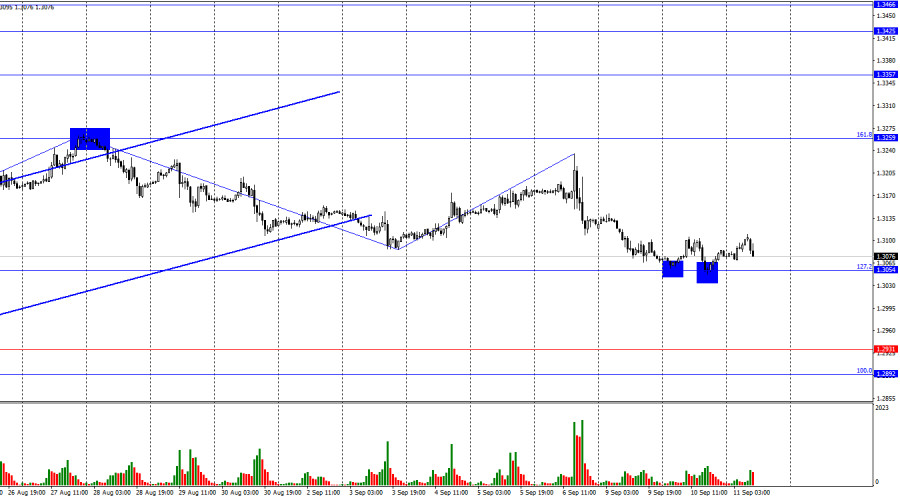

On the hourly chart, the GBP/USD pair continued its decline toward the 127.2% corrective level at 1.3054 on Tuesday. A rebound from this level gives traders hope for a reversal in favor of the pound and some growth toward the 161.8% Fibonacci level at 1.3259. However, I doubt the bulls can drive the pair back up to this level. Consolidation below 1.3054 will increase the likelihood of a further decline toward the 1.2931 level.

There are no questions regarding the wave structure. The last completed downward wave did not break the low of the previous wave, but the most recent upward wave also failed to break the previous peak at 1.3264. Therefore, we are now witnessing a downward trend reversal. The most recent, still incomplete, downward wave has broken the previous wave's low, further confirming the formation of a bearish trend.

The news background on Tuesday did not help the bulls much, and today it has been of no help at all. While yesterday's reports from the UK could be considered positive, as both unemployment fell and the number of unemployment claims was lower than expected, today's GDP showed no growth, and industrial production declined by 0.8%. Traders had anticipated 0.2% growth for GDP in July and a 0.3% increase in industrial production. In both cases, they were disappointed. However, even these figures demonstrate how little interest the market currently has in economic data, particularly from the UK. Yesterday, relatively good data pushed the pound up by just 30 pips, while today's poor data caused a drop of only 20 pips, showing how little the market reacts to UK data. Thus, the market clearly indicates that it is focused on the U.S. inflation report, the Federal Reserve meeting, and Jerome Powell's speech, rather than routine economic data from the UK.

On the 4-hour chart, the pair retraced to the 1.3044 level. A rebound from this level, combined with a bullish divergence on the CCI indicator, suggests the possibility of some growth for the pair, but I don't expect it to be significant. I anticipate more consolidation below the 1.3044 level, which will pave the way for further decline toward the next corrective level of 61.8% – 1.2745.

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders has become much more bullish over the past week. The number of long positions held by speculators increased by 8,610 units, while short contracts decreased by 9,537 units. The bulls still have a solid advantage. The gap between the number of long and short positions is 108,000: 160,000 long versus 52,000 short.

In my opinion, the pound still has the potential for a decline, but the COT reports currently suggest otherwise. Over the past three months, the number of long positions has risen from 102,000 to 160,000, while the number of short positions has decreased from 58,000 to 52,000. I believe that over time, professional players will start to reduce their long positions or increase short positions, as all possible factors for buying the British pound have already been priced in. However, this is merely speculation. Technical analysis suggests a likely decline in the near future, but a clear bullish trend remains for now.

News calendar for the U.S. and the UK:

* UK – GDP change for July (06-00 UTC).

* UK – Industrial production change (06-00 UTC).

* U.S. – Consumer Price Index (12-30 UTC).

On Wednesday, the economic calendar contains three important reports, two of which have already been released. The influence of the news background on market sentiment will be strong throughout the rest of the day.

Forecast for GBP/USD and trader recommendations:

Selling the pair was possible after the rebound from the 1.3258 level on the hourly chart, with a target of 1.3054. The target has been reached, as expected. New sales should be considered after a close below 1.3054 with a target of 1.2931. I wouldn't rush into buying, even if there is a rebound from the 1.3054 level.

Fibonacci levels are drawn from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

There are no questions regarding the wave structure. The last completed downward wave did not break the low of the previous wave, but the most recent upward wave also failed to break the previous peak at 1.3264. Therefore, we are now witnessing a downward trend reversal. The most recent, still incomplete, downward wave has broken the previous wave's low, further confirming the formation of a bearish trend.

The news background on Tuesday did not help the bulls much, and today it has been of no help at all. While yesterday's reports from the UK could be considered positive, as both unemployment fell and the number of unemployment claims was lower than expected, today's GDP showed no growth, and industrial production declined by 0.8%. Traders had anticipated 0.2% growth for GDP in July and a 0.3% increase in industrial production. In both cases, they were disappointed. However, even these figures demonstrate how little interest the market currently has in economic data, particularly from the UK. Yesterday, relatively good data pushed the pound up by just 30 pips, while today's poor data caused a drop of only 20 pips, showing how little the market reacts to UK data. Thus, the market clearly indicates that it is focused on the U.S. inflation report, the Federal Reserve meeting, and Jerome Powell's speech, rather than routine economic data from the UK.

On the 4-hour chart, the pair retraced to the 1.3044 level. A rebound from this level, combined with a bullish divergence on the CCI indicator, suggests the possibility of some growth for the pair, but I don't expect it to be significant. I anticipate more consolidation below the 1.3044 level, which will pave the way for further decline toward the next corrective level of 61.8% – 1.2745.

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders has become much more bullish over the past week. The number of long positions held by speculators increased by 8,610 units, while short contracts decreased by 9,537 units. The bulls still have a solid advantage. The gap between the number of long and short positions is 108,000: 160,000 long versus 52,000 short.

In my opinion, the pound still has the potential for a decline, but the COT reports currently suggest otherwise. Over the past three months, the number of long positions has risen from 102,000 to 160,000, while the number of short positions has decreased from 58,000 to 52,000. I believe that over time, professional players will start to reduce their long positions or increase short positions, as all possible factors for buying the British pound have already been priced in. However, this is merely speculation. Technical analysis suggests a likely decline in the near future, but a clear bullish trend remains for now.

News calendar for the U.S. and the UK:

* UK – GDP change for July (06-00 UTC).

* UK – Industrial production change (06-00 UTC).

* U.S. – Consumer Price Index (12-30 UTC).

On Wednesday, the economic calendar contains three important reports, two of which have already been released. The influence of the news background on market sentiment will be strong throughout the rest of the day.

Forecast for GBP/USD and trader recommendations:

Selling the pair was possible after the rebound from the 1.3258 level on the hourly chart, with a target of 1.3054. The target has been reached, as expected. New sales should be considered after a close below 1.3054 with a target of 1.2931. I wouldn't rush into buying, even if there is a rebound from the 1.3054 level.

Fibonacci levels are drawn from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment