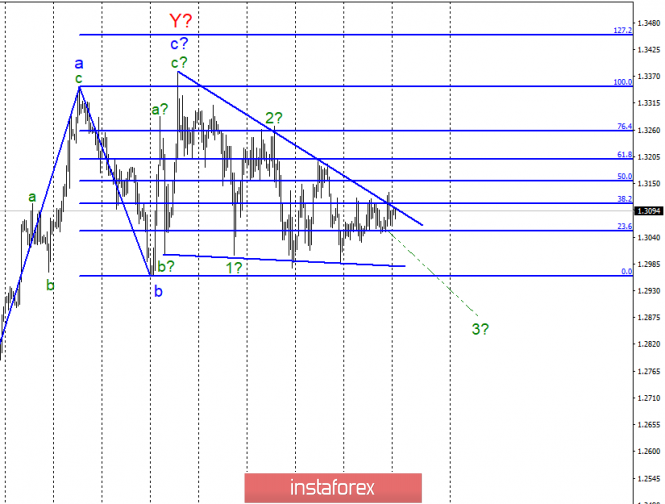

Wave counting analysis:

On April 12, the GBP / USD pair gained about 15 bp and reached the narrowest area of the tapering triangle. The activity on the instrument has decreased and it seems that even if the pair leaves the triangle, it will not grow. A pound sterling now needs a strong news background, which is still unknown when it will appear, since Brexit's transfer in itself for half a year means that there will be new negotiations between the EU government and the UK government. It is quite difficult to say what the parties will come to this time, and when new information will come to this account or whether it will come at all in the near future. Thus, it is best now to expect the pair to leave the limits of the triangle, which will give at least a hint at the direction of the pair in the coming days.

Purchase goals:

1.3350 - 100.0% Fibonacci

1.3454 - 127.2% Fibonacci

Sales targets:

1.2961 - 0.0% Fibonacci

General conclusions and trading recommendations:

Wave pattern still involves the construction of a downward trend. Markets, as before, cannot withdraw a pair from a triangle, therefore, trading takes place in a narrow price range. Accordingly, I recommend expecting the pair to exit the triangle. From the upper border of the triangle, a decline to the bottom can begin, which you can try to carefully work. However, the lot deal should be small.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment