Markets recover from sharp decline

The S&P 500 and Nasdaq jumped 1% on Tuesday, showing a strong recovery from the recent sell-off. Investors began to actively buy stocks again, inspired by positive comments from Federal Reserve officials, which eased fears about a possible recession in the U.S.

Global growth and a return to risk

Equally on the day, stocks around the world began to recover from the aggressive declines the previous day. Amid this gain, U.S. Treasury yields increased and the dollar strengthened. Investors have returned to buying riskier assets despite lingering concerns about an economic slowdown.

Cooling Optimism

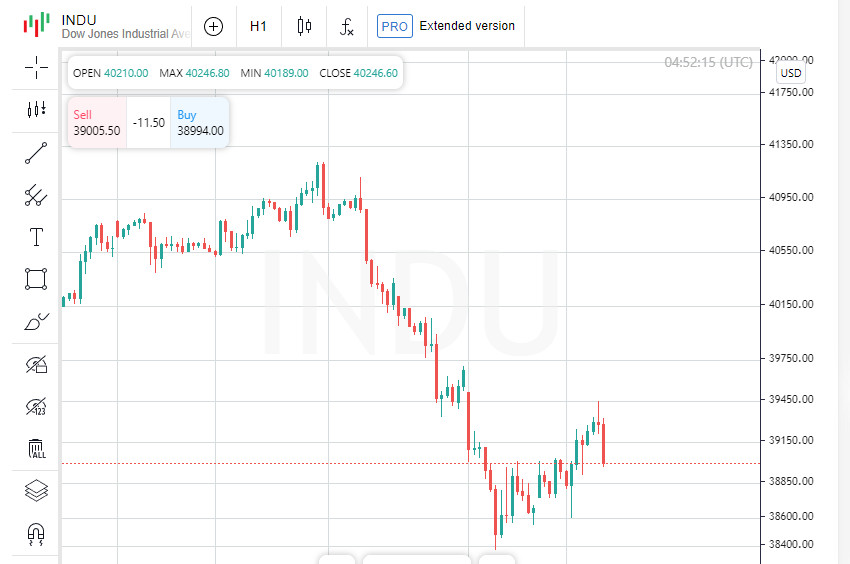

The Dow Jones Industrial Average also showed positive dynamics, but, like other major indices, it fell by the end of the trading day, falling short of the daily highs. This shows some caution among market participants despite the overall improvement in sentiment.

Fed calms markets

U.S. Federal Reserve officials issued statements rejecting the view that weak July employment data points to an approaching recession. However, they warned that lowering interest rates may be necessary to prevent a possible economic slowdown.

Rate cuts likely

Amid weak economic data, stocks were under pressure, fueling fears of a U.S. recession. According to CME Group's FedWatch tool, traders are pricing in the likelihood of a rate cut at the next meeting in September, with 75% expecting a 50 basis point cut and 25% expecting a 25 basis point cut.

S&P 500 Sectors Advance: The Day's Top Performers

All of the major sectors of the S&P 500 ended the day higher, with real estate and financials leading the way. Tech company Nvidia was a particular highlight, jumping nearly 4% to lead the gains for the S&P 500 and Nasdaq.

Investors Return to the Market

"The market has been oversupplied, but there's a significant recovery happening, particularly in the Nasdaq. Investors are starting to believe again that lower interest rates will be good for stocks," said Rick Meckler, a partner at Cherry Lane Investments, a family-owned investment firm in New Vernon, N.J.

Indices Are Rising

The Dow Jones Industrial Average gained 294.39 points, or 0.76%, to 38,997.66. The S&P 500 gained 53.7 points, or 1.04%, to 5,240.03, and the Nasdaq Composite gained 166.77 points, or 1.03%, to 16,366.86.

The Impact of Artificial Intelligence

The Nasdaq Composite has risen 9% in 2024, helped by strong earnings and a bullish outlook for AI. However, as Meckler noted, "while recent earnings have been good, they have fallen short of expectations in many cases." Market valuations remain high, with the S&P 500 trading at 20 times trailing 12-month earnings, according to LSEG, well above the long-term average of 15.7.

Expectations and Risks

Amid unexpected developments such as the Bank of Japan's recent rate hike, investors have begun to unwind the yen-denominated financing that has been used to buy stocks for years. This has added to market uncertainty and left many wondering about the outlook.

Awaiting Powell's Speech

One of the key events investors are watching is Federal Reserve Chairman Jerome Powell's speech at a symposium in Jackson Hole, Wyoming, scheduled for August 22-24. His words could influence future market moves and provide insight into the future of monetary policy.

Uber and Caterpillar Succeed

Uber shares soared 11%, beating Wall Street's second-quarter revenue and profit expectations. The company was able to show solid growth thanks to strong demand for its ride-sharing and food delivery services. Meanwhile, Caterpillar shares rose 3% as the company also beat analysts' forecasts despite weaker demand in North America. Rising prices for heavy equipment such as excavators helped offset those losses.

Trading Activity on the Rise

Trading volume on U.S. stock exchanges totaled 13.52 billion shares, above the 20-day average of 12.48 billion. Advancing stocks outnumbered declining stocks on the New York Stock Exchange by a 2.59-to-1 ratio, while the Nasdaq saw a 1.93-to-1 ratio.

Highs and Lows

The S&P 500 posted 12 new 52-week highs and seven new lows, while the Nasdaq Composite posted 31 new highs and 144 new lows. These figures highlight the continued volatile market, with gains and losses alike.

Oil Prices Rebounding

Oil prices also edged higher after falling to multi-month lows on Monday. Investors' attention has shifted to supply-side concerns, which, along with a recovery in financial markets, has eased concerns about future energy demand.

Nikkei recovery: relief after collapse

Tokyo's Nikkei index rose 10%, providing some relief after its 12.4% plunge on Monday. The drop was the biggest one-day sell-off in Japan since Black Monday in 1987, causing global investor jitters.

Fed: Slowdown, not recession

U.S. Federal Reserve officials on Monday dismissed speculation about a recession despite weak employment data for July. San Francisco Fed President Mary Daly stressed that current data suggest the economy is slowing, but not collapsing. She noted the importance of preventing a labor market crisis.

Global Markets Rise

The MSCI index, which tracks shares around the world, rose 8.91 points, or 1.17%, to 770.99, off its daily high of 777.81. That followed a more than 3% drop on Monday, marking the third straight day of losses for the global market.

European Markets Volatility

Europe's STOXX 600 index ended the session up 0.29%, despite earlier volatility, when it fell 0.54%. That underscores the nervousness among European investors trying to adjust to rapidly changing market conditions.

FX Market Jitters

On the FX front, the dollar strengthened against its major counterparts, while the Japanese yen hit seven-month highs against the US dollar. Some of the more dramatic moves of recent days have eased, and markets are beginning to feel a sense of calm again.

Dollar Strengthens Amid Currency Volatility

The dollar index, which tracks the dollar against major currencies including the yen and euro, rose 0.07% to 102.94. Against the Japanese yen, the dollar gained 0.4% to 144.74, while the euro weakened 0.2% to $1.093.

U.S. Treasury Yields Rise

U.S. Treasury yields rose as fears of a potential recession in the country proved overblown, dampening demand for safe-haven U.S. bonds.

The 10-year yield rose 12 basis points to 3.903%, while the 30-year yield rose 12.1 basis points to 4.1924%. The yield on 2-year bonds, which often react to changes in interest rate expectations, also rose to 3.9936%.

Oil prices recover

Oil prices have stabilized after falling on Monday. U.S. crude rose 0.36% to $73.20 a barrel, while Brent crude ended the trading session at $76.48 a barrel, up 0.24% from the previous day.

Precious Metals: Gold Loses Ground

With the dollar strengthening and bond yields rising, precious metals prices fell. Spot gold fell 0.82% to $2,387.88 an ounce. U.S. gold futures also fell 0.37% to $2,392.70 an ounce. However, expectations of a U.S. interest rate cut in September and ongoing tensions in the Middle East limited gold's losses, maintaining its appeal as a safe haven asset.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The S&P 500 and Nasdaq jumped 1% on Tuesday, showing a strong recovery from the recent sell-off. Investors began to actively buy stocks again, inspired by positive comments from Federal Reserve officials, which eased fears about a possible recession in the U.S.

Global growth and a return to risk

Equally on the day, stocks around the world began to recover from the aggressive declines the previous day. Amid this gain, U.S. Treasury yields increased and the dollar strengthened. Investors have returned to buying riskier assets despite lingering concerns about an economic slowdown.

Cooling Optimism

The Dow Jones Industrial Average also showed positive dynamics, but, like other major indices, it fell by the end of the trading day, falling short of the daily highs. This shows some caution among market participants despite the overall improvement in sentiment.

Fed calms markets

U.S. Federal Reserve officials issued statements rejecting the view that weak July employment data points to an approaching recession. However, they warned that lowering interest rates may be necessary to prevent a possible economic slowdown.

Rate cuts likely

Amid weak economic data, stocks were under pressure, fueling fears of a U.S. recession. According to CME Group's FedWatch tool, traders are pricing in the likelihood of a rate cut at the next meeting in September, with 75% expecting a 50 basis point cut and 25% expecting a 25 basis point cut.

S&P 500 Sectors Advance: The Day's Top Performers

All of the major sectors of the S&P 500 ended the day higher, with real estate and financials leading the way. Tech company Nvidia was a particular highlight, jumping nearly 4% to lead the gains for the S&P 500 and Nasdaq.

Investors Return to the Market

"The market has been oversupplied, but there's a significant recovery happening, particularly in the Nasdaq. Investors are starting to believe again that lower interest rates will be good for stocks," said Rick Meckler, a partner at Cherry Lane Investments, a family-owned investment firm in New Vernon, N.J.

Indices Are Rising

The Dow Jones Industrial Average gained 294.39 points, or 0.76%, to 38,997.66. The S&P 500 gained 53.7 points, or 1.04%, to 5,240.03, and the Nasdaq Composite gained 166.77 points, or 1.03%, to 16,366.86.

The Impact of Artificial Intelligence

The Nasdaq Composite has risen 9% in 2024, helped by strong earnings and a bullish outlook for AI. However, as Meckler noted, "while recent earnings have been good, they have fallen short of expectations in many cases." Market valuations remain high, with the S&P 500 trading at 20 times trailing 12-month earnings, according to LSEG, well above the long-term average of 15.7.

Expectations and Risks

Amid unexpected developments such as the Bank of Japan's recent rate hike, investors have begun to unwind the yen-denominated financing that has been used to buy stocks for years. This has added to market uncertainty and left many wondering about the outlook.

Awaiting Powell's Speech

One of the key events investors are watching is Federal Reserve Chairman Jerome Powell's speech at a symposium in Jackson Hole, Wyoming, scheduled for August 22-24. His words could influence future market moves and provide insight into the future of monetary policy.

Uber and Caterpillar Succeed

Uber shares soared 11%, beating Wall Street's second-quarter revenue and profit expectations. The company was able to show solid growth thanks to strong demand for its ride-sharing and food delivery services. Meanwhile, Caterpillar shares rose 3% as the company also beat analysts' forecasts despite weaker demand in North America. Rising prices for heavy equipment such as excavators helped offset those losses.

Trading Activity on the Rise

Trading volume on U.S. stock exchanges totaled 13.52 billion shares, above the 20-day average of 12.48 billion. Advancing stocks outnumbered declining stocks on the New York Stock Exchange by a 2.59-to-1 ratio, while the Nasdaq saw a 1.93-to-1 ratio.

Highs and Lows

The S&P 500 posted 12 new 52-week highs and seven new lows, while the Nasdaq Composite posted 31 new highs and 144 new lows. These figures highlight the continued volatile market, with gains and losses alike.

Oil Prices Rebounding

Oil prices also edged higher after falling to multi-month lows on Monday. Investors' attention has shifted to supply-side concerns, which, along with a recovery in financial markets, has eased concerns about future energy demand.

Nikkei recovery: relief after collapse

Tokyo's Nikkei index rose 10%, providing some relief after its 12.4% plunge on Monday. The drop was the biggest one-day sell-off in Japan since Black Monday in 1987, causing global investor jitters.

Fed: Slowdown, not recession

U.S. Federal Reserve officials on Monday dismissed speculation about a recession despite weak employment data for July. San Francisco Fed President Mary Daly stressed that current data suggest the economy is slowing, but not collapsing. She noted the importance of preventing a labor market crisis.

Global Markets Rise

The MSCI index, which tracks shares around the world, rose 8.91 points, or 1.17%, to 770.99, off its daily high of 777.81. That followed a more than 3% drop on Monday, marking the third straight day of losses for the global market.

European Markets Volatility

Europe's STOXX 600 index ended the session up 0.29%, despite earlier volatility, when it fell 0.54%. That underscores the nervousness among European investors trying to adjust to rapidly changing market conditions.

FX Market Jitters

On the FX front, the dollar strengthened against its major counterparts, while the Japanese yen hit seven-month highs against the US dollar. Some of the more dramatic moves of recent days have eased, and markets are beginning to feel a sense of calm again.

Dollar Strengthens Amid Currency Volatility

The dollar index, which tracks the dollar against major currencies including the yen and euro, rose 0.07% to 102.94. Against the Japanese yen, the dollar gained 0.4% to 144.74, while the euro weakened 0.2% to $1.093.

U.S. Treasury Yields Rise

U.S. Treasury yields rose as fears of a potential recession in the country proved overblown, dampening demand for safe-haven U.S. bonds.

The 10-year yield rose 12 basis points to 3.903%, while the 30-year yield rose 12.1 basis points to 4.1924%. The yield on 2-year bonds, which often react to changes in interest rate expectations, also rose to 3.9936%.

Oil prices recover

Oil prices have stabilized after falling on Monday. U.S. crude rose 0.36% to $73.20 a barrel, while Brent crude ended the trading session at $76.48 a barrel, up 0.24% from the previous day.

Precious Metals: Gold Loses Ground

With the dollar strengthening and bond yields rising, precious metals prices fell. Spot gold fell 0.82% to $2,387.88 an ounce. U.S. gold futures also fell 0.37% to $2,392.70 an ounce. However, expectations of a U.S. interest rate cut in September and ongoing tensions in the Middle East limited gold's losses, maintaining its appeal as a safe haven asset.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment