EUR lost significant momentum recently after the price rejected off the 1.1450 area with a daily close. Despite downbeat economic reports, such gains on the USD side signal severe EUR weakness.

According to Finnish Central Bank chief Olli Rehn, the risk of Britain leaving the EU without a deal is the biggest risk which could aggravate the eurozone's economic slowdown in the short term. BREXIT is a biggest threat to both economies. Ahead of the BREXIT vote on March 29th, EUR is expected to lose further momentum against USD. Today, German Ifo Business Climate report is going to be published with the appropriate index to edge up to 98.7 from the previous figure of 98.5. The survey will hardly make a serious impact on EUR.

On the other hand, USD was hurt by recent economic events and reports. USD lost shine as the Federal Reserve states its intention to refrain from raising interest rates throughout this year. As a result, USD is losing favor with investors. This week, the US is due to release revised GDP data which is expected to decrease to 2.4% from the previous value of 2.6%. Nevertheless, USD is still gaining momentum. The US economy is losing steam as the $1.5 trillion tax cuts arise along with cuts in government spending. Moreover, there are other global factors which dent investor confidence: the trade war between the US and China, softening global growth, and uncertainty ahead of BREXIT.

This week is going to be very volatile for both EUR and USD as the economic calendar contains high impact economic reports and events. Though USD gained momentum amid EUR weakness, any negative reading in the US macroeconomic reports like GDP will affect USD momentum. Under the current economic conditions, USD has the upper hand over EUR to gain significant momentum ahead of possible BREXIT this week.

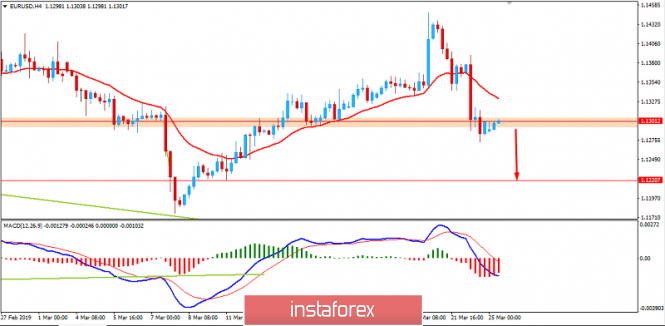

Now let us look at the technical view. The pair is currently trading at bear the psychological level of 1.1300 with higher volatility. The price is making corrections along the way. After the impulsive bearish pressure off the 1.1450 area, further bearish momentum is expected as per the preceding trend. The price is expected to move lower towards 1.1200 support area in the coming days. As the price remains below 1.1500 with a daily close, the bearish bias is expected to continue further.

Download NOW!

Download NOW!

No comments:

Post a Comment