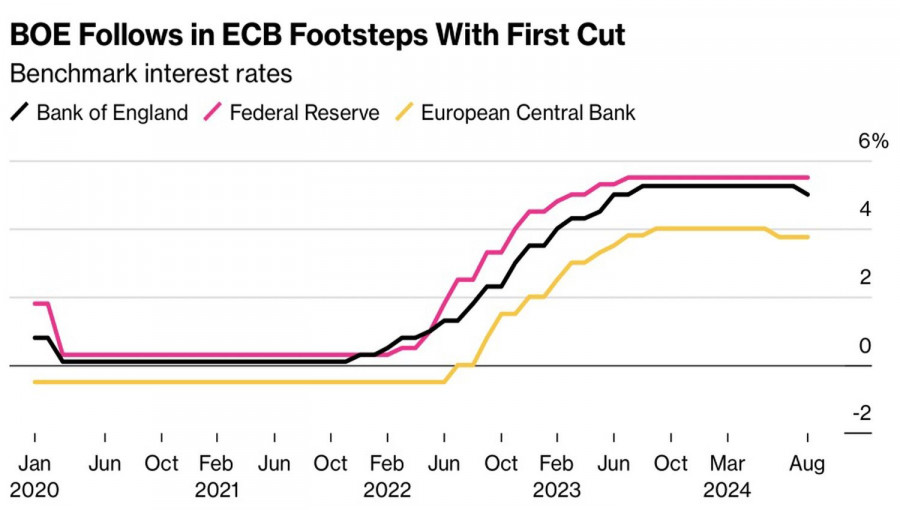

Don't bet against the Federal Reserve. This market principle should be ingrained in traders from the start, but failing to heed it won't lead to big earnings. It seems the markets are playing poker with central banks, and their August maneuvering more closely resembles a bluff. The Bank of Japan took the bait, promising not to raise the overnight rate if market turbulence persists. Will the Fed fall for it? The fate of EUR/USD depends on it.

Dynamics of Fed rates and other central banks

What happened on August 5 has been compared to Black Monday, October 19, 1987. The movements of assets were rapid in both instances, but there are differences between these events. From the beginning of the year until mid-summer, the S&P 500 did not face a significant correction, and investors became fixated on buying tech stocks, selling the Japanese yen, and engaging in carry trading. They were all reversed in August.

The trigger was the Bank of Japan's tightening of monetary policy, which was then exacerbated by fears of an impending recession in the US economy. Now, investors are concerned with one question: Has the panic in the financial markets, including Forex, ended?

The markets are normalizing because of the stabilization of the main currencies involved in carry-trade, like the Japanese yen, Mexican peso, and Australian dollar. JP Morgan believes that about 75% of the transactions in the carry-trade game have been closed. A quarter remains. This does not rule out further shocks, but they are unlikely to be comparable in scale to Black Monday. According to LPL Financial, the drop in Treasury yields and the US dollar's weakness will strengthen the yen, increasing the risks of further unwinding carry-trade.

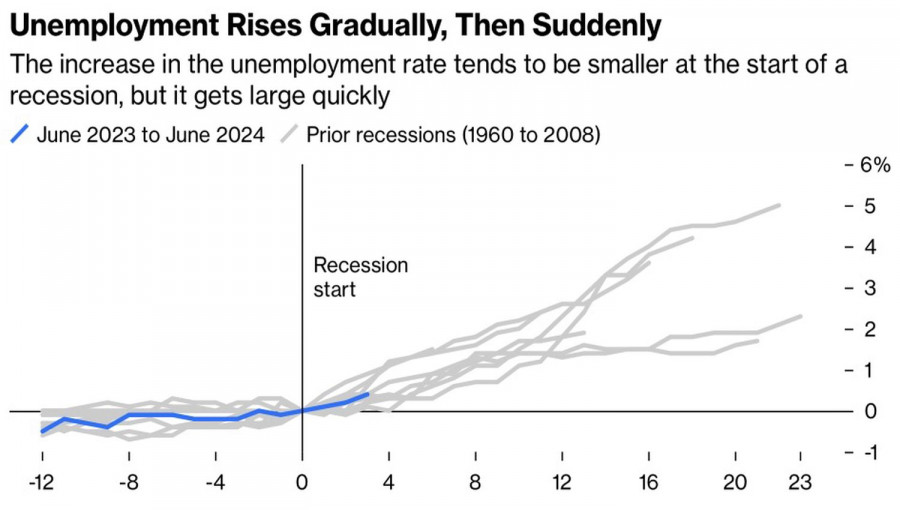

Diminishing fears allows for the formation of a strategy to sell EUR/USD on its rise. However, deterioration in US macro data, especially in the labor market, calls for adjustments to this strategy. Unsurprisingly, investors are holding their breath, awaiting the release of unemployment benefits claims data. Indeed, before recessions, unemployment rises slowly and then accelerates. The American economy is not yet in a recession, but a downturn is not out of the question.

Unemployment dynamics during recessions in the US

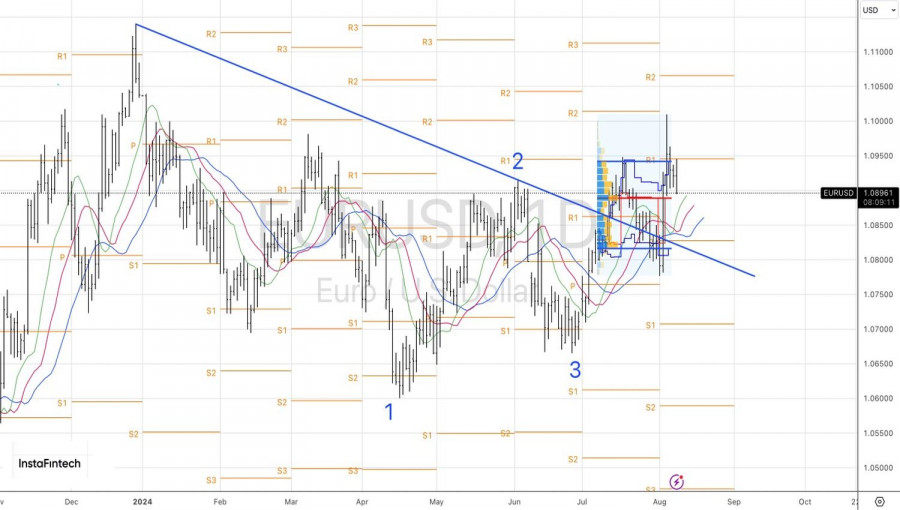

In my opinion, until the release of the US inflation data for July on August 14, the markets will be nervous and erratic, leading to a consolidation of EUR/USD in the range of 1.0865-1.1000. It is not ruled out that quotes will break out of this range and return later.

Technically, on the daily chart, EUR/USD is in a short-term consolidation within the Adam and Eve pattern. The bulls' inability to break through the upper boundary of the fair value range from 1.0815 to 1.0940 indicates their weakness. It provides a basis for forming short positions on the euro against the US dollar, targeting 1.0880 and 1.0865.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment