The Bank of England started its easing cycle on August 1, and the market expects a further 50 basis points cut by the end of the year. The Bank of England's chief economist, Huw Pill, voted against the cut and warned against expecting more rate cuts in the near future. The market considered this and currently assigns less than a 50% probability to a rate cut next month.

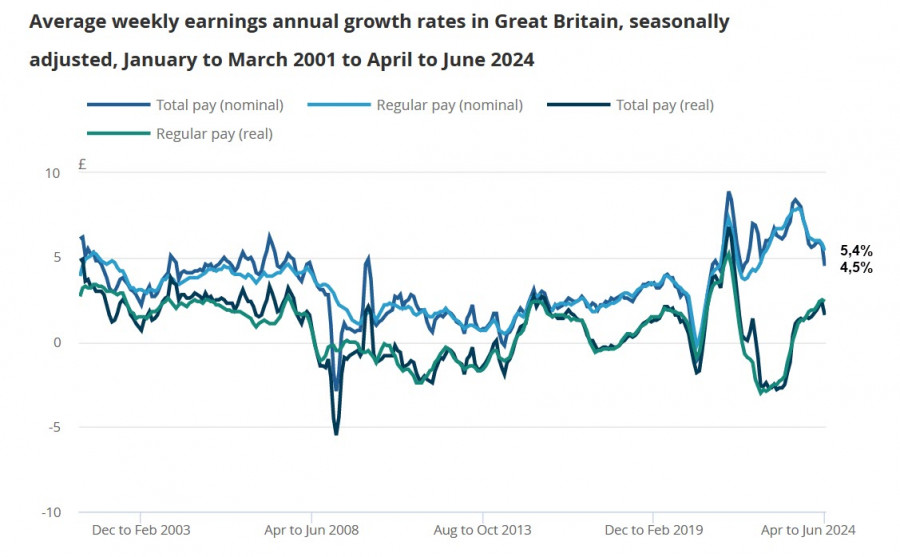

Today's agenda includes updated data on the labor market and inflation. Labor market data for July was released this morning, and it turned out to be significantly unexpected. Growth in average earnings, excluding bonuses, slowed from 5.7% to 5.4%. While this seems like good news in terms of slowing inflation, forecasts had predicted a drop to 4.6%. Now, the probability of a BoE rate cut next month has decreased further, which is a distinctly bullish signal for the pound.

At the same time, unemployment rose from 4.4% to 4.7%, and the number of jobless claims was 135,000, compared to a forecast of 14.5%. The sharp increase in claims indicates that the economy is closer to a recession than previously thought, and this figure, on the contrary, provides grounds to continue cutting rates.

As we can see, the market received two opposing signals on Tuesday and reacted with only a slight spike in volatility. It seems that significant conclusions will be drawn on Wednesday after the release of the consumer inflation report.

The NIESR Institute, analyzing various statistical data (CPI, PPI, 10-year UK government bond yields, effective pound sterling exchange rate, BoE bank rate) within its own forecasting model, expects July inflation to be between 2.2% and 2.4%. This is higher than the previous month and aligns with market forecasts. Interestingly, the forecasts suggest that inflation will decrease to 2% in September, which supports further rate cuts, but then, due to accumulated effects, it will rise back to 2.9% by early 2025, which suggests caution regarding rate cuts.

As we can see, the uncertainty is too high to make a definitive forecast. The market balances expectations for the Federal Reserve and BoE rates, which provides a driver for movement in either direction, but the accumulated uncertainty needs resolution.

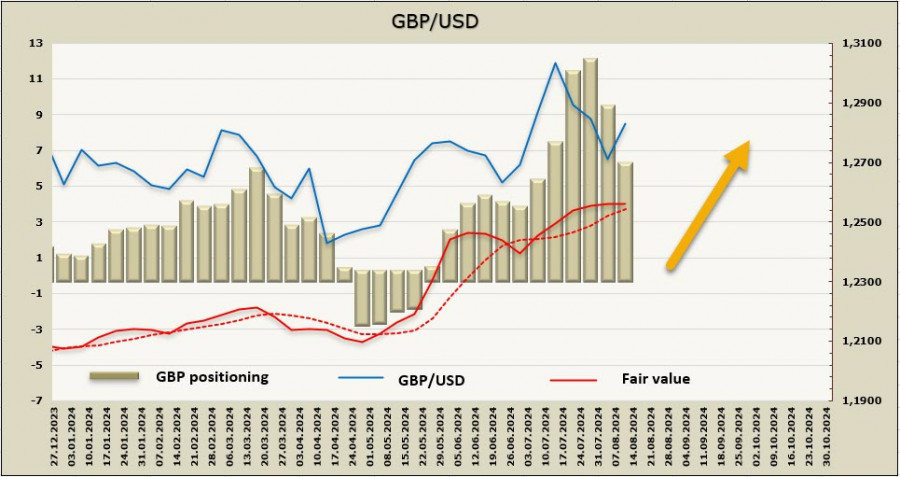

The net long GBP position decreased by $3.0 billion to $5.9 billion over the reporting week. Despite the significant decline, the bullish bias persists, and although the price has lost some momentum, it is still above the long-term average.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment