Analysis of Macroeconomic Reports:

Only a few macroeconomic events are scheduled for Monday, and none are particularly important. In Germany, an inflation report for September will be published, which might seem significant at first glance. However, firstly, it concerns only one of the 27 countries in the Eurozone, and secondly, the European Central Bank has already lowered rates twice, so the inflation trend doesn't carry as much weight as it used to. The third estimate of the second-quarter GDP will be released in the UK. The economy's growth may range between 0.6% and 0.7%. Many market participants prefer to call such growth a "recovery," but we consider it to be extremely weak. The US economy is growing much faster, which the market continues to ignore.

Analysis of Fundamental Events:

Among Monday's fundamental events, the speeches by ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell should be noted first. On Thursday, they didn't provide the market with anything interesting or address the topic of monetary policy. Nevertheless, the dollar still weakened. Therefore, regardless of what Powell and Lagarde might say on Monday, the dollar could once again depreciate, as the market is currently only reacting to the factor of the Fed's monetary policy easing.

General Conclusions:

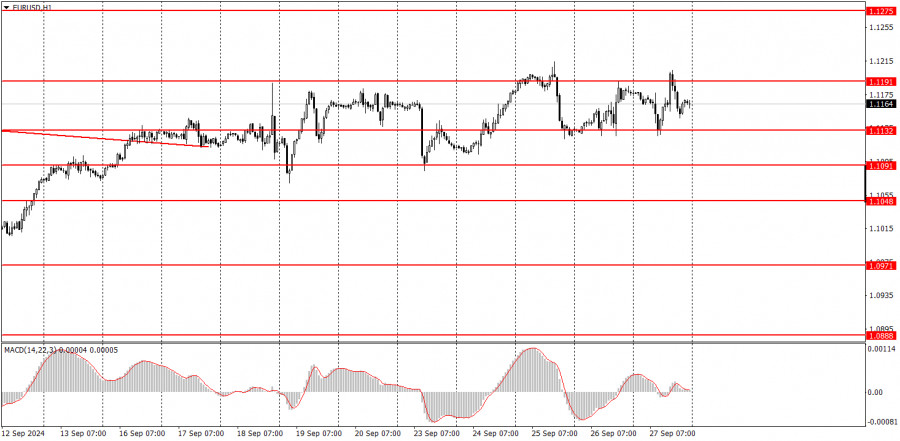

During the first trading day of the new week, the euro may remain within a limited price range between 1.1091 and 1.1191. The British pound seems unstoppable, as it grows much more frequently than the euro and more than the fundamental and macroeconomic backdrop would suggest. Therefore, the British pound might continue its upward movement.

Basic Rules of the Trading System:

1) Signal Strength: The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

2) False Signals: If two or more trades are opened near a certain level based on false signals, all subsequent signals from that level should be ignored.

3) Flat Market: In a flat market, any pair can generate numerous false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trading Timeframe: Trades should be opened between the start of the European session and the middle of the American session, after which they should be closed manually.

5) MACD Indicator Signals: In the hourly time frame, it is preferable to trade based on MACD signals only when there is good volatility and a trend confirmed by a trendline or trend channel.

6) Close Levels: If two levels are located too close to each other (between 5 and 20 pips), they should be considered as a single support or resistance area.

7) Stop Loss: Once the price moves 15-20 pips in the intended direction, a Stop Loss should be set at the breakeven point.

What's on the Charts:

Support and Resistance Price Levels: These levels serve as targets when opening buy or sell positions. They can also be used as points to set Take Profit levels.

Red Lines: These represent channels or trend lines that display the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): The histogram and signal line serve as an auxiliary indicator that can also be used as a source of trading signals.

Important Speeches and Reports (always found in the news calendar) can significantly impact the movement of a currency pair. Therefore, trading should be done with maximum caution during their release, or you may choose to exit the market to avoid a sharp price reversal against the preceding movement.

For Beginners Trading on the Forex Market: It's essential to remember that not every trade will be profitable. Developing a clear strategy and practicing money management is key to achieving long-term success in trading.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment