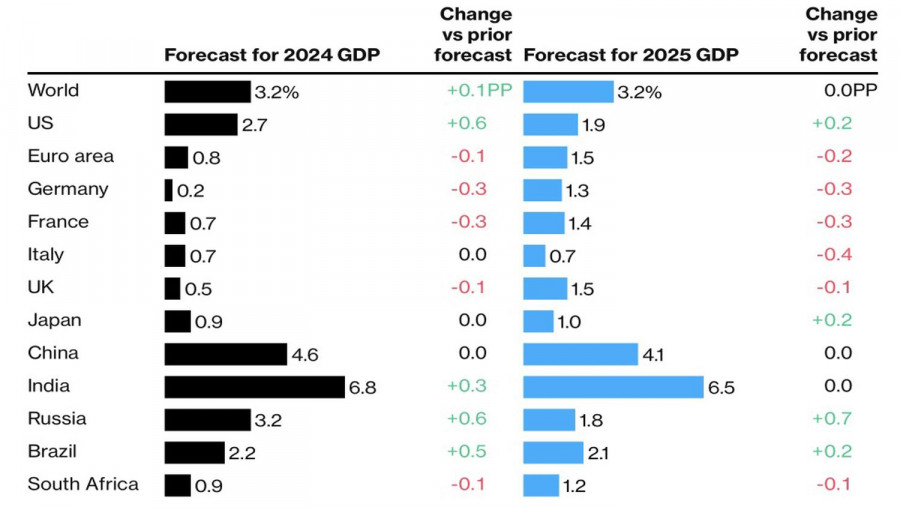

The IMF raises its GDP forecast for the US economy for 2024 by a significant 0.6 percentage points, to 2.7%. Goldman Sachs highlights the US as the only G10 nation where inflation is accelerating, suggesting potential for continued growth in the USD. American exceptionalism, coupled with the Federal Reserve's intention to keep the federal funds interest rate at 5.5% longer than expected, creates a strong foundation for the downward movement of EUR/USD. However, at the slightest pretext, the bulls indicate readiness to fight.

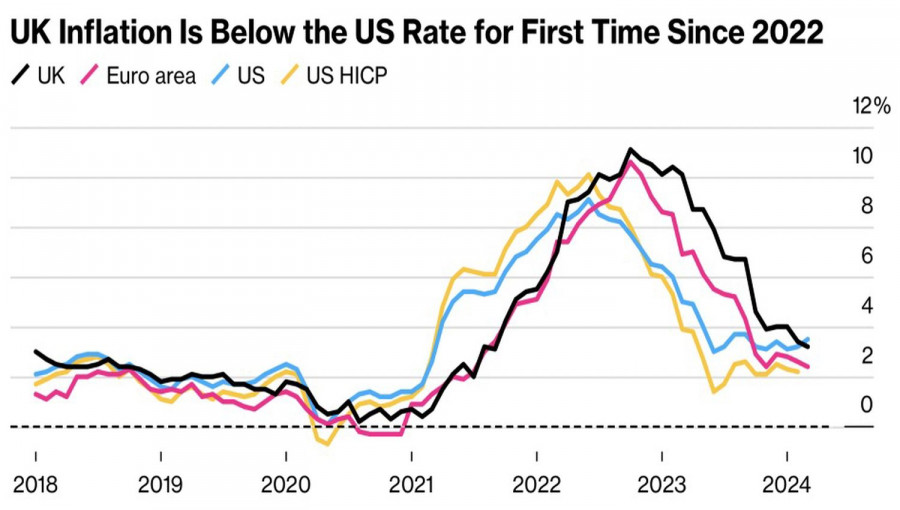

Goldman Sachs is slightly mistaken. The US is not the only country where consumer prices are surprising Bloomberg experts. UK inflation fell less than expected in March. Consumer prices rose 3.2%, prompting the futures market to push back rate cut bets for the Bank of England. Derivatives suggest that the rate will only be lowered at one MPC meeting, with a 50% chance of it happening again in December. The pound strengthened against major world currencies, pulling EUR/USD upwards.

Inflation dynamics in developed countries

Bloomberg economists say that inflation in the UK is on course to fall below 2% in coming months, and the BoE will likely start easing in the summer. However, it no longer expects an extended period of prices below the BoE's target. All efforts by the bulls to counterattack the pound and the euro are doomed to fail.

Indeed, when the eurozone economy is poised to grow by only 0.8%, according to the IMF, and inflation slowed to 2.4% in March, it is difficult to count on a significant EUR/USD correction. Especially since members of the Governing Council continue to insist on the start of the European Central Bank's monetary policy easing cycle in June. For instance, Mario Centeno said it's about time to change this monetary policy. The ECB will need to make further reductions to interest rates this year and next, following an initial move in June, according to Francois Villeroy de Galhau. Christine Lagarde asserts that in the absence of shocks, the central bank remains on course to cut interest rates in the near term.

IMF forecasts for various countries

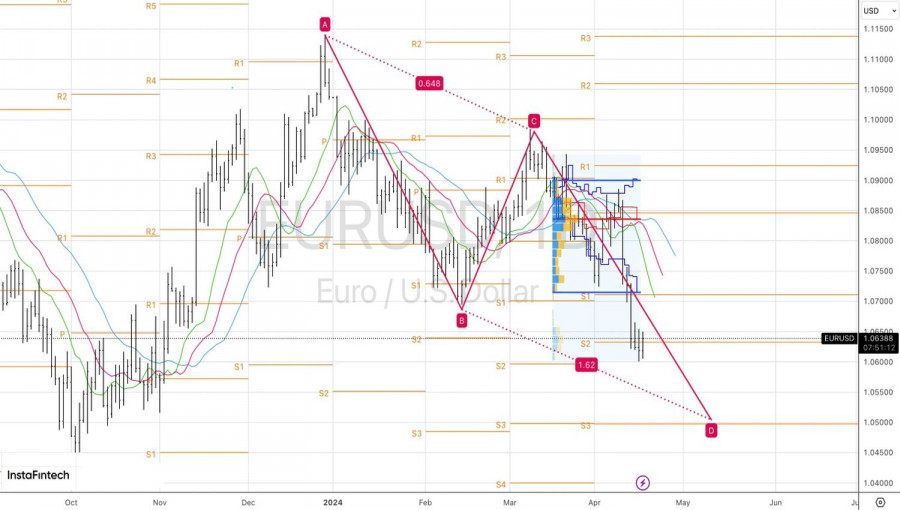

Thus, the ECB is ready to start in early summer, and the futures market is pricing in expectations of three acts of policy easing in 2024 with a small probability of a fourth. Derivatives markets expect the Fed to ease monetary policy in September, with more than a 50% chance of a second step in this direction. However, it's quite possible that the different pace of policy easing is already factored into EUR/USD quotes. The main currency pair needs a fresh driver to break out of the consolidation range of 1.06-1.07.

Will it be a stock market crash or an escalation of geopolitical conflict in the Middle East? Or, on the contrary, will the rise of the S&P 500 and global risk appetite driven by strong corporate earnings push the euro higher?

Technically, on the EUR/USD daily chart, the bulls are winning the battle for the key pivot level of 1.0635, which increases the risk of updating intraday highs at 1.0650 and 1.0665. A confident breakthrough could provide a basis for short-term buying.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment