Monday, March 25, 2019

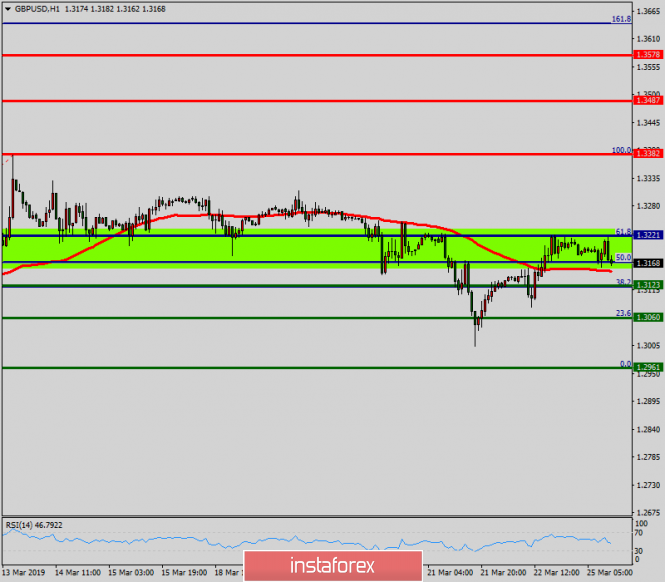

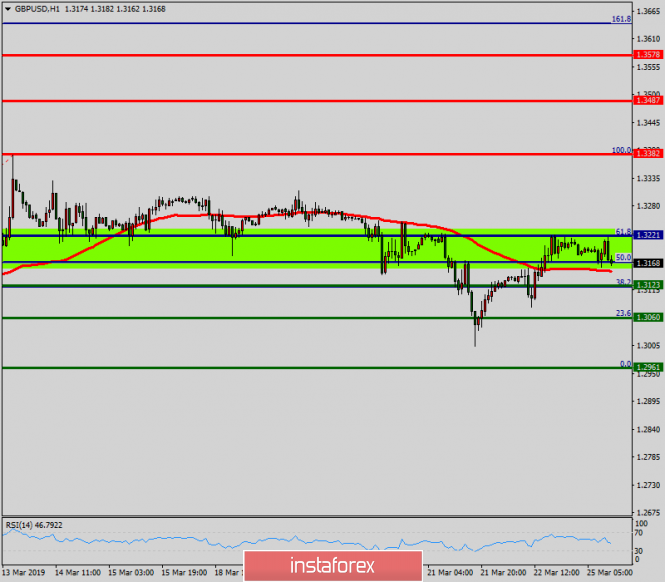

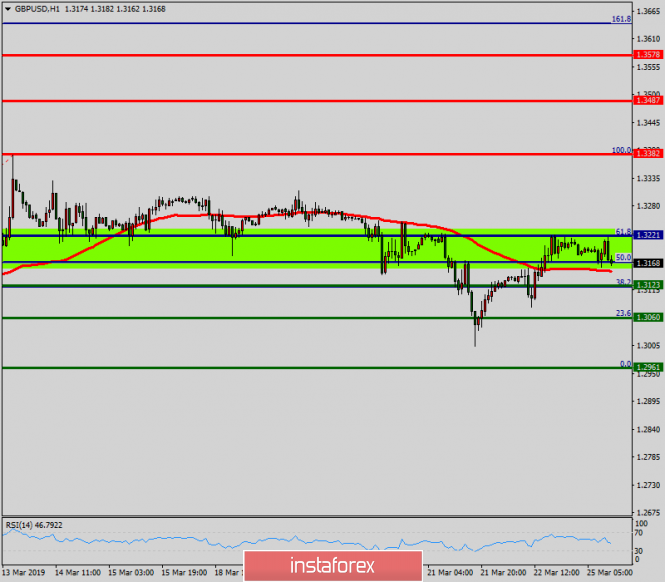

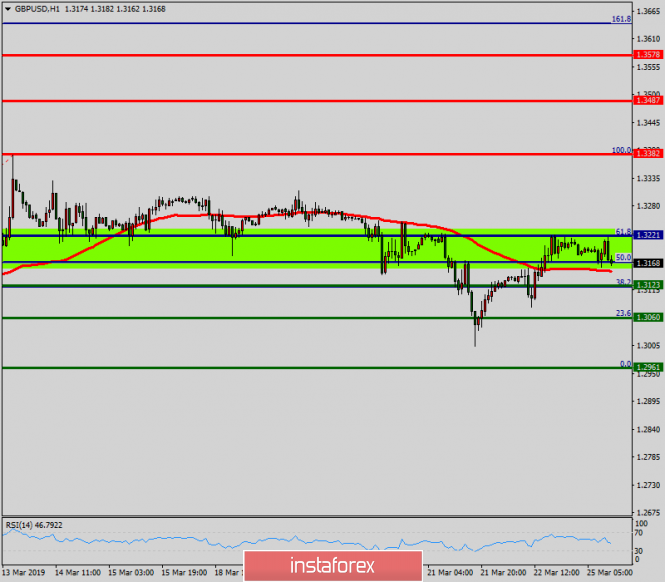

Technical analysis of GBP/USD for March 25, 2019

Subscribe to:

Post Comments (Atom)

★ ★ ★ ★ ★

📈 StairSteps is an EA which can trade consolidation zones using a stairstep breakout trading strategy, trail the price and much more.

★ ★ ★ ★ ★

📈 StairSteps is an EA which can trade consolidation zones using a stairstep breakout trading strategy, trail the price and much more.

★ ★ ★ ★ ★

📈 Fluid is a MT4 EA with trend detector, precise entry/exit points and advanced basket trade management which can hedge and recover a loss.

★ ★ ★ ★ ★

📈 Fluid is a MT4 EA with trend detector, precise entry/exit points and advanced basket trade management which can hedge and recover a loss.

★ ★ ★ ★ ★

📈 Heiken Ashi expert advisor with trend detector and advanced trailing options, such as ATR, PSAR, MA, Fractals and more.

★ ★ ★ ★ ★

📈 Heiken Ashi expert advisor with trend detector and advanced trailing options, such as ATR, PSAR, MA, Fractals and more.

★ ★ ★ ★ ★

📈 NonLagMA is a Metatrader EA that can trade with the trend using the nonlagma indicator to determine the trend and the entries.

★ ★ ★ ★ ★

📈 NonLagMA is a Metatrader EA that can trade with the trend using the nonlagma indicator to determine the trend and the entries.

★ ★ ★ ★ ★

📈 Auto Recovery is a MT4 EA that can successfully hedge a losing trade or a basket of trades until it will reach breakeven.

★ ★ ★ ★ ★

📈 Auto Recovery is a MT4 EA that can successfully hedge a losing trade or a basket of trades until it will reach breakeven.

★ ★ ★ ★ ★

📈 News was designed to trade news events in an OCO approach and can open multiple trades during the same event.

★ ★ ★ ★ ★

📈 News was designed to trade news events in an OCO approach and can open multiple trades during the same event.

★ ★ ★ ★ ★

📈 MACD was designed to trade using MACD while following the trend and the signals from the Stochastic indicator.

★ ★ ★ ★ ★

📈 MACD was designed to trade using MACD while following the trend and the signals from the Stochastic indicator.

★ ★ ★ ★ ★

📈 Trailing Stop is a Metatrader expert adisor designed to trail the price using various methods (ATR, MA, chandelier etc.).

★ ★ ★ ★ ★

📈 Trailing Stop is a Metatrader expert adisor designed to trail the price using various methods (ATR, MA, chandelier etc.).

★ ★ ★ ★ ★

📈 Renko Expert Advisors is a set of two EAs, Renko Chart and Renko Trader, that can successfully trade with the trend on renko.

★ ★ ★ ★ ★

📈 Renko Expert Advisors is a set of two EAs, Renko Chart and Renko Trader, that can successfully trade with the trend on renko.

★ ★ ★ ★ ★

📈 Traders Dynamic Index expert advisor that can trade with the trend following the TDI trading strategy.

★ ★ ★ ★ ★

📈 Traders Dynamic Index expert advisor that can trade with the trend following the TDI trading strategy.

★ ★ ★ ★ ★

📈 Price Channel Expert Advisor for MetaTrader trades within the support/resistance levels, following the up or down trends.

★ ★ ★ ★ ★

📈 Price Channel Expert Advisor for MetaTrader trades within the support/resistance levels, following the up or down trends.

★ ★ ★ ★ ★

📈 Grid expert advisor can trade following a grid trading strategy while following signals from Stochastic.

★ ★ ★ ★ ★

📈 Grid expert advisor can trade following a grid trading strategy while following signals from Stochastic.

We only display advertisements on our article pages to support our content. Clicking the button will prevent ads from loading for the remainder of your visit.

No comments:

Post a Comment