Analysis of Trades and Tips for Trading the Japanese Yen

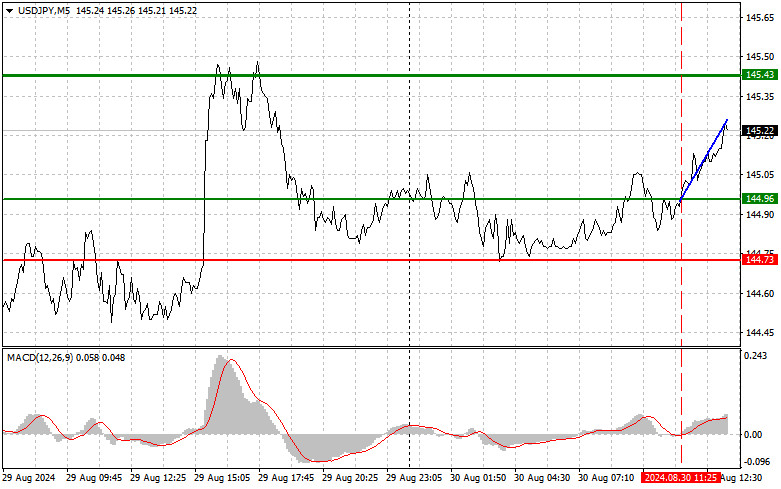

The test of the 144.96 level occurred as the MACD indicator just began moving upward from the zero mark, confirming a valid entry point for buying the dollar. As a result, the pair rose by more than 30 points, but we didn't reach the target level of 145.43. In the second half of the day, only a strong U.S. inflation report, paired with rising income and spending news, will strengthen the dollar and trigger another sell-off of the Japanese yen. However, if the data aligns with economists' forecasts, it's unlikely to significantly help the dollar against the persistent high demand for the Japanese currency. For my intraday strategy, I plan to act according to scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY when the price reaches the 145.35 level (green line on the chart) with the target of rising to 145.74 (thicker green line on the chart). At the 145.74 level, I will exit the market and open a short position, targeting a 30-35 point movement back from that level. The pair's growth today is likely only following very strong U.S. statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 145.07 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal. Growth towards the 145.35 and 145.74 levels can be expected.

Sell Signal

Scenario #1: I will sell USD/JPY today after the 145.07 level is breached (red line on the chart), which should lead to a quick drop in the pair. The key target for sellers will be the 144.64 level, where I will exit the short position and immediately open a buy position, targeting a 20-25 point movement back from that level. Sellers will dominate in the event of reduced price pressure in the U.S. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 145.35 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal. A drop towards the 145.07 and 144.64 levels can be expected.

Chart Description:

* Thin green line: The entry price for buying the asset.

* Thick green line: The anticipated price for setting a Take Profit or manually securing profits, as further growth above this level is unlikely.

* Thin red line: The entry price for selling the asset.

* Thick red line: The anticipated price for setting a Take Profit or manually securing profits, as further decline below this level is unlikely.

* MACD Indicator: When entering the market, it is important to consider overbought and oversold areas.

Important:

Beginner traders should be very cautious when making market entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sudden exchange rate fluctuations. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

The test of the 144.96 level occurred as the MACD indicator just began moving upward from the zero mark, confirming a valid entry point for buying the dollar. As a result, the pair rose by more than 30 points, but we didn't reach the target level of 145.43. In the second half of the day, only a strong U.S. inflation report, paired with rising income and spending news, will strengthen the dollar and trigger another sell-off of the Japanese yen. However, if the data aligns with economists' forecasts, it's unlikely to significantly help the dollar against the persistent high demand for the Japanese currency. For my intraday strategy, I plan to act according to scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY when the price reaches the 145.35 level (green line on the chart) with the target of rising to 145.74 (thicker green line on the chart). At the 145.74 level, I will exit the market and open a short position, targeting a 30-35 point movement back from that level. The pair's growth today is likely only following very strong U.S. statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 145.07 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal. Growth towards the 145.35 and 145.74 levels can be expected.

Sell Signal

Scenario #1: I will sell USD/JPY today after the 145.07 level is breached (red line on the chart), which should lead to a quick drop in the pair. The key target for sellers will be the 144.64 level, where I will exit the short position and immediately open a buy position, targeting a 20-25 point movement back from that level. Sellers will dominate in the event of reduced price pressure in the U.S. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 145.35 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal. A drop towards the 145.07 and 144.64 levels can be expected.

Chart Description:

* Thin green line: The entry price for buying the asset.

* Thick green line: The anticipated price for setting a Take Profit or manually securing profits, as further growth above this level is unlikely.

* Thin red line: The entry price for selling the asset.

* Thick red line: The anticipated price for setting a Take Profit or manually securing profits, as further decline below this level is unlikely.

* MACD Indicator: When entering the market, it is important to consider overbought and oversold areas.

Important:

Beginner traders should be very cautious when making market entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sudden exchange rate fluctuations. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment