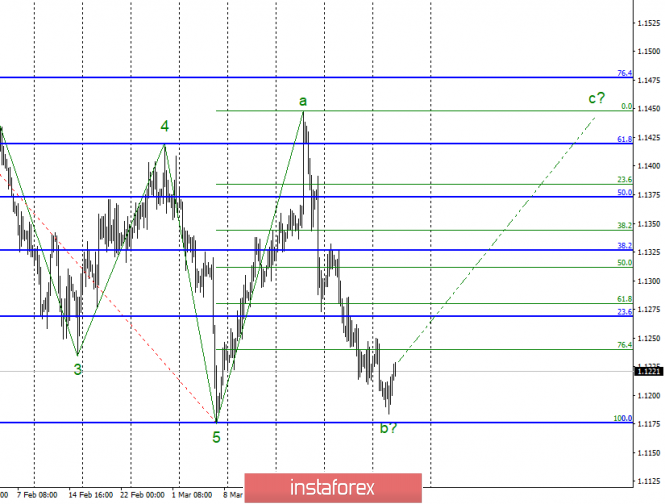

Wave counting analysis:

On Tuesday, April 2, trading ended for EUR / USD with another 10 bp loss. However, the minimum of the expected wave 5 is still not updated, which saves the pair with chances of building an upward wave exactly as part of the upward section trend. With today's tool increase, these chances can even increase slightly. The news background in the short term unexpectedly became in favor of the euro currency. Yesterday, there were rather weak reports on orders for durable goods in the United States. Information about business activity indices in the service sector will be shown from America today. If the news turns out to be weaker than market expectations once again, the tool may continue to rise.

Sales targets:

1.1177 - 100.0% Fibonacci

Purchase goals:

1.1448 - 0.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly completed the construction of wave b. Now, I recommend buying a pair with targets near the 1.1455 mark, which corresponds to the maximum of wave a, based on the construction of wave c. Purchases should not be large in volume, as there is a fairly high probability of breaking the wave minimum 5. Nevertheless, purchases near the lows are always attractive.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment