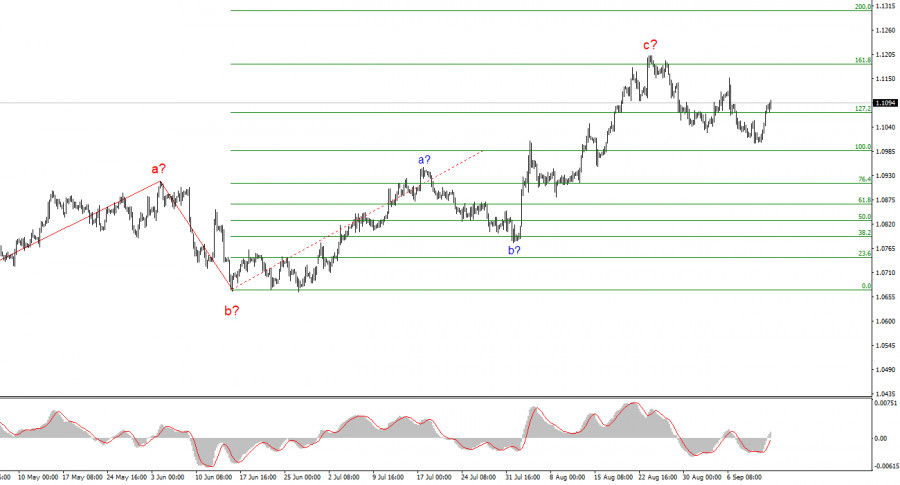

The wave pattern for EUR/USD on the 4-hour chart is becoming increasingly complex. If we analyze the entire trend, which began in September 2022 when the euro dropped to 0.9530, it appears that we are currently part of an upward wave structure. However, there is a constant alternation of three- and five-wave corrective structures. It can be assumed that an impulsive upward trend began forming on April 16, but its internal structure raises many questions. In my view, it is crucial to focus on the simplest and most comprehensible wave structures.

Since January 2024, I can identify only two a-b-c three-wave patterns, with a reversal point on April 16. Therefore, the first thing to understand is that there is no clear trend at the moment. Once the current "c" wave is completed, a new downward three-wave structure may begin. The trend from April 16 may take on a five-wave form, but it would still be corrective in nature, as the lows of corrective waves fall below the peaks of impulsive ones. Under such circumstances, I find it difficult to believe in a prolonged rise for the euro. However, it may continue for some time.

The Market Reversed Course Again

The EUR/USD rate rose by 80 basis points on Thursday and Friday. This might seem like a modest move, if not for one key factor. As expected, the ECB lowered all three interest rates yesterday, shifting the market's focus to ECB President Christine Lagarde's speech. However, this raised more questions than it provided answers to.

Let's first analyze the market's reaction to these events. It was clear—buying the euro. But why, given the ECB's rate cuts? Was Christine Lagarde "hawkish"? Personally, I didn't hear anything hawkish in her speech. Did the market expect the ECB head to explicitly state that the regulator would continue cutting rates at the next meeting and beyond? When has that ever happened? However, it seems the market interpreted it that way, which I believe is completely wrong. In my opinion, the market once again interpreted the information in a way that suited its needs.

It could also be argued that the market had already accounted for the ECB's rate cut. But if that's the case, how should we interpret the behavior of the U.S. dollar, which has been declining for almost two years? Does this mean that the market has also priced in the Federal Reserve's monetary easing, which has been discussed throughout 2024? If this assumption holds true, then we may see a rise in the U.S. dollar next week, regardless of the outcome. However, we must still wait for next week's developments, and the market continues to increase demand for the euro even today, despite the decline in industrial production in the EU and the lack of other significant news throughout the day.

General Conclusions

Based on my analysis of EUR/USD, I conclude that the pair continues to form multiple corrective wave structures. The rise in prices may continue within a five-wave corrective structure, with targets around the 1.13 level, but the scenario for wave "d" has been reactivated. Unfortunately, this wave may already be completed, so I cannot be confident in the pair's resumption of decline.

On a larger wave scale, it is also clear that the wave pattern is becoming more complex. We are likely to see an upward wave set, but its length and structure are difficult to predict at this stage.

Key Principles of My Analysis:

* Wave structures should be simple and comprehensible. Complex structures are difficult to trade and often subject to change.

* If there is uncertainty in the market, it is better to stay out of it.

* There is never 100% certainty in the direction of movement. Always use Stop Loss orders for protection.

* Wave analysis can be combined with other forms of analysis and trading strategies.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Since January 2024, I can identify only two a-b-c three-wave patterns, with a reversal point on April 16. Therefore, the first thing to understand is that there is no clear trend at the moment. Once the current "c" wave is completed, a new downward three-wave structure may begin. The trend from April 16 may take on a five-wave form, but it would still be corrective in nature, as the lows of corrective waves fall below the peaks of impulsive ones. Under such circumstances, I find it difficult to believe in a prolonged rise for the euro. However, it may continue for some time.

The Market Reversed Course Again

The EUR/USD rate rose by 80 basis points on Thursday and Friday. This might seem like a modest move, if not for one key factor. As expected, the ECB lowered all three interest rates yesterday, shifting the market's focus to ECB President Christine Lagarde's speech. However, this raised more questions than it provided answers to.

Let's first analyze the market's reaction to these events. It was clear—buying the euro. But why, given the ECB's rate cuts? Was Christine Lagarde "hawkish"? Personally, I didn't hear anything hawkish in her speech. Did the market expect the ECB head to explicitly state that the regulator would continue cutting rates at the next meeting and beyond? When has that ever happened? However, it seems the market interpreted it that way, which I believe is completely wrong. In my opinion, the market once again interpreted the information in a way that suited its needs.

It could also be argued that the market had already accounted for the ECB's rate cut. But if that's the case, how should we interpret the behavior of the U.S. dollar, which has been declining for almost two years? Does this mean that the market has also priced in the Federal Reserve's monetary easing, which has been discussed throughout 2024? If this assumption holds true, then we may see a rise in the U.S. dollar next week, regardless of the outcome. However, we must still wait for next week's developments, and the market continues to increase demand for the euro even today, despite the decline in industrial production in the EU and the lack of other significant news throughout the day.

General Conclusions

Based on my analysis of EUR/USD, I conclude that the pair continues to form multiple corrective wave structures. The rise in prices may continue within a five-wave corrective structure, with targets around the 1.13 level, but the scenario for wave "d" has been reactivated. Unfortunately, this wave may already be completed, so I cannot be confident in the pair's resumption of decline.

On a larger wave scale, it is also clear that the wave pattern is becoming more complex. We are likely to see an upward wave set, but its length and structure are difficult to predict at this stage.

Key Principles of My Analysis:

* Wave structures should be simple and comprehensible. Complex structures are difficult to trade and often subject to change.

* If there is uncertainty in the market, it is better to stay out of it.

* There is never 100% certainty in the direction of movement. Always use Stop Loss orders for protection.

* Wave analysis can be combined with other forms of analysis and trading strategies.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment