Labor market, and that's it! If the Federal Reserve has shifted its focus from inflation to U.S. employment indicators, why shouldn't investors do the same? As a result, the slowdown in weekly unemployment claims to 227,000, the lowest level since July, had a more significant impact on the markets than the deceleration in consumer price growth. EUR/USD gave up much of its gains after the release of data on the Producer Price Index and Consumer Price Index, and there will be more to come!

In less than two weeks, the market's outlook has significantly changed. Back on Black Monday, everyone did nothing but shout about the recession on every corner. Now, investors argue that the U.S. economy is still strong as a bull, and employment issues in July were due to hurricane impacts. In August, everything will return to normal. Why would the Fed lower the federal funds rate by 50 basis points in September? The odds of such a move have dropped from 50% to less than 24%, allowing the bears on EUR/USD to counterattack.

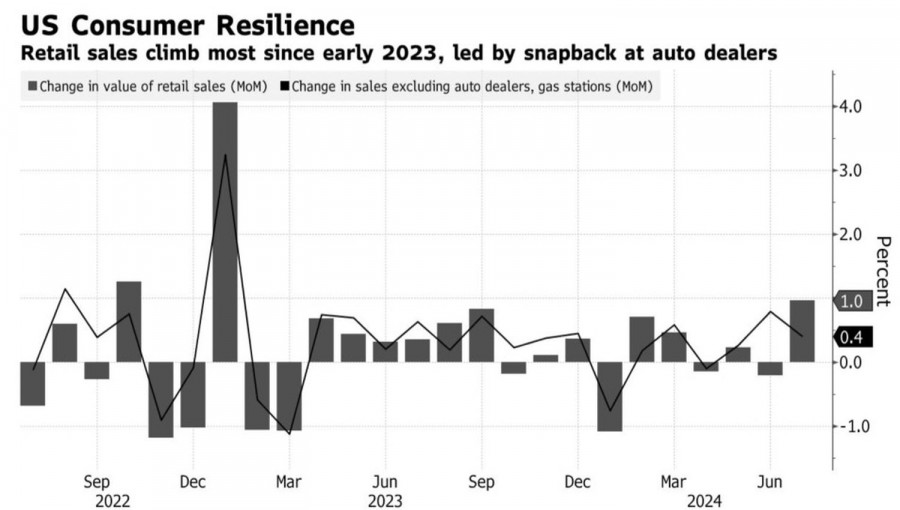

Indeed, if retail sales in July increased by an impressive 1% month-on-month, the best performance of the indicator since the beginning of 2023, should we expect a slowdown in GDP? In the second quarter, GDP surged by 2.8%, and the leading indicator from the Atlanta Fed signals further acceleration to 3% in July-September. American exceptionalism is making a comeback. What's the point of buying EUR/USD? The pair should definitely be sold!

Dynamics of U.S. Retail Sales

If the U.S. economy is doing well, the futures market's expectations for a 100 basis point cut in the federal funds rate in 2024 seem clearly overestimated. Derivatives indicate more than a 50% probability of such an outcome and show a 47.5% chance of a 75 bps cut in borrowing costs to 4.75% by the end of 2024.

The situation is painfully reminiscent of the first quarter when markets shifted from expecting six acts of monetary easing by the Fed this year to just one. As a result, the U.S. dollar confidently led the G10 currency race and continues to maintain its lead. In January-March, the surprise was the unexpected acceleration of inflation in the U.S. Why not pull off the same trick with the labor market from September to December?

Moreover, the bears on EUR/USD have additional trump cards up their sleeves. Uncertainty surrounding the presidential elections generally leads to increased demand for the U.S. dollar as a safe-haven currency. Donald Trump's protectionist and inflationary policies risk bringing back high prices and slowing the Fed's progress toward easing monetary policy.

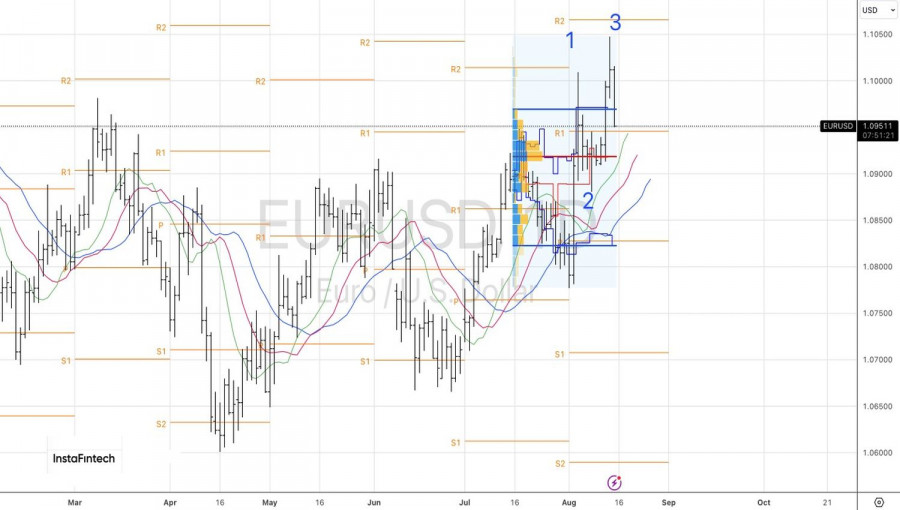

Technically, on the daily chart, EUR/USD clearly played out the Anti-Turtles reversal pattern, allowing traders to go short from 1.104. Short positions on the euro against the U.S. dollar should be maintained and periodically increased. Target levels are 1.092 and 1.088.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment