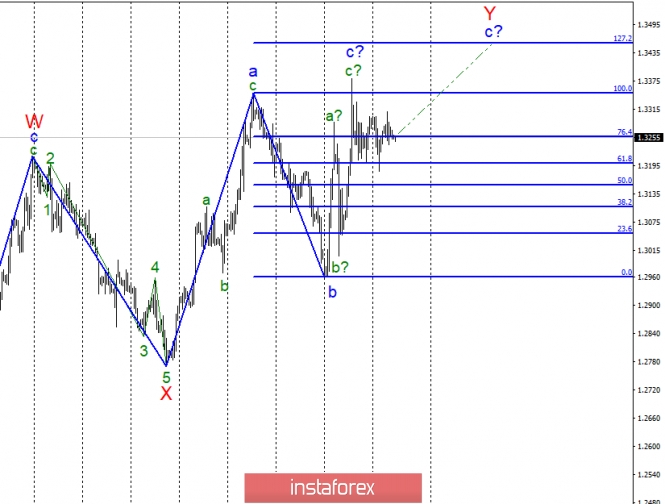

Wave counting analysis:

On March 19, the GBP / USD pair added about 20 bp. The instrument continues to be in limbo, since the current position may well continue to build a wave with in Y, and begin a new descending trend section. In the news plan, too, nothing really changes. There is no new data on Brexit, most likely, it will be transferred for 3 months, until June 30. And how all this will help to reach an agreement with the European Union on an agreement that the Parliament of Great Britain will arrange, it is still difficult even to assume. Today, the inflation rate and the outcome of the Fed meeting, which is important for the pound sterling, can significantly affect the movement of the instrument especially this concerns the evening press conference of the Fed. I expect that today the wave pattern will become clearer, and the pound will come out of the "fog".

Purchase goals:

1.3350 - 100.0% Fibonacci

1.3454 - 127.2% Fibonacci

Sales targets:

1.2961 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern assumes the construction of an upward wave with targets located near the estimated marks of 1.3350 and 1.3454, which corresponds to 100.0% and 127.2% of Fibonacci. However, the probability remains that the upward wave is completed. The news background on Wednesday can clarify the current wave marking. The pound will have chances of growth if Powell and the company declare a relaxation of monetary policy.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment