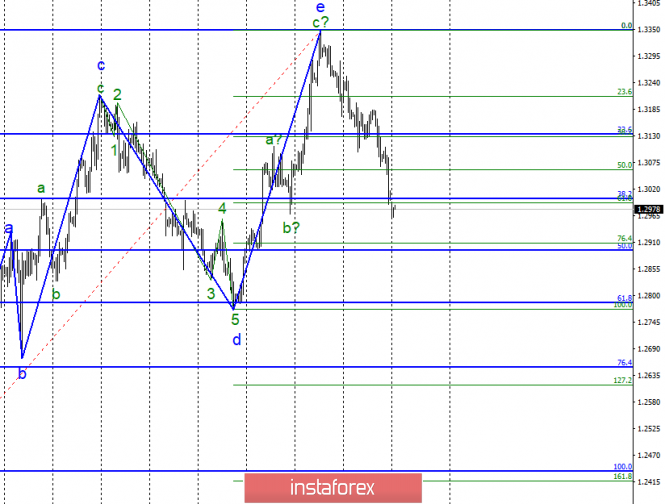

Wave counting analysis:

On March 8, the GBP / USD pair dropped by another 70 bp, so the first wave of the downward trend continues its construction according to the plan. There are no prerequisites for completing this wave. The pair is making successful attempts to break through all the Fibonacci levels that it encounters on its way. Tomorrow, for the pound sterling, a very important moment will come when the British Parliament will vote for the Brexit agreement with the EU. The market reaction can be any. Everything will depend on how the market interprets the decision made by parliament. Thus, the rejection of the Theresa May agreement can even have a beneficial effect on the pound, although it also presents a negative point.

Shopping goals:

1.3348 - 0.0% Fibonacci

Sales targets:

1.2891 - 50.0% Fibonacci (senior Fibonacci grid)

1.2784 - 61.8% Fibonacci (senior Fibonacci grid)

General conclusions and trading recommendations:

The wave pattern still assumes the construction of a downward set of waves. Therefore, sales are now expedient with targets 1.2891 and 1.2784, which equates to 50.0% and 61.8% Fibonacci. Larger sales are recommended when receiving negative news from the UK about Brexit. In the near future, the construction of a correctional wave can begin. An unsuccessful attempt to break through one of the target levels will indicate the pair's readiness to execute this option.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment