After a strong bullish momentum, the price is currently trading at the edge of 1.33 with certain indecision and volatility. Canada provided mixed economic reports, so CAD managed to sustain momentum over USD.

A positive employment report with a flat unemployment rate encouraged certain gains on the CAD side over USD. Canada is also facing the escalating debt effect which is derailing the economic growth and making the economy more vulnerable to financial instability. After 5 rate hikes since 2017, the Bank of Canada recently kept the ON target rate unchanged at 1.75% citing concerns over the global economic slowdown.

Recently Canada's Foreign Securities Purchases showed a significant increase to 28.40B from the previous negative figure of -20.49B which was expected to be at 15.03B. Ahead of Canadian CPI and Retail Sales report to be published on Friday, the pair is going to trade with higher volatility, though CAD could make some gains.

On the USD side, the Federal Reserve advocates for a cautious approach towards monetary policy that means a pause in the cycle of monetary tigthening in 2019. However, in 2020 if the US economy does not develop as planned, the regulator could resort even to rate cuts. Previously, some FED officials signaled that the key interest rate could increase to 3.00% to 3.50% with at least 2 rate hikes this year. However, under current economic conditions, the domestic economy is not ready for higher interest rates. The US economy is showing mixed economic results, for example, soft employment growth with rising wages. Recently US NAHB Housing Market Index report was published unchanged at 62 which was expected to increase to 63. Today US Factory Orders are expected to increase to 0.3% from the previous value of 0.1%.

Meanwhile, both the BOC and the FED express the dovish rhetoric with an effort to deal with the global crisis and lackluster economic data. So, the pair is set to trade with higher volatility in the coming days. A FOMC Statement will clear up whether the central bank shifts its tone from dovish to hawkish. If the rhetoric remains dovish, USD will lose momentum. On the other hand, CAD will have an opportunity to assert its strength to push the price much lower.

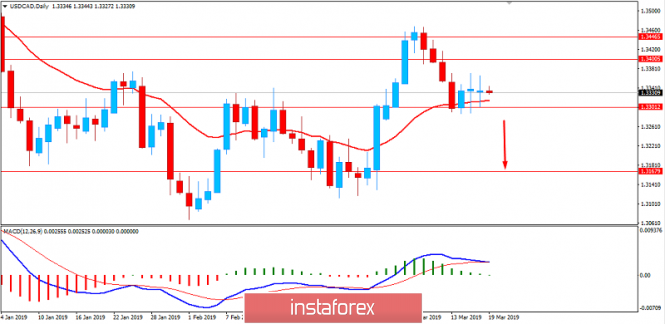

Now let us look at the technical view. The price formed an outside indecisive daily bar at the edge of 1.33 area after impulsive bearish momentum after rejecting off 1.3450 with a daily close. The price is still bearish. A break below 1.33 with MACD moving averages crossing over indicate further bearish momentum with a target towards 1.3150 and later towards 1.30 support area. As the price remains below 1.35 with a daily close, this price move will invite bears.

Download NOW!

Download NOW!

No comments:

Post a Comment