The dollar was steady despite relatively good data on retail sales. In fact, their growth rate in the United States slowed from 2.6% to 2.3%. The thing is that the growth rate was expected to slow down from 2.3% to 2.1%. So in theory, the dollar should have strengthened somewhat. However, the general sentiment on the dollar is quite negative, as investors expect the Federal Reserve to start lowering its interest rate soon. Thus, the retail sales data simply supported the dollar, preventing it from falling further.

Apparently, today we expect a repeat of yesterday's scenario. Sentiments about the Fed's monetary policy still weighs on the dollar. It will be supported by the industrial production data, whose growth rate in the United States should accelerate from 0.1% to 0.4%. But the eurozone inflation data as a whole can not be considered, as the final data are published, designed only to confirm the preliminary estimates, the market has already taken into account.

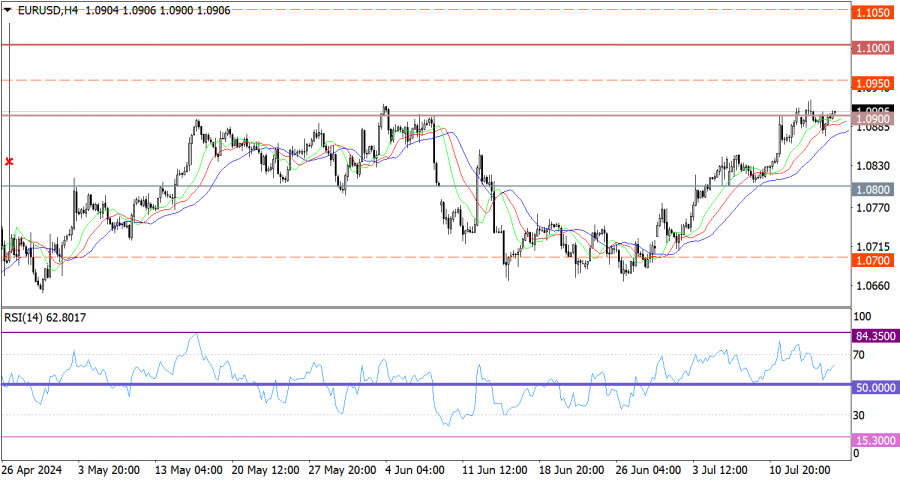

EUR/USD is moving around the resistance level of 1.0900, which indicates that the bullish sentiment is still in force.

On the 4-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which suggests that the euro may rise further.

On the same chart, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Based on the absence of a full-scale correction, we can conclude that there's a high volume of long positions on the euro. Rising above the level of 1.0900 may lead to a new round of growth, where buyers will face the psychological level of 1.1000. As an alternative scenario, traders are considering movement along the level of 1.0900.

The complex indicator analysis unveiled that in the short-term and intraday periods, indicators are providing an upward signal.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment