The EU leaders decided to delay Brexit deadline until October 31, 2019. This decision seems to have empowered GBP to gain sustainable momentum over USD.

Nevertheless, the effect of the Brexit extension is fading away. The UK-based businesses are currently prioritizing their cashflow as the UK-based firms are going to suffer economic shock in case of a hard-Brexit. Large businesses with a good amount of capital investment in the UK are trying to protect themselves against the risks by raising cash levels and bullet-proof balance sheets.

This week, the UK is due to release a series of macroeconomic data. Tomorrow the UK average earnings report will be posted. Average earnings including bonus is expected to inch up to 3.5% from the previous value of 3.4%. If the consensus comes true, GBP can benefit from it. Claimant Count Change is also expected to bring a good figure with a decrease to 17.3k from the previous increase to 27.0k. Unemployment Rate is likely to be unchanged at 3.9%.

Thus, the UK economy may gain certain momentum in a pause for a few months before the Brexit decision looms again before October 31, 2019. As other economies like the eurozone, the US, and Japan have to survive the global economic crisis, GBP may thrive well for a while because Brexit jitters have calmed down.

On the other hand, the US central bank is faithful to its dovish monetary policy while the US economy is underperforming in some sectors. This caused a collision between the Federal Reserve and President Trump's administration. After four rate hikes last year, The US regulator intends to keep its official funds rates between 2.25% to 2.50% as the incipient global crisis is creating uncertainty. Today FOMC member Charles Evans is going to speak about monetary policy and short-term interest rates. However, his speech is expected to have a neutral impact on USD. New York Empire State Manufacturing Index is expected to surge to 8.1 from the previous figure of 3.7. On Thursday, a Retail Sales report will be posted which is expected to rebound to 0.9% from the previous value of -0.2%. Amid such a busy economic calendar, the pair is set to trade with higher volatility and corrections. If the forecasts come true, USD will gain impulsive momentum.

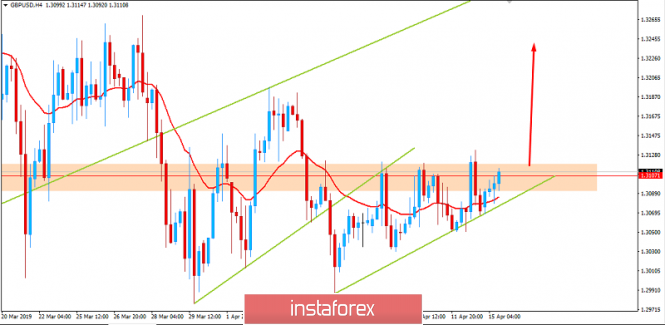

Now let us look at the technical view. The price is currently trading above 1.3100 important price area from where it is expected to continue a climb with a target towards 1.3200 and later towards 1.3300 resistance area in the coming days. The price squeeze at the edge of 1.3100 was a pre-breakout structure which is currently validated after the intraday close above the area. As the price remains above 1.30 area with a daily close, the bullish bias is expected to continue.

Download NOW!

Download NOW!

No comments:

Post a Comment