Everything is relative. If inflation is no longer of particular interest to financial markets, they have focused on the recession, but for politicians, it still is. Donald Trump continuously criticizes the Democrats for high inflation. It must be acknowledged that the Republican has a point—prices did indeed soar in 2022 and 2023. However, the former President's promises to bring them down to the level of a grain of sand are not very credible.

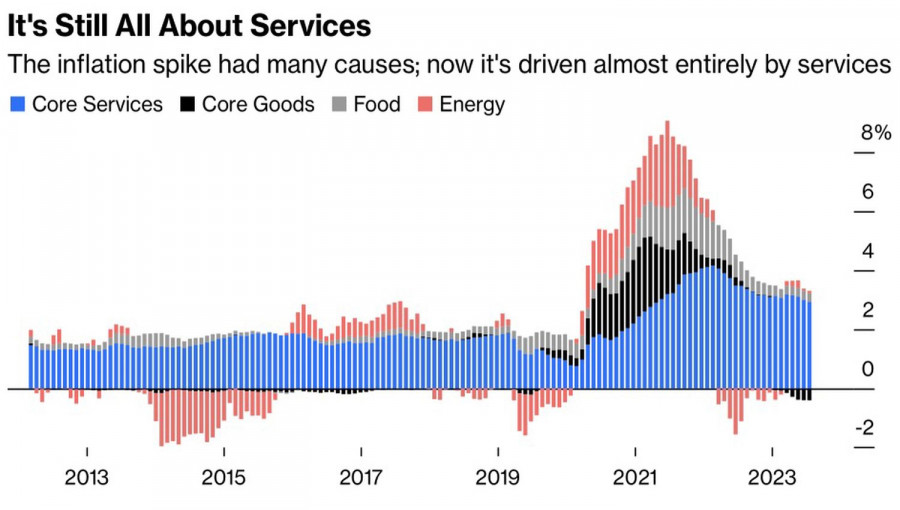

Trump's plan involves increasing oil production, which would then affect gasoline prices, save Americans money, and allow them to invest elsewhere. However, in reality, energy prices no longer have the significant impact on the CPI that they once did. Combating inflation requires something else—something that monetary policy from the Federal Reserve can influence.

Dynamics and Structure of American Inflation

Thus, if Trump intends to increase oil production while simultaneously pressuring the Federal Reserve to sharply lower interest rates, nothing substantial will result. Meanwhile, Fed Chair Jerome Powell and his team are preparing to announce the start of a monetary easing cycle in September, with Jackson Hole as the ideal venue for this announcement.

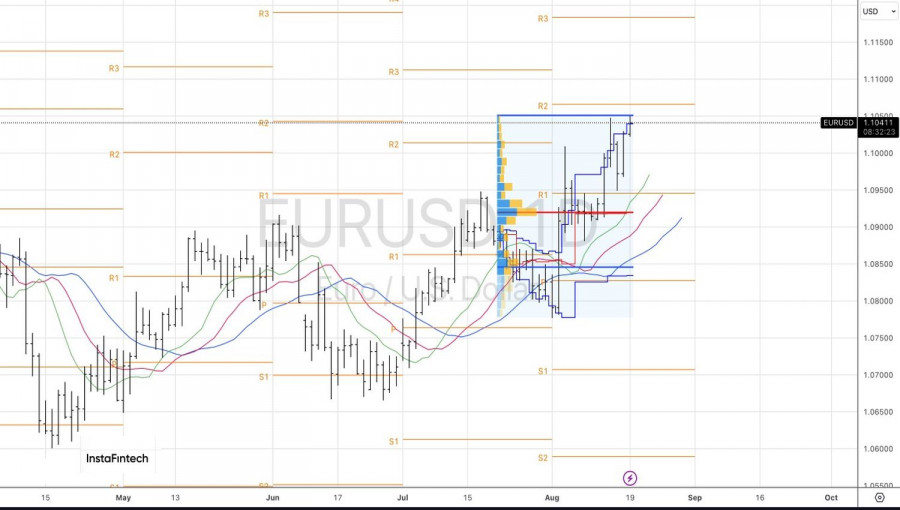

The market already expects the Fed to begin easing its monetary policy within the first month of autumn. Therefore, if Powell refuses to give hints, we should anticipate US stock indices and EUR/USD sell-offs. The only leverage the bears have on the main currency pair is the silence of the Fed chair and concerns about Trump coming to power.

Despite the weakness of the eurozone economy, positive developments elsewhere, including in the UK, Japan, China, and the US, extend a helping hand to the euro as a pro-cyclical currency. It reacts sharply to the recovery of the global economy, even if led by the US. I don't think the European business activity figures will significantly deviate from Bloomberg's expert forecasts in a way that would negatively impact EUR/USD. Minor discrepancies allow for purchasing the main currency pair on price dips.

Another important event of the week will occur at the midpoint of the week, in addition to Jackson Hole and the release of the Eurozone PMI data. This concerns the release of the minutes from the July FOMC meeting. At that meeting, the Fed decided to keep the federal funds rate at a plateau of 5.5%, but a change in rhetoric caused investors to become concerned. What exactly did the central bank mean? Investors will try to extract the answer from the minutes.

Technically, the long positions formed from the 1.1 level in EUR/USD appear shaky on the daily chart. A rebound from the pivot levels at 1.1065 and 1.1110, or the bulls' inability to hold the upper boundary of the fair value range of 1.0845–1.1040, will be grounds for selling.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment