Analysis of Trades and Tips for Trading the Euro

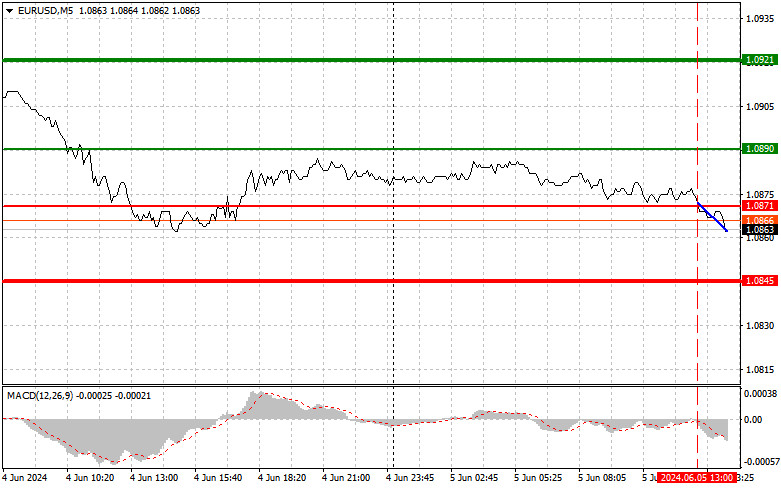

The test of the 1.0871 price level occurred when the MACD indicator started to move down from the zero mark, confirming the correct entry point for selling the euro. At the time of writing, the pair had moved down about 10 points, maintaining a good chance for further decline. The diverse statistics on service sector activity in the Eurozone countries harmed the upward potential of risky assets, preventing buyers from re-entering the market. All attention will be paid to the next batch of US labor market data and similar activity reports. Expected figures include ADP employment changes, the ISM services sector business activity index, and the composite PMI. Strong figures will further push the euro, allowing sellers to recover yesterday's losses. Regarding the intraday strategy, I plan to act based on Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, I plan to buy the euro when it reaches around 1.0879 (the green line on the chart), with a target of rising to the 1.0909 level. At 1.0909, I will exit the market and sell the euro in the opposite direction, expecting a move of 30-35 points from the entry point. An upward move in the euro today can be expected only after weak PMI reports. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario No. 2: I also plan to buy the euro today in case of two consecutive tests of the 1.0853 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. Growth can be expected to be at the opposite levels of 1.0879 and 1.0909.

Sell Signal

Scenario No. 1: I will sell the euro after it reaches the 1.0853 level (the red line on the chart). The target will be the 1.0829 level. I plan to exit the market and buy the euro immediately in the opposite direction (expecting a move of 20-25 points in the opposite direction from the level). Pressure on the pair will return in case of strong US statistics, leading to a new wave of euro decline. Important! Before selling, please ensure the MACD indicator is below the zero mark and starting to decline.

Scenario No. 2: I also plan to sell the euro today in case of two consecutive tests of the 1.0879 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline can be expected to the opposite levels of 1.0853 and 1.0829.

What's on the chart:

* Thin green line – the entry price for buying the trading instrument.

* Thick green line – the estimated price where you can place Take Profit or fix profits yourself, as further growth above this level is unlikely.

* Thin red line – the entry price for selling the trading instrument.

* Thick red line – the estimated price where you can place Take Profit or fix profits yourself, as further decline below this level is unlikely.

* MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the forex market must carefully make entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The test of the 1.0871 price level occurred when the MACD indicator started to move down from the zero mark, confirming the correct entry point for selling the euro. At the time of writing, the pair had moved down about 10 points, maintaining a good chance for further decline. The diverse statistics on service sector activity in the Eurozone countries harmed the upward potential of risky assets, preventing buyers from re-entering the market. All attention will be paid to the next batch of US labor market data and similar activity reports. Expected figures include ADP employment changes, the ISM services sector business activity index, and the composite PMI. Strong figures will further push the euro, allowing sellers to recover yesterday's losses. Regarding the intraday strategy, I plan to act based on Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, I plan to buy the euro when it reaches around 1.0879 (the green line on the chart), with a target of rising to the 1.0909 level. At 1.0909, I will exit the market and sell the euro in the opposite direction, expecting a move of 30-35 points from the entry point. An upward move in the euro today can be expected only after weak PMI reports. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario No. 2: I also plan to buy the euro today in case of two consecutive tests of the 1.0853 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. Growth can be expected to be at the opposite levels of 1.0879 and 1.0909.

Sell Signal

Scenario No. 1: I will sell the euro after it reaches the 1.0853 level (the red line on the chart). The target will be the 1.0829 level. I plan to exit the market and buy the euro immediately in the opposite direction (expecting a move of 20-25 points in the opposite direction from the level). Pressure on the pair will return in case of strong US statistics, leading to a new wave of euro decline. Important! Before selling, please ensure the MACD indicator is below the zero mark and starting to decline.

Scenario No. 2: I also plan to sell the euro today in case of two consecutive tests of the 1.0879 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline can be expected to the opposite levels of 1.0853 and 1.0829.

What's on the chart:

* Thin green line – the entry price for buying the trading instrument.

* Thick green line – the estimated price where you can place Take Profit or fix profits yourself, as further growth above this level is unlikely.

* Thin red line – the entry price for selling the trading instrument.

* Thick red line – the estimated price where you can place Take Profit or fix profits yourself, as further decline below this level is unlikely.

* MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the forex market must carefully make entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment