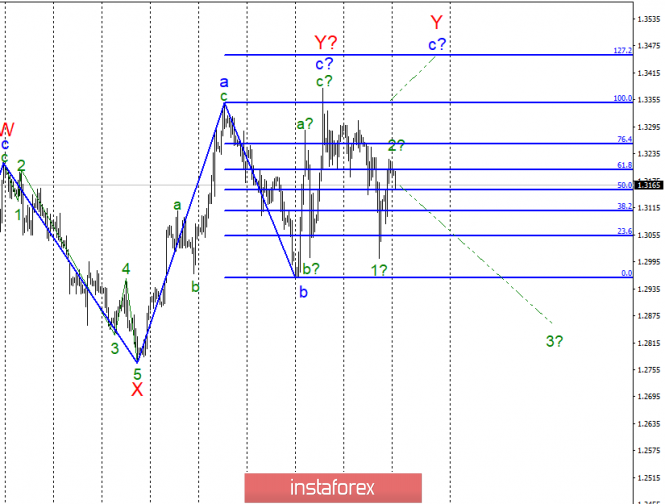

Wave counting analysis:

On March 22, the GBP / USD pair rose by 90 bps. Thus, if the upward trend is completed near the 100.0% Fibonacci level, then the pair has started to build a downward section and has already completed the construction of internal waves 1 and 2. If this is true, then the tool will continue to decline as part of wave 3 with targets located under the 29th figure. Unfortunately, the news background remains unstable. There is still no final decision on Brexit. What awaits the country is a clear indication on whether or not the government will change in the near future. It is still unknown. Whether there will be new negotiations with the European Union is doubtful. Therefore, the pound will remain in the potential "zone of turbulence" until the end of this process.

Purchase goals:

1.3350 - 100.0% Fibonacci

1.3454 - 127.2% Fibonacci

Sales targets:

1.2961 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern allows for the construction of an upward wave with targets located near the estimated level of 1.3454; however, I recommend returning to this option only in case of a successful attempt to break through the level of 100.0%. A more likely development of events is now the construction of a downward wave with targets below 29 figures, thus, I recommend sales in small volumes.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment