Analysis of Trades and Tips for Trading the Japanese Yen

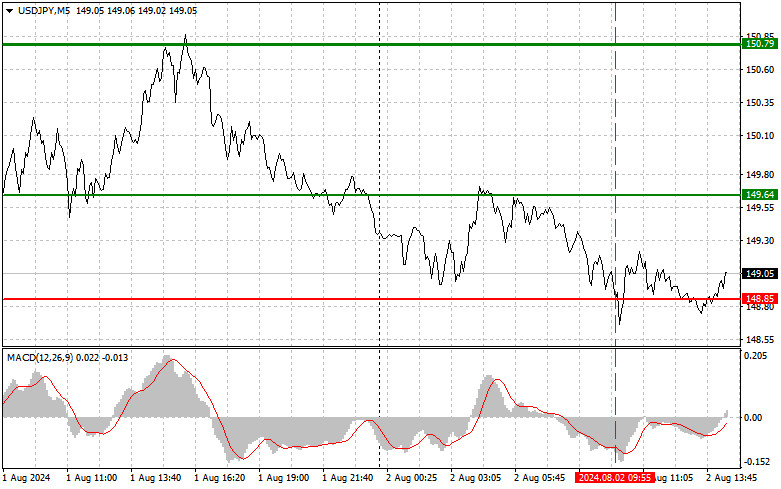

The price test at 148.85 occurred when the MACD indicator had significantly moved downward from the zero mark, which limited the pair's downward potential. For this reason, I chose not to sell dollars. Selling at the current level is quite risky from a technical standpoint because we have moved significantly downward over the week without any substantial correction. Upcoming data from the U.S. labor market may help the dollar recover. In the second half of the day, we will have to deal with the following fundamental statistics: the unemployment level, changes in the number of employed in the U.S. non-agricultural sector, changes in the number of employed in the private sector, changes in the average hourly wage, which are also very important, and the proportion of the economically active population. Only extremely weak statistics are likely to lead to a new wave of decline in USD/JPY. As for the intraday strategy, I plan to act based on the implementation of scenarios No. 1 and No. 2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today when the entry point reaches the area of 149.27 (green line on the chart), with a target of rising to the level of 150.05 (thicker green line on the chart). At the 150.05 area, I will exit the buys and open sales in the opposite direction (calculation of a movement of 30-35 points in the opposite direction from the level). Expecting a strong rise in the pair today will only be feasible in the case of very strong U.S. labor market data. Important, before buying, make sure that the MACD indicator is above the zero mark and that it is just starting to rise from there.

Scenario #2: I also plan to buy USD/JPY today in the case of two consecutive tests of the price at 148.70 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. A rise to the levels of 149.27 and 150.05 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after updating the level of 148.70 (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the level of 147.86, where I will exit the sales and also immediately open buys in the opposite direction (calculation of a movement of 20-25 points in the opposite direction from the level). Pressure on the pair will return in case of a failed attempt to break above 149.27 and weak U.S. statistics. Important, before selling, make sure that the MACD indicator is below the zero mark and that it is just starting its decline from there.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the price at 149.27 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a downward market reversal. A decline to the levels of 148.70 and 147.86 can be expected.

What's on the Chart:

* Thin green line: Entry price for buying the trading instrument.

* Thick green line: Presumed price where you can set Take Profit or independently secure profits, as further growth above this level is unlikely.

* Thin red line: Entry price for selling the trading instrument.

* Thick red line: Presumed price where you can set Take Profit or independently secure profits, as further decline below this level is unlikely.

* MACD Indicator: It's important to be guided by overbought and oversold zones when entering the market.

Important: For beginners in the Forex market, it is crucial to be cautious when making market entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sharp fluctuations in exchange rates. If you decide to trade during news releases, always set stop orders to minimize losses. You need to place stop orders to avoid losing your entire deposit, especially if you do not use money management and trade large volumes.

Remember: For successful trading, you must have a clear trading plan, like the one I have presented above. Making spontaneous trading decisions based on the current market situation is initially a losing strategy for an intraday trader.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The price test at 148.85 occurred when the MACD indicator had significantly moved downward from the zero mark, which limited the pair's downward potential. For this reason, I chose not to sell dollars. Selling at the current level is quite risky from a technical standpoint because we have moved significantly downward over the week without any substantial correction. Upcoming data from the U.S. labor market may help the dollar recover. In the second half of the day, we will have to deal with the following fundamental statistics: the unemployment level, changes in the number of employed in the U.S. non-agricultural sector, changes in the number of employed in the private sector, changes in the average hourly wage, which are also very important, and the proportion of the economically active population. Only extremely weak statistics are likely to lead to a new wave of decline in USD/JPY. As for the intraday strategy, I plan to act based on the implementation of scenarios No. 1 and No. 2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today when the entry point reaches the area of 149.27 (green line on the chart), with a target of rising to the level of 150.05 (thicker green line on the chart). At the 150.05 area, I will exit the buys and open sales in the opposite direction (calculation of a movement of 30-35 points in the opposite direction from the level). Expecting a strong rise in the pair today will only be feasible in the case of very strong U.S. labor market data. Important, before buying, make sure that the MACD indicator is above the zero mark and that it is just starting to rise from there.

Scenario #2: I also plan to buy USD/JPY today in the case of two consecutive tests of the price at 148.70 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. A rise to the levels of 149.27 and 150.05 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after updating the level of 148.70 (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the level of 147.86, where I will exit the sales and also immediately open buys in the opposite direction (calculation of a movement of 20-25 points in the opposite direction from the level). Pressure on the pair will return in case of a failed attempt to break above 149.27 and weak U.S. statistics. Important, before selling, make sure that the MACD indicator is below the zero mark and that it is just starting its decline from there.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the price at 149.27 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a downward market reversal. A decline to the levels of 148.70 and 147.86 can be expected.

What's on the Chart:

* Thin green line: Entry price for buying the trading instrument.

* Thick green line: Presumed price where you can set Take Profit or independently secure profits, as further growth above this level is unlikely.

* Thin red line: Entry price for selling the trading instrument.

* Thick red line: Presumed price where you can set Take Profit or independently secure profits, as further decline below this level is unlikely.

* MACD Indicator: It's important to be guided by overbought and oversold zones when entering the market.

Important: For beginners in the Forex market, it is crucial to be cautious when making market entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sharp fluctuations in exchange rates. If you decide to trade during news releases, always set stop orders to minimize losses. You need to place stop orders to avoid losing your entire deposit, especially if you do not use money management and trade large volumes.

Remember: For successful trading, you must have a clear trading plan, like the one I have presented above. Making spontaneous trading decisions based on the current market situation is initially a losing strategy for an intraday trader.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment