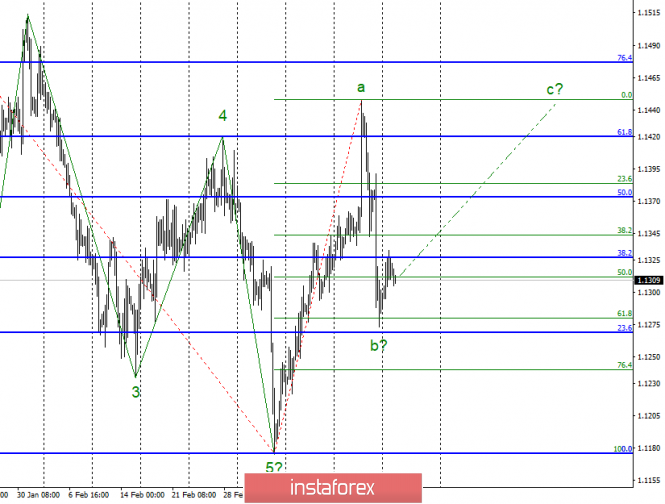

Wave counting analysis:

On Monday, March 25, trading ended on EUR / USD by 20 bp increase for the pair EUR / USD. Thus, there are more reasons to assume that the construction of wave b is completed as part of the new upward trend section after an unsuccessful attempt to break through the Fibonacci 61.8% level. If this is true, then the quotation increase will continue with a minimum target located around 1.1450. The news background, interesting for the instrument, was absent yesterday. And most likely for today as well, it will not affect the course of trading in any way. Therefore, the tool will have good chances for continued moderate growth.

Sales targets:

1.1280 - 61.8% Fibonacci (small grid)

1.1240 - 76.4% Fibonacci (small grid)

Purchase goals:

1.1448 - 0.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly completed the construction of wave b. Now I recommend re-buying the pair in small volumes, and as confidence increases in the transition of the instrument to the construction of an upward wave, increase volumes with targets located near the estimated 1.1448 mark, which equals to 0.0% Fibonacci.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment