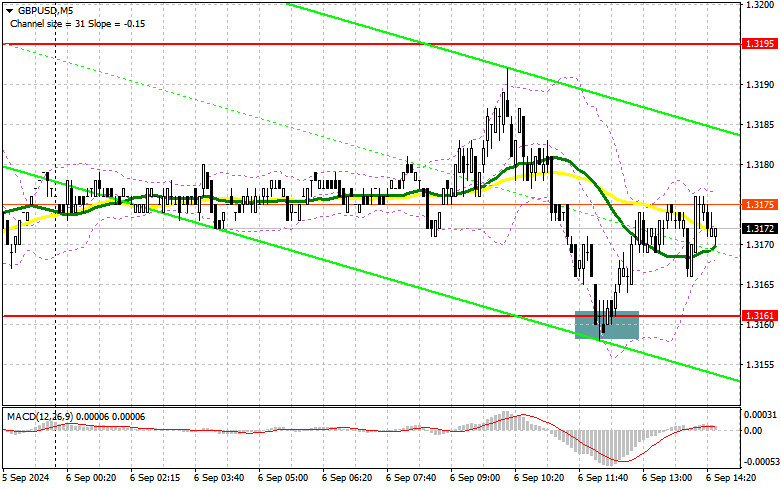

In my morning forecast, I highlighted the 1.3161 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The drop and formation of a false breakout at that level provided a buying point for the pound and led the pair to rise by 15 points. The technical picture for the second half of the day has not been revised.

To open long positions on GBP/USD:

If the U.S. unemployment rate rises and the growth of non-farm employment remains weak, pressure on the dollar will increase, leading to a sharp strengthening of the pound and a continuation of the upward trend. The reason for the dollar's weakness could be the high probability of a 0.5% rate cut in the U.S. Speeches by FOMC members John Williams and Christopher Waller will be important in this scenario. If the U.S. unemployment rate decreases, the dollar will likely strengthen by the end of the week, causing the pound to lose significant ground. I plan to buy only after a false breakout forms around the support level of 1.3127, which would provide a long position entry point with a target of returning to 1.3161. A breakout and subsequent retest of this range from above will increase the chances of continuing the upward trend, triggering stop orders from sellers and offering a good entry point for long positions, with the potential to reach 1.3195. The final target will be the 1.3227 level, where I plan to take profits. If GBP/USD declines and bulls show no activity around 1.3127, pressure on the pair will increase. This would likely lead to a drop and a test of the next support level at 1.3088, which would cancel buyers' plans. Only a false breakout at that level would provide a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3051 low, targeting a 30–35 point correction within the day.

To open short positions on GBP/USD:

Sellers tried, but quickly encountered resistance at 1.3161. In the event of poor U.S. data, the bears' main task will be to protect the 1.3195 resistance level, where a false breakout would provide a valid condition for opening new short positions against the trend, targeting a correction and a retest of the 1.3161 and 1.3127 support levels. A breakout and reverse test from below of this range would weaken buyers' positions, triggering stop orders and opening the path to 1.3088, where I expect more active actions from major players. Testing this level will return the pair to a sideways channel. The final target will be the 1.3051 level, where I plan to take profits. If GBP/USD rises and bears are absent at 1.3195, which is more likely, buyers will strengthen their initiative. In this case, bears will have no choice but to retreat to the 1.3227 resistance area. I will sell there only on a false breakout. If there's no downward movement there either, I'll look for short positions on a rebound around 1.3260, but only targeting a 30–35 point downward correction.

The COT (Commitment of Traders) report for August 27 showed a sharp rise in long positions and a slight increase in short positions. Traders are confident that a rate cut in the U.S. is much more significant than similar actions by the Bank of England, which is why market sentiment continues to shift in favor of pound buyers, whose numbers are growing. This week, a lot of important U.S. statistics are being released, which could further weaken the dollar and restore a bullish trend for the GBP/USD pair. Labor market-related reports will be especially important. The latest COT report indicates that long non-commercial positions jumped by 26,529 to 152,163, while short non-commercial positions increased by 4,109 to 62,323. As a result, the gap between long and short positions widened by 2,549.

Indicator signals:

Moving Averages: Trading is occurring around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of the moving averages are considered by the author on the hourly chart (H1), which differs from the standard definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.3161 will act as support.

Indicator descriptions:

* Moving average: Determines the current trend by smoothing volatility and noise. Period: 50. Marked in yellow on the chart.

* Moving average: Determines the current trend by smoothing volatility and noise. Period: 30. Marked in green on the chart.

* MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

* Bollinger Bands: Period 20.

* Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain criteria.

* Long non-commercial positions: The total long open positions held by non-commercial traders.

* Short non-commercial positions: The total short open positions held by non-commercial traders.

* Total non-commercial net position: The difference between short and long positions of non-commercial traders.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

To open long positions on GBP/USD:

If the U.S. unemployment rate rises and the growth of non-farm employment remains weak, pressure on the dollar will increase, leading to a sharp strengthening of the pound and a continuation of the upward trend. The reason for the dollar's weakness could be the high probability of a 0.5% rate cut in the U.S. Speeches by FOMC members John Williams and Christopher Waller will be important in this scenario. If the U.S. unemployment rate decreases, the dollar will likely strengthen by the end of the week, causing the pound to lose significant ground. I plan to buy only after a false breakout forms around the support level of 1.3127, which would provide a long position entry point with a target of returning to 1.3161. A breakout and subsequent retest of this range from above will increase the chances of continuing the upward trend, triggering stop orders from sellers and offering a good entry point for long positions, with the potential to reach 1.3195. The final target will be the 1.3227 level, where I plan to take profits. If GBP/USD declines and bulls show no activity around 1.3127, pressure on the pair will increase. This would likely lead to a drop and a test of the next support level at 1.3088, which would cancel buyers' plans. Only a false breakout at that level would provide a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3051 low, targeting a 30–35 point correction within the day.

To open short positions on GBP/USD:

Sellers tried, but quickly encountered resistance at 1.3161. In the event of poor U.S. data, the bears' main task will be to protect the 1.3195 resistance level, where a false breakout would provide a valid condition for opening new short positions against the trend, targeting a correction and a retest of the 1.3161 and 1.3127 support levels. A breakout and reverse test from below of this range would weaken buyers' positions, triggering stop orders and opening the path to 1.3088, where I expect more active actions from major players. Testing this level will return the pair to a sideways channel. The final target will be the 1.3051 level, where I plan to take profits. If GBP/USD rises and bears are absent at 1.3195, which is more likely, buyers will strengthen their initiative. In this case, bears will have no choice but to retreat to the 1.3227 resistance area. I will sell there only on a false breakout. If there's no downward movement there either, I'll look for short positions on a rebound around 1.3260, but only targeting a 30–35 point downward correction.

The COT (Commitment of Traders) report for August 27 showed a sharp rise in long positions and a slight increase in short positions. Traders are confident that a rate cut in the U.S. is much more significant than similar actions by the Bank of England, which is why market sentiment continues to shift in favor of pound buyers, whose numbers are growing. This week, a lot of important U.S. statistics are being released, which could further weaken the dollar and restore a bullish trend for the GBP/USD pair. Labor market-related reports will be especially important. The latest COT report indicates that long non-commercial positions jumped by 26,529 to 152,163, while short non-commercial positions increased by 4,109 to 62,323. As a result, the gap between long and short positions widened by 2,549.

Indicator signals:

Moving Averages: Trading is occurring around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of the moving averages are considered by the author on the hourly chart (H1), which differs from the standard definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.3161 will act as support.

Indicator descriptions:

* Moving average: Determines the current trend by smoothing volatility and noise. Period: 50. Marked in yellow on the chart.

* Moving average: Determines the current trend by smoothing volatility and noise. Period: 30. Marked in green on the chart.

* MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

* Bollinger Bands: Period 20.

* Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain criteria.

* Long non-commercial positions: The total long open positions held by non-commercial traders.

* Short non-commercial positions: The total short open positions held by non-commercial traders.

* Total non-commercial net position: The difference between short and long positions of non-commercial traders.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment