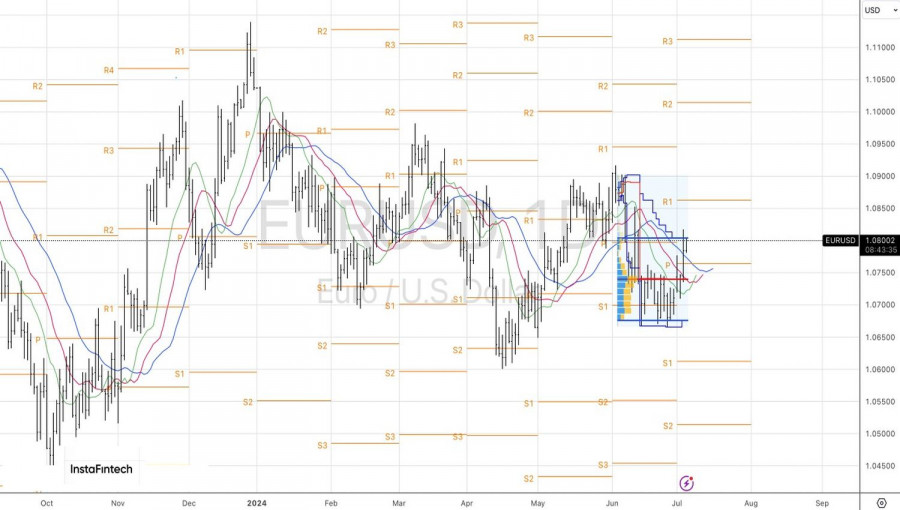

Fears about Frexit and the related parity in the EUR/USD pair are gradually receding, the yield spread between French and German bonds is narrowing, and Morgan Stanley is even recommending buying significantly cheaper stocks of the Eurozone's second-largest economy. They argue that as the degree of political risk diminishes, these stocks will rise significantly. We shall see, but for now, the euro has reached the first of the two bullish targets at 1.08 and 1.0835.

Dynamics of CAC-40 and the Yield Spread of French and German Bonds

The fact that investors are satisfied with the attempt by the alliance of the New Popular Front and Renaissance to prevent the National Rally from gaining an absolute majority is also evidenced by the results of the auction for the placement of French bonds amounting to €10.5 billion. Demand exceeded supply by 2.58 times, more than at the previous two auctions. If local bonds appeared toxic, who would buy them?

The decrease in political risk is far from the only bullish driver for EUR/USD. According to ECB Chief Economist Philip Lane, the central bank is not entirely convinced that price pressures in the Eurozone have been contained. The central bank has concerns about domestic inflation, which is currently around 4%. Lane is likely referring to service prices. In any case, if the European Central Bank does not rush to take the second step toward monetary easing, the euro will only benefit.

In contrast, the US economy indicates that the Federal Reserve should hurry with easing monetary policy. Bad news comes from repeated unemployment claims, which have been rising for nine consecutive weeks. People are finding it harder to get jobs. The increase in private-sector employment from ADP disappointed, the services PMI fell to a four-year low, and the widening trade deficit suggests that net exports will slow GDP growth in the second quarter.

Dynamics of Repeated Unemployment Claims

Treasury yields fell and the US dollar broadly weakened against major currencies due to the combination of weak data and dovish notes in the June FOMC minutes. The futures market is indicating a 73% probability of a federal funds rate cut in September. If inflation and the economy continue to cool, borrowing costs could drop to 5% by the end of the year.

At the same time, it's too early to count out the US dollar. The chances of Donald Trump winning the presidential race are significant. With the Republican back in the White House, protectionist policies, trade wars, and additional fiscal stimuli could return, which would lend support to the USD index.

Technically, on the daily EUR/USD chart, there is a battle for the upper boundary of the fair value range of 1.0675-1.0805. If the bulls win, it will create an opportunity to increase previously formed long positions in the euro towards $1.0835 and $1.0865.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment