn which was unlikely to fall after 27 years of recession-free expansion. According to RBA Governor Lowe, the labor market has become the most important factor for RBA's monetary policy assessment. Further tightening of the labor market will contribute to gradual improvement in the wages and income. Recently Australian Retail Sales report was published with a certain increase to 0.1% from the previous negative value of -0.4% but failed to meet the forecast for an increase to 0.3%. However, Trade Balance showed an increase to 4.55B from the previous figure of 3.77B which was expected to decrease to 2.85B.

Meanwhile, both the eurozone and Australia have been facing a slowdown which have been proved by mixed economic reports. Notably, Australia is in a better shape with the Trade Balance. This managed to attract market sentiment in favor of AUD. EUR is still struggling to maintain momentum. The ECB is trying to revive the economy. AUD gained certain momentum. So, AUD is expected to set the tone in the pair.

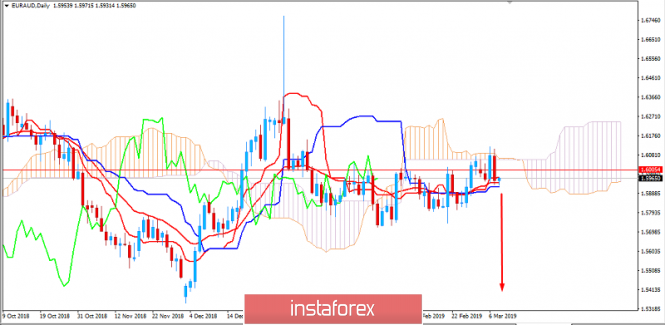

Now let us look at the technical view. The price is currently trading below 1.60 price area with a strong bearish impulsive daily close which is also being held as support by the dynamic levels like 20 EMA, Tenkan and Kijun line. As the price breaks below the dynamic level with an intraday close or below 1.5950 area, further bearish momentum is expected with a target towards 1.5850, 1.5500 and later towards 1.5300.

Download NOW!

Download NOW!

No comments:

Post a Comment