Analyzing Thursday's trades:

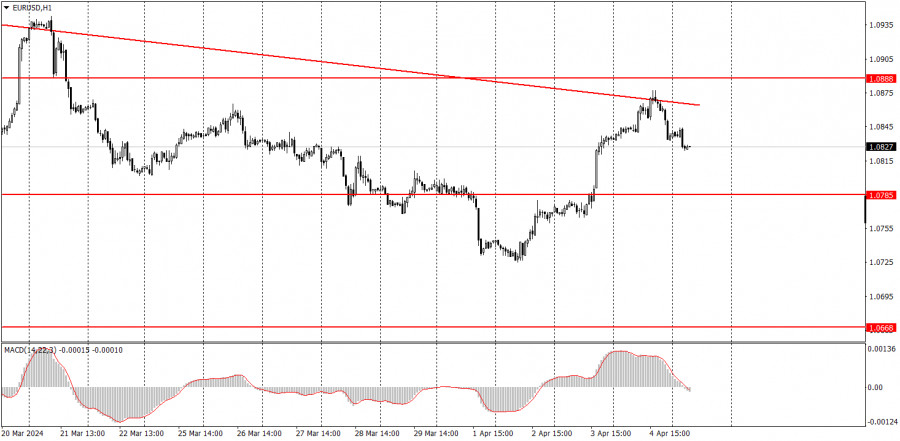

EUR/USD on 1H chart

EUR/USD continued its upward movement for half of the day, which was not justified by anything. We have already drawn your attention to the fact that this week the majority of reports and events were supposed to support the dollar. As we can see, the market has taken up its favorite activity of buying the euro for no particular reason. It is fortunate that the descending trend line stood in the way of the euro's upward movement. At the moment, it appears that the price has rebounded from this mark, which shows that the downtrend is still intact and the pair may resume the downward movement.

Yesterday, there were no significant macroeconomic or fundamental events. If the market was simply gaining momentum before a new prolonged decline, then it should start either today or on Monday. If the price breaches the trend line, the pair will follow an uptrend, and we can expect the euro to exhibit unreasonable growth once again.

EUR/USD on 5M chart

Several trading signals were generated on the 5-minute timeframe, but volatility was quite disappointing. Initially, there was a breakthrough of the level at 1.0838, and novice traders could open long positions based on this signal. Later, the pair surpassed the level at 1.0856, but it couldn't reach the next mark, so the long position could be manually closed at any point in the evening. The profit amounted to about 20 pips, which is a decent result considering that the day's volatility was just 44 pips.

Trading tips on Friday:

On the hourly chart, the downtrend persists, but EUR/USD has been correcting higher for the past three days. We believe that the euro should fall further, as the price is still too high, and the global trend is downward. Unfortunately, the market doesn't always want to trade the pair in a logical manner, and occasionally, it exhibits unreasonable growth. Most of this week's fundamental and macroeconomic factors should have weighed on the pair.

Today, it may be worth trying to trade bearish again as the price has bounced off the trendline. If the price breaches the trend line, the downtrend will be broken, and the pair may initially retreat before it continues to rise.

The key levels on the 5M chart are 1.0568, 1.0611-1.0618, 1.0668, 1.0725, 1.0785-1.0797, 1.0838-1.0856, 1.0888-1.0896, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091. On Friday, the EU's docket will feature the retail sales report. Moving on, market participants will focus on the Nonfarm Payrolls and unemployment data. In the second half of the day, the price may fluctuate significantly in different directions.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, after which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

EUR/USD on 1H chart

EUR/USD continued its upward movement for half of the day, which was not justified by anything. We have already drawn your attention to the fact that this week the majority of reports and events were supposed to support the dollar. As we can see, the market has taken up its favorite activity of buying the euro for no particular reason. It is fortunate that the descending trend line stood in the way of the euro's upward movement. At the moment, it appears that the price has rebounded from this mark, which shows that the downtrend is still intact and the pair may resume the downward movement.

Yesterday, there were no significant macroeconomic or fundamental events. If the market was simply gaining momentum before a new prolonged decline, then it should start either today or on Monday. If the price breaches the trend line, the pair will follow an uptrend, and we can expect the euro to exhibit unreasonable growth once again.

EUR/USD on 5M chart

Several trading signals were generated on the 5-minute timeframe, but volatility was quite disappointing. Initially, there was a breakthrough of the level at 1.0838, and novice traders could open long positions based on this signal. Later, the pair surpassed the level at 1.0856, but it couldn't reach the next mark, so the long position could be manually closed at any point in the evening. The profit amounted to about 20 pips, which is a decent result considering that the day's volatility was just 44 pips.

Trading tips on Friday:

On the hourly chart, the downtrend persists, but EUR/USD has been correcting higher for the past three days. We believe that the euro should fall further, as the price is still too high, and the global trend is downward. Unfortunately, the market doesn't always want to trade the pair in a logical manner, and occasionally, it exhibits unreasonable growth. Most of this week's fundamental and macroeconomic factors should have weighed on the pair.

Today, it may be worth trying to trade bearish again as the price has bounced off the trendline. If the price breaches the trend line, the downtrend will be broken, and the pair may initially retreat before it continues to rise.

The key levels on the 5M chart are 1.0568, 1.0611-1.0618, 1.0668, 1.0725, 1.0785-1.0797, 1.0838-1.0856, 1.0888-1.0896, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091. On Friday, the EU's docket will feature the retail sales report. Moving on, market participants will focus on the Nonfarm Payrolls and unemployment data. In the second half of the day, the price may fluctuate significantly in different directions.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, after which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment