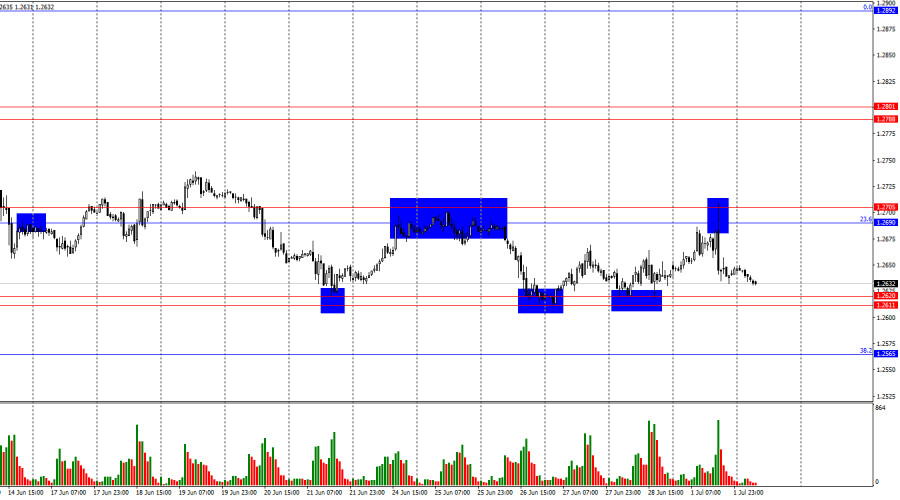

On the hourly chart, the GBP/USD pair executed a new rebound from the resistance zone of 1.2690–1.2705 on Monday, favoring the US dollar and beginning to decline towards the support zone of 1.2611–1.2620. A rebound from this zone will favor the British currency and a new rise towards 1.2690–1.2705. Securing the pair's quotes below 1.2611–1.2620 will allow a further pound decline toward the 38.2% retracement level at 1.2565. At the moment, we are dealing with a clear sideways movement.

The wave situation remains unchanged. The last upward wave broke the peak from June 4, and the new downward wave (still forming) managed to break the low of the wave from June 10. Thus, the trend for the GBP/USD pair has shifted to "bearish" and remains so. I am cautious about concluding that a bearish trend has started, as the bulls have not completely left the market. The emerging advantage of the bears can be easily overturned. However, at this time, the zone of 1.2690–1.2705 indicates that the bears have slightly better prospects than the bulls.

The informational background on Monday allowed the bulls to launch a new attack, as the ISM Manufacturing Index in the US turned out to be worse than traders expected. The figure dropped from 48.7 to 48.5, while most traders expected a rise to 49.1. However, the dollar did not seem too upset by this. It rose in the first half of the day and in the second half, ignoring the US statistics. The Manufacturing PMI was also published in the UK, decreasing instead of increasing. It can be said that yesterday, the pair moved contrary to traders' expectations. However, all these movements combined form a sideways trend. It does not matter how the pair trades within it. At this time, it is only possible to trade on a rebound from the boundaries of the sideways channel.

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the ascending trend line. After rebounding from 1.2620, the British pound grew slightly, but the "bearish" divergence in the CCI and RSI indicators suggests a reversal in favor of the US dollar and a resumption of the decline. Consolidation below the level of 1.2620 will increase the likelihood of further decline towards the next level of 1.2450.

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders became slightly less "bullish" over the last reporting week. The number of long positions held by speculators decreased by 3,373 units, while the number of short positions increased by 200. Bulls still hold a solid advantage. The gap between long and short positions is 44 thousand: 102 thousand versus 58 thousand.

The British pound still has prospects for a decline. Technical analysis has given several signals indicating the breakdown of the "bullish" trend, and the bulls cannot keep attacking indefinitely. Over the last three months, the number of long positions has increased from 98 thousand to 102 thousand, while the number of short positions has grown from 54 thousand to 58 thousand. Over time, major players will continue to get rid of long positions or increase short positions, as all possible factors for buying the British pound have already been factored in. However, it should be remembered that this is just a hypothesis. Technical analysis still indicates the weakness of the bears, who cannot even "take" the 1.2620 level.

News Calendar for the US and the UK:

USA

* Speech by Fed Chair Jerome Powell (13:30 UTC)

* JOLTS Job Openings (14:00 UTC)

On Tuesday, the economic event calendar contains only two entries, but both are significant. The impact of the information background on market sentiment today could be moderate in the second half of the day.

GBP/USD Forecast and Trading Tips:

Sales of the pound were possible upon a rebound from the zone of 1.2690 - 1.2705 with a target of 1.2611 - 1.2620. This target has been reached. Purchases can be considered on a rebound from the zone of 1.2611 - 1.2620 on the hourly chart with a target of 1.2690 - 1.2705. New sales are possible upon closing below 1.2611 - 1.2620 with a target of 1.2565.

The Fibonacci level grids are drawn from 1.2036 to 1.2892 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The wave situation remains unchanged. The last upward wave broke the peak from June 4, and the new downward wave (still forming) managed to break the low of the wave from June 10. Thus, the trend for the GBP/USD pair has shifted to "bearish" and remains so. I am cautious about concluding that a bearish trend has started, as the bulls have not completely left the market. The emerging advantage of the bears can be easily overturned. However, at this time, the zone of 1.2690–1.2705 indicates that the bears have slightly better prospects than the bulls.

The informational background on Monday allowed the bulls to launch a new attack, as the ISM Manufacturing Index in the US turned out to be worse than traders expected. The figure dropped from 48.7 to 48.5, while most traders expected a rise to 49.1. However, the dollar did not seem too upset by this. It rose in the first half of the day and in the second half, ignoring the US statistics. The Manufacturing PMI was also published in the UK, decreasing instead of increasing. It can be said that yesterday, the pair moved contrary to traders' expectations. However, all these movements combined form a sideways trend. It does not matter how the pair trades within it. At this time, it is only possible to trade on a rebound from the boundaries of the sideways channel.

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the ascending trend line. After rebounding from 1.2620, the British pound grew slightly, but the "bearish" divergence in the CCI and RSI indicators suggests a reversal in favor of the US dollar and a resumption of the decline. Consolidation below the level of 1.2620 will increase the likelihood of further decline towards the next level of 1.2450.

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders became slightly less "bullish" over the last reporting week. The number of long positions held by speculators decreased by 3,373 units, while the number of short positions increased by 200. Bulls still hold a solid advantage. The gap between long and short positions is 44 thousand: 102 thousand versus 58 thousand.

The British pound still has prospects for a decline. Technical analysis has given several signals indicating the breakdown of the "bullish" trend, and the bulls cannot keep attacking indefinitely. Over the last three months, the number of long positions has increased from 98 thousand to 102 thousand, while the number of short positions has grown from 54 thousand to 58 thousand. Over time, major players will continue to get rid of long positions or increase short positions, as all possible factors for buying the British pound have already been factored in. However, it should be remembered that this is just a hypothesis. Technical analysis still indicates the weakness of the bears, who cannot even "take" the 1.2620 level.

News Calendar for the US and the UK:

USA

* Speech by Fed Chair Jerome Powell (13:30 UTC)

* JOLTS Job Openings (14:00 UTC)

On Tuesday, the economic event calendar contains only two entries, but both are significant. The impact of the information background on market sentiment today could be moderate in the second half of the day.

GBP/USD Forecast and Trading Tips:

Sales of the pound were possible upon a rebound from the zone of 1.2690 - 1.2705 with a target of 1.2611 - 1.2620. This target has been reached. Purchases can be considered on a rebound from the zone of 1.2611 - 1.2620 on the hourly chart with a target of 1.2690 - 1.2705. New sales are possible upon closing below 1.2611 - 1.2620 with a target of 1.2565.

The Fibonacci level grids are drawn from 1.2036 to 1.2892 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment